EUR/USD stabilises, considers Trump’s impact

EUR/USD is settling around 1.0785, assessing the market impact of this week's events. With Donald Trump’s return as US President, the market is recalibrating expectations around inflation and economic policies that his administration may reintroduce.

Trump’s protectionist stance could stir inflationary pressures, prompting the Federal Reserve to maintain higher interest rates than anticipated. This potential for elevated rates is boosting the dollar’s appeal.

Yesterday, the Federal Reserve cut interest rates by 25 basis points to 4.75% in line with market predictions. The Fed’s commentary suggested no deviations from its planned rate trajectory, hinting at continued easing.

Looking ahead, another rate reduction of 25 basis points is expected at the Fed’s December meeting, continuing its cautious but steady approach to monetary easing.

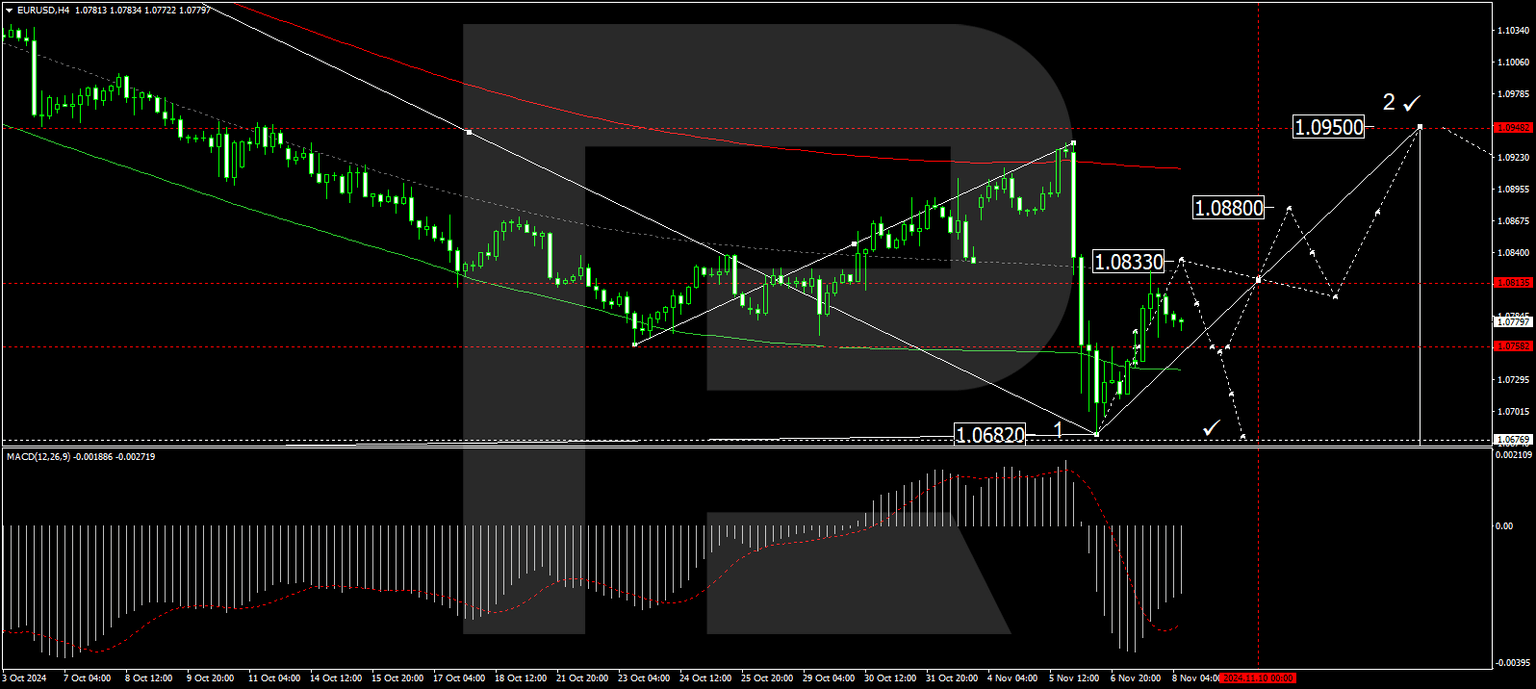

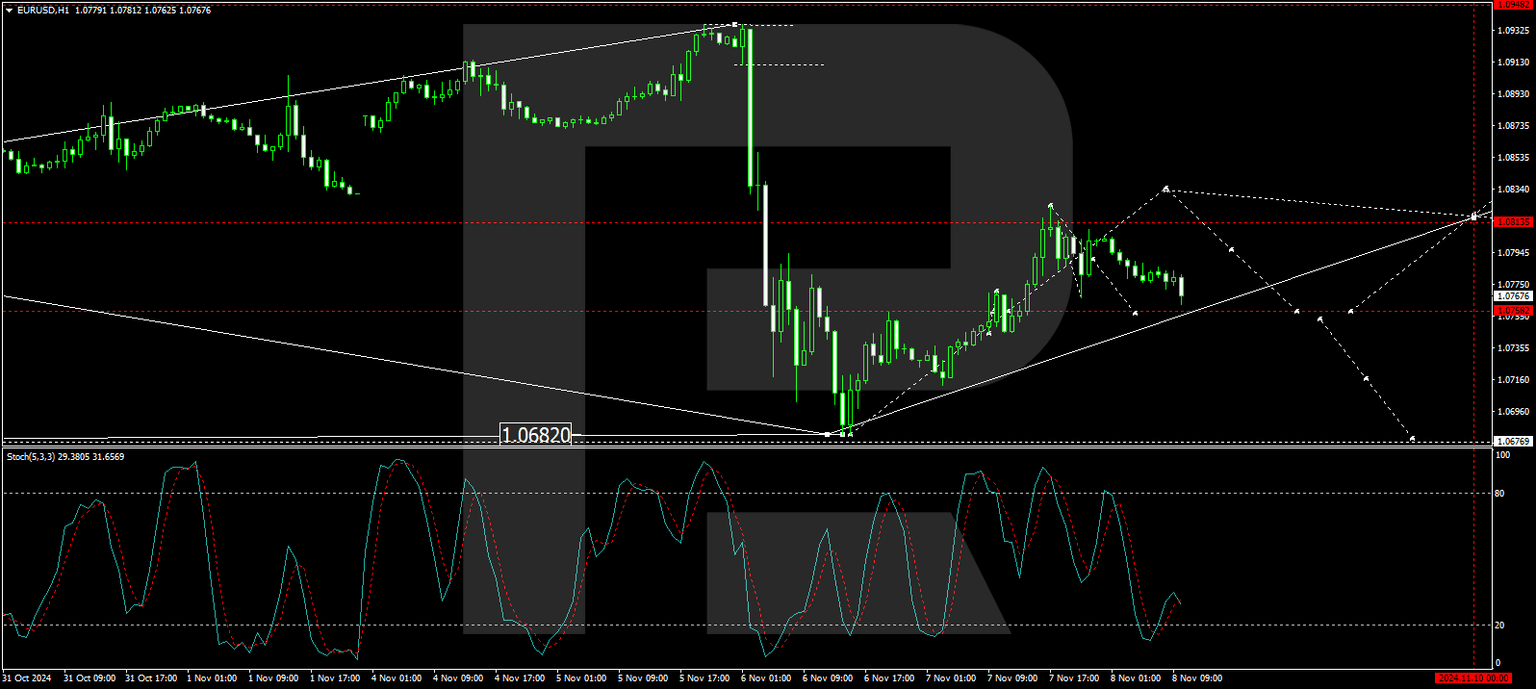

Technical analysis of EUR/USD

The EUR/USD pair has completed a bullish move towards 1.0820, as part of an ongoing upward impulse. Current market behaviour suggests a retracement to 1.0758 before resuming its ascent towards 1.0833. This outlook is supported by the MACD indicator, which, although below zero, is trending upwards, signalling a potential bullish continuation.

The hourly frame shows EUR/USD undergoing a corrective phase to 1.0758. Upon reaching this level, a rebound to 1.0833 is expected, followed by another potential pullback to 1.0758. The stochastic oscillator supports this outlook, with its signal line poised to rise towards 80, suggesting increasing bullish momentum.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.