EUR/USD outlook: Bears hold grip but prolonged consolidation may precede fresh push lower

EUR/USD

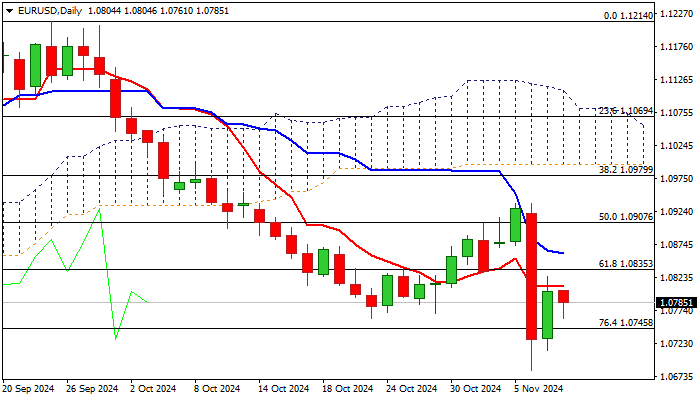

EURUSD weakened on Friday after recovery attempts from new multi-month low (1.0682), hit after Wednesday’s post-election 1.7% fall (the biggest daily loss since 19 Mar 2020), failed to clear daily Tenkan-sen (1.0809).

Formation of bull-trap pattern on daily chart adds to weak near term outlook as Wednesday’s massive bearish daily candle weighs heavily, technical studies remain in full bearish setup and converging weekly Tenkan/Kijun-sen are about to form bear-cross.

However, bears continue to face headwinds from a false break of Fibo support at 1.0745 (76.4% retracement of 1.0601/1.1214 ascend) with weekly close above this level to add to signals that bears are likely to consolidate before resuming the larger downtrend.

Long shadows on weekly candlestick contribute to scenario.

Near-term bias to remain with bears while daily Tenkan-sen caps, with potential extended upticks to be capped under pivotal 200DMA barrier (1.0868).

Res: 1.0835; 1.0848; 1.0869; 1.0907.

Sup: 1.0761; 1.0745; 1.0700; 1.0682.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.