- Electric vehicle stocks see more volatility this week with a small IPO (SEV) and Rivian bouncing.

- Semiconductor stocks boomed as Nvidia and AMD made fresh all-time highs.

- Fed chair decision due this weekend from President Biden will it be Brainard or Powell?

Will Federal Reserve Chair Jerome Powell's tenure be transitory as President Biden mulls a change to the US Central Banks leadership this weekend? It has come down to a battle of the doves with Lael Brainard in the running to replace Jerome Powell. The US central bank has been extremely accommodative since the pandemic struck but Brainard is reputedly even more of a dove than Powell. The Nasdaq especially will love her appointment if it comes to pass. The ECB meanwhile went all lovey-dovey of its own when President Christine Lagarde said Friday that inflation will be temporary and interest rate rises are not being considered. This sent European markets into a tailspin as investors took flight, for fear of the ECB being too doveish and behind the inflation curve. Europe is also facing more threats from covid now that winter has struck. Already lockdowns are being announced in Austria with new restrictions in place in Ireland and Germany considering further measures. European stocks ended the week badly as a result.

The US equity indices remain immune from doubt though and power on regardless. We did expect some form of pullback shortly, before a year-end rally, but now even we are starting to wonder if there will be another pullback this side of 2022. The flow of money is huge with corporate buybacks increasing and fast money still flowing into equities. Fast money certainly found the sectors of choice this week in electric vehicles and semiconductors. Rivian (RIVN) finally had a down day on Wednesday and followed up with another one on Thursday but rallied sharply on Friday. Sono Group (SEV), a German EV maker, IPO'd on Wednesday and duly doubled while Lucid Motors is once again surging, up 11% at the time of writing. Semiconductor stocks meanwhile were boosted by Nvidia earnings beating estimates and the company forecasting further outperformance for Q4. Analysts rushed to increase price targets as the week wore on. AMD and NVDA both hit all-time highs on Thursday.

Equity exposure

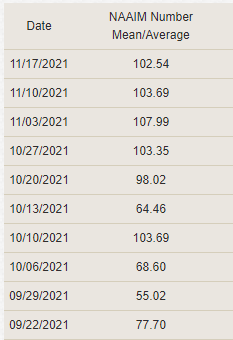

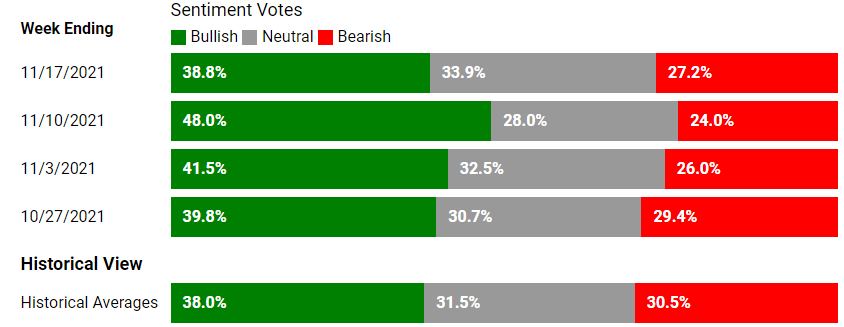

We have to admit to being slightly puzzled by the latest leg higher in the main US indices. Data from the National Association of American Investment Managers (NAAIM) confirmed our initial suspicions that this latest rally was all retail. Investment managers have slightly lowered their net long exposure from 107.99% net long to 102.54% net long as of Wednesday. Individual investors though are now less bullish on stocks and as the sentiment chart below indicates, the American Association of Individual Investors (AAII) survey is more or less bang on the historical average.

Source: National Association of American Investment Managers

Source: American Association of Individual Investors

The latest data from Bank of America and Refinitiv Lipper Alpha also shows net equity inflows slowing or even reversing. Lipper Alpha shows equity funds lost just over $400 million in outflows last week. Our guess remains that this rally is mostly retail-led and that the majority of retail is not represented by the American Association of Individual Investors. This is more likely to be longer-term professional traders in our view, just an educated guess to explain the data.

Market breadth

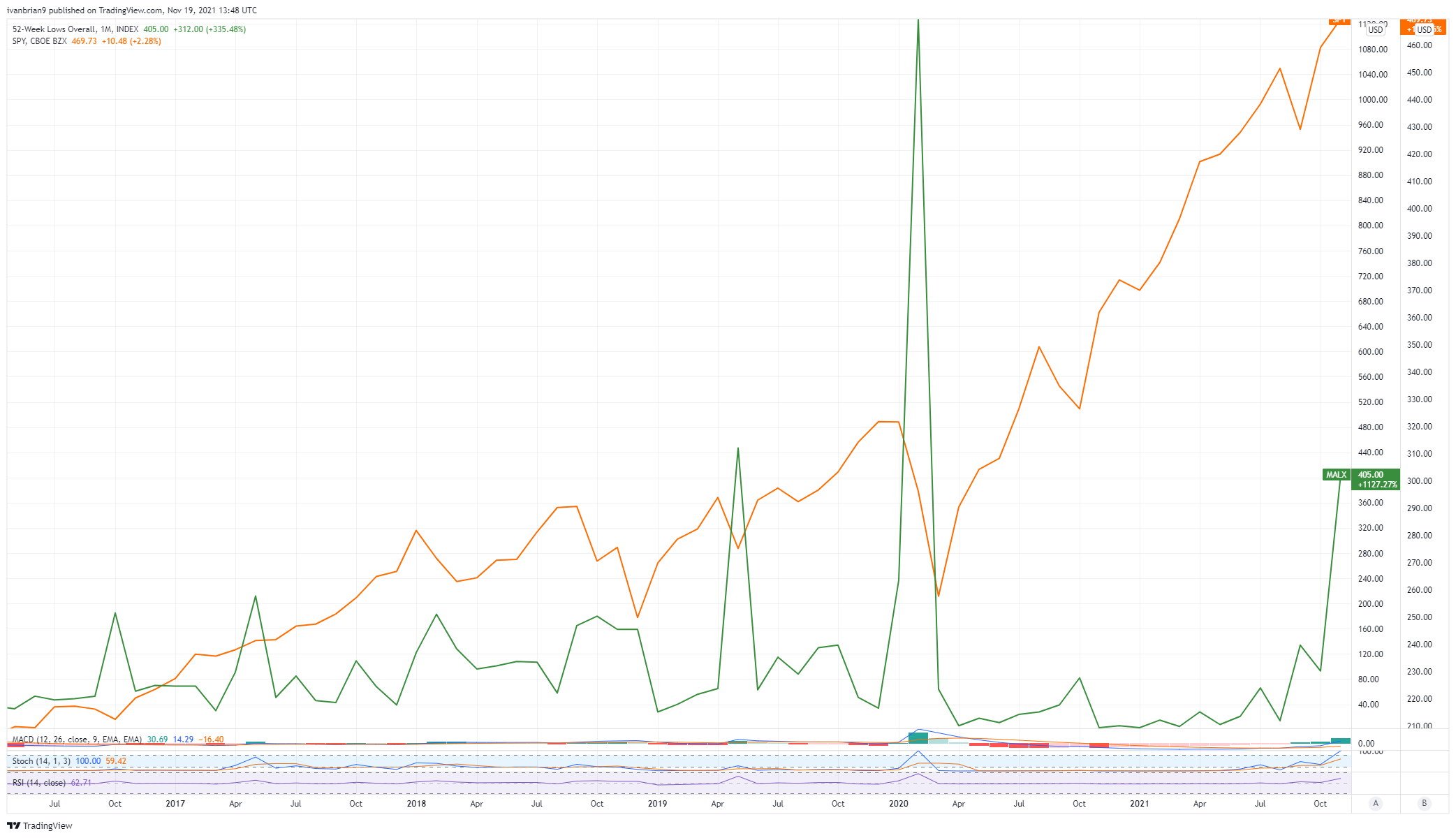

Your breath stinks sir! Reasonable to say here with the number of stocks making new highs still declining and the number of stocks making new lows surging. The graph below shows the correlation between the number of stocks making new 52-week lows (green line) and the S&P (SPY). The huge spike in 52 weeks lows was the start of the pandemic but we are starting to have another worrying spike this week so things could get shaky for the main indices.

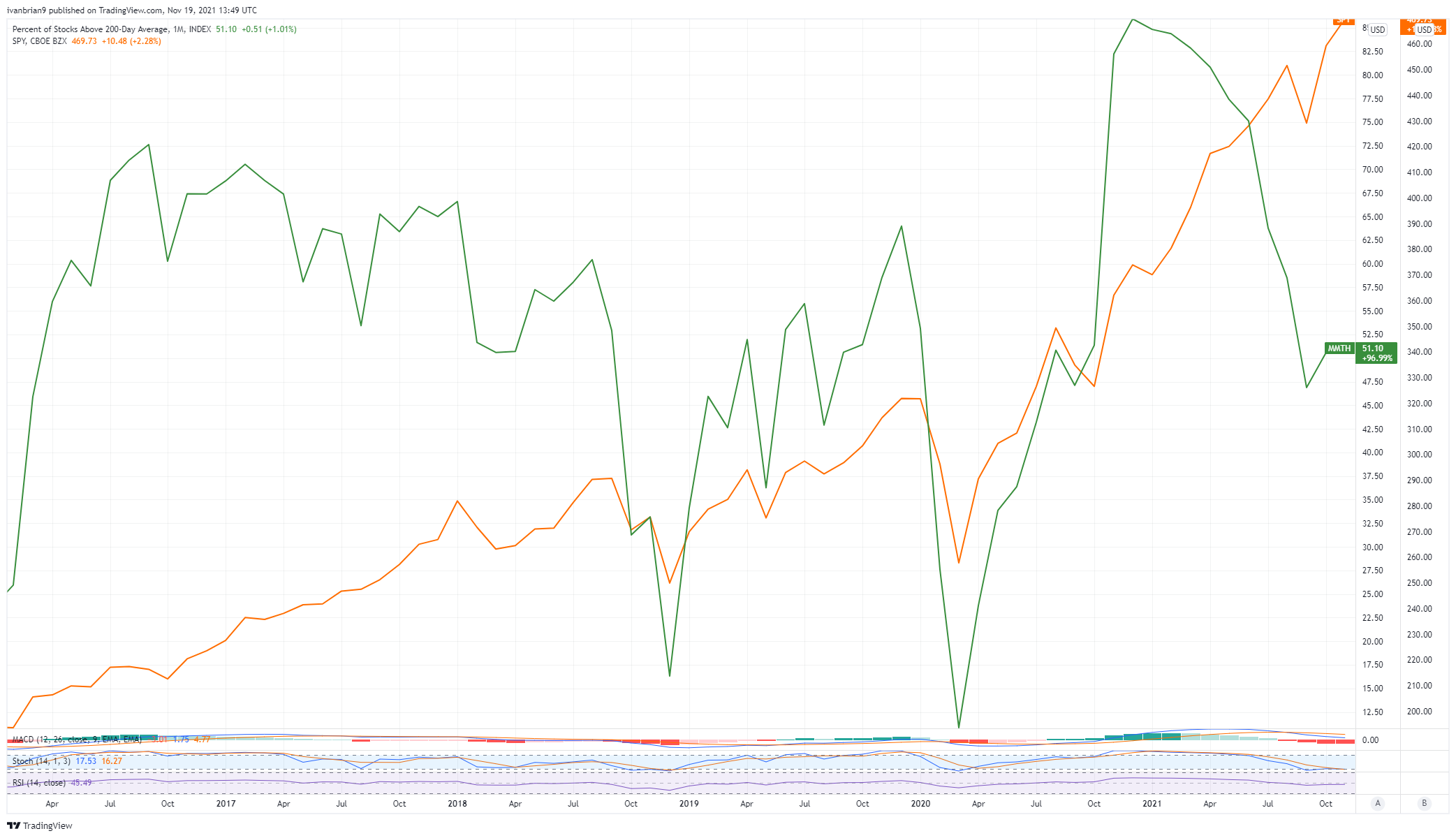

The number of stocks trading above their 200-day moving average, below (green line), also continues to decline despite record highs for some mega-cap names and the main indices. This definitely does not look like a broad-based rally and something does not feel right. The broader Russell 2000 (IWM) is retracing to its year-long range and has been falling all week.

Russell 2000 (IWM) has continued to fall and now sits on a key pivot, return to the range or hold the breakout?

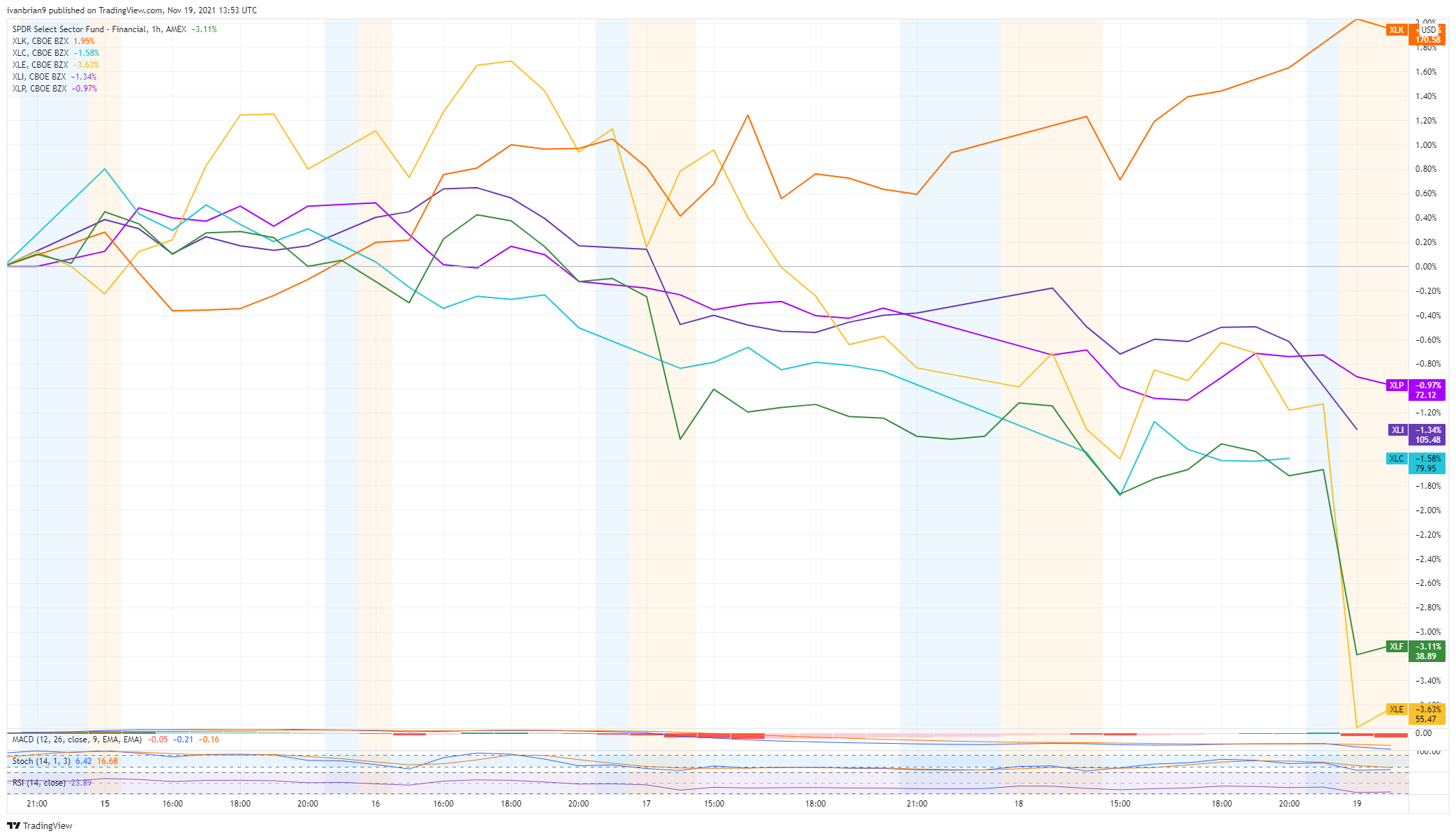

Sectoral performance

Tech (XLK) continues to outperform with another strong week under its belt while the rest more or less limp along with little change on the week.

S&P (SPY) stock forecast

We are going to go out on a limb here and call for the S&P (SPY) to top out and retrace next week to $453. The factors above re market breadth are weighing on our mind as is the mess that Europe is in economically and covid related. While yields have dropped the upward trend in them for the last months is still intact and we expect a tech derailment to bring this rally to a halt. The holiday rally will then be set up. We have a topping out in the SPY chart below and more significantly a bearish divergence in the relative strength index (RSI) from this recent rally, the RSI is not making matching highs.

Earnings week ahead

We still have a few nice earnings surprises left despite the season more or less being complete. Next week sees lockdown darling Zoom Video (ZM) report. Other lockdown darlings have not fared too well (Peloton PTON) so let's see how that earnings report comes in. HP and Dell keep tech traders interested while the GAP, Abercrombie (ANF) and American Eagle (AEO) will give us some more clues to retail sentiment and supply chain issues.

Economic releases

A short week ahead with Thanksgiving on Thursday. The decision over the Fed chair will be the most important event if Powell is replaced. Otherwise, PMI data on Tuesday and Michigan consumer sentiment on Wednesday are the highlights. There is a strong lagging correlation between PMI data and equity performance. This holds globally.

Happy Thanksgiving week!

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD remains pressured below 1.0800 on renewed USD strength

EUR/USD stays under pressure and declines toward 1.0750 following Thursday's recovery. A renewed US Dollar uptick and a cautious mood weigh on the pair, as traders digest the Trump win and the Federal Reserve's monetary policy announcements.

GBP/USD holds lower ground near 1.2950 amid tepid risk sentiment

GBP/USD trades in negative territory at around 1.2950 in the second half of the day on Friday. The emergence of dip-buying in the US Dollar and a tepid risk tone undermine the pair. The BoE’s cautious rate cut could check the pair's downside as traders comments from central bankers.

Gold fluctuates below $2,700 amid stronger USD, positive risk tone

Gold trades below $2,700 in the early American session on Friday and is pressured by a combination of factors. Hopes that Trump's policies would spur economic growth and inflation, to a larger extent, overshadow the Fed's dovish outlook, which, in turn, helps revive the USD demand.

Week ahead – US CPI to shift market focus back to data after Trump shock

After Trump comeback, normality to return to markets with US CPI. GDP data from UK and Japan to also be important. But volatility to likely persist as markets assess impact of Trump.

October’s US CPI rates to be the next big test for the greenback

With the US elections being over, Trump getting elected and the Fed having released its interest rate decision, we take a look at what next week has in store for the markets. On the monetary front a number of policymakers from various central banks are scheduled to speak at some point or the other.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.