Week ahead – US CPI to shift market focus back to data after Trump shock [Video]

-

After Trump comeback, normality to return to markets with US CPI.

-

GDP data from UK and Japan to also be important.

-

But volatility to likely persist as markets assess impact of Trump.

![Week ahead – US CPI to shift market focus back to data after Trump shock [Video]](https://editorial.fxstreet.com/images/Macroeconomics/EconomicIndicator/Prices/CPI/tablet-with-consumer-price-index-cpi-business-concept-gm499730392-80399281_XtraLarge.jpg)

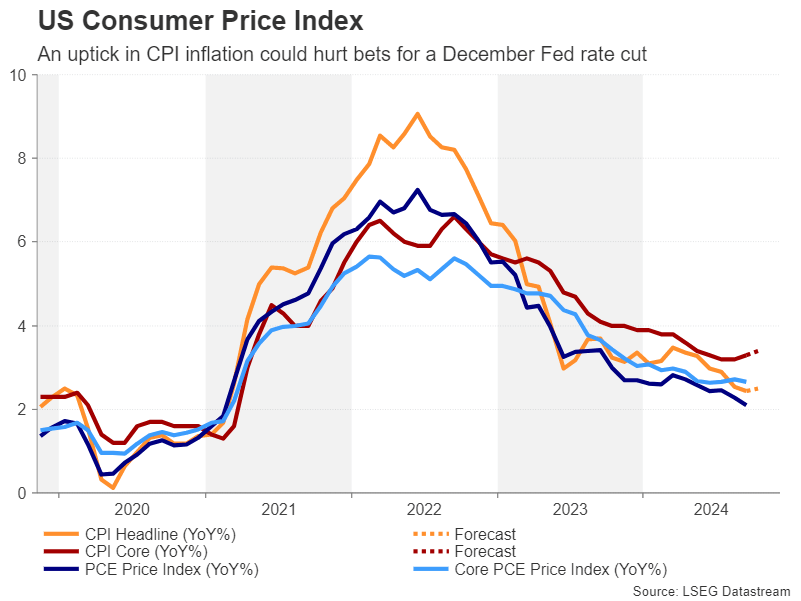

US CPI eyed as rate cut bets fade after Trump win

Donald Trump’s historic return to the White House was met with a euphoric response by the markets. Wall Street and Bitcoin rallied to record highs, while the US dollar skyrocketed to 4-month highs. Perhaps the most significant move, however, is the surge in Treasury yields.

Yields had already been on the rise since late September as investors pared back their bets of how many times the Federal Reserve would cut interest rates over the course of the next 2-3 years. But Trump’s victory has dealt a further blow to hopes of low interest rates.

If Trump enacts his campaign pledges of lower taxes and higher tariffs, the expected effect on the economy is that this would push up prices by boosting domestic demand and raising import costs. The Fed would have little choice but to maintain restrictive monetary policy for longer than is currently anticipated.

The October CPI report due on Wednesday will be the first post-election test for rate cut bets following the repricing from the ‘Trump trade’. In September, the headline CPI rate fell to 2.4% y/y. However, it is expected to have edged up to 2.5 y/y in October. The month-on-month rate is projected at 0.2%, unchanged from the prior month. Core CPI is also forecast to have ticked up, rising from 3.3% to 3.4% y/y in October.

On Thursday, producer prices for the same month will also be watched, while on Friday, attention will turn to the retail sales report. Other releases will include the Empire State Manufacturing index and industrial production, both due on Friday.

Should the CPI numbers come in below expectations, yields and the dollar will be at risk of correcting lower following the recent sharp gains. However, if the data continue to surprise to the upside, the greenback’s bullish run might have further to go. This could prove problematic for Wall Street, though, as sooner or later, higher yields would begin to bite for Wall Street traders.

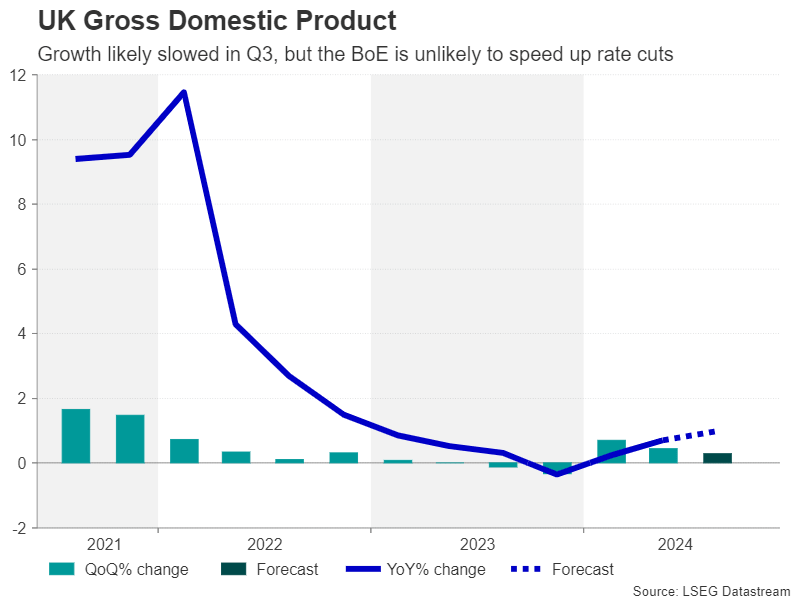

Can UK data halt the Pound’s slide?

US yields are not the only ones soaring lately. The 10-year yield on UK government gilts has risen by more than 20 basis points since the country’s new Labour government presented its tax and spend budget on October 30. Despite tax hikes amounting to £40 billion, the budget is seen as increasing the government’s borrowing requirements, as spending looks set to rise faster than the tax intake. Moreover, much of the spending increases will be frontloaded in the first two years of the parliamentary term, potentially lifting GDP growth in the current fiscal year and next.

The Bank of England has already incorporated the Budget impact into its economic projections and has signalled it will have to maintain caution on the pace of easing. Wage growth remains a concern despite falling substantially this year. The latest figures on average weekly earnings are out on Tuesday, as well as the employment change for the three months to September.

GDP stats will follow on Friday with the first estimate for the third quarter. The UK economy is forecast to have grown by 0.2% q/q during the quarter, slowing from the prior quarter’s 0.5% pace.

Faster-than-expected growth in Q3 would further dash hopes of the BoE speeding up rate cuts over the coming months, and this may help the pound recoup some of its recent losses versus the greenback.

However, disappointing data could add to sterling’s woes, potentially pushing it below $1.29.

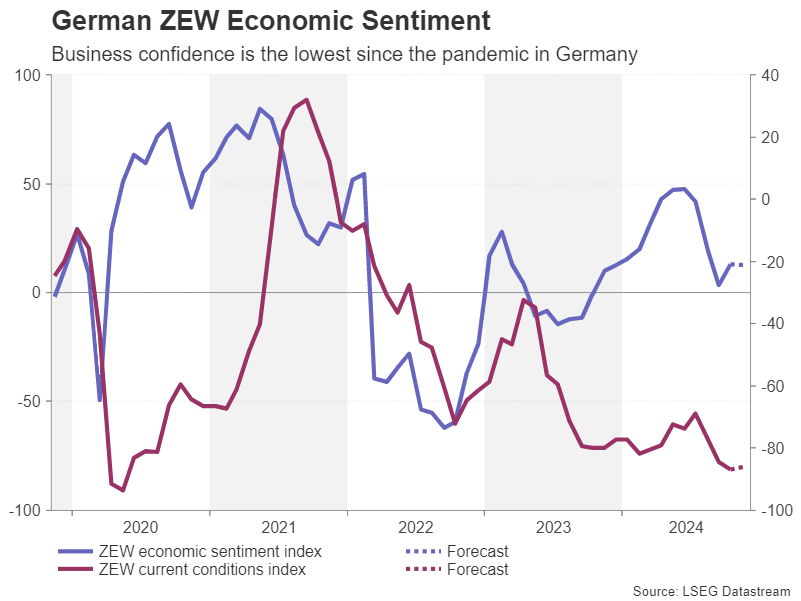

Euro could take to the sidelines

The euro has also been under strain lately amid a gloomier Eurozone outlook compared to other major economies. Nevertheless, Q3 growth surprised to the upside and the preliminary reading of 0.4% q/q will likely be confirmed in the second estimate on Thursday. Quarterly employment growth numbers are also on the agenda on Thursday, as well as September industrial production.

Ahead of those releases, Germany’s ZEW economic sentiment survey might attract some attention on Tuesday. However, investors might be more interested in the political happenings in Germany following the collapse of the coalition government. Snap elections are looming, which may take place as early as January. A change in government in Berlin might pave the way for a reform of the country’s debt brake rule, which limits new borrowing to 0.35% of GDP.

However, any reaction in the euro is likely to be muted for now and the single currency will likely have a calmer time following the volatility of the past week.

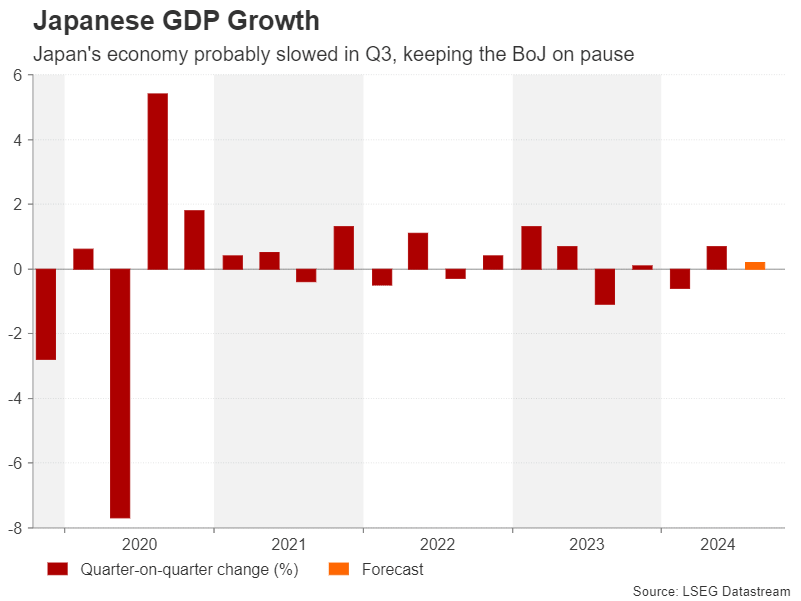

Can Japanese GDP revive the yen?

The yen’s losses since mid-September deepened after the US elections as the dollar jumped to a three-month high of 154.71 yen. But the primary reason for the yen’s negative reversal is the uncertainty around the timing of the Bank of Japan’s next rate hike.

Investors are currently assigning around a 40% probability for a 25-basis-point rate rise in December. But the BoJ may decide to wait until after next year’s annual spring wage negotiations before making up its mind.

For expectations for an earlier rate cut to strengthen, there would have to be a significant improvement in both the growth and inflation data. Hence, better-than-forecast GDP numbers for Q3 on Friday could lift the yen slightly.

Waiting for China’s stimulus to kick in

Elsewhere, the Australian dollar will be keeping an eye on domestic wage growth and employment indicators on Wednesday and Thursday, respectively. Meanwhile the RBZN’s quarterly survey on inflation expectations on Monday could be vital for the New Zealand dollar, as a further decline could bolster bets of a 75-bps rate cut in November.

The aussie and kiwi will additionally be watching the latest data out of China. CPI and PPI figures for October are out on Saturday and the monthly prints on industrial output and retail sales will follow on Friday. Although Chinese authorities have stepped up their stimulus policies over the past year, there’s yet to be a notable acceleration in growth. However, any pickup in activity in October, particularly in retail sales, could raise hopes of a quickening economic recovery, boosting the antipodean currencies and risk assets more broadly.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl