The Canadian dollar was almost unchanged last week, as USD/CAD closed the week at 1.3340. The upcoming week has just three events. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Federal Reserve minutes didn’t contain any surprises, as the guessing game continues regarding a rate hike in December. US Core Inflation met expectations, with a gain of 1.9%. Canadian Retail Sales beat the forecast at 0.3%, but Core Retail Sales missed the estimate with a poor reading of -0.5%.

Updates:

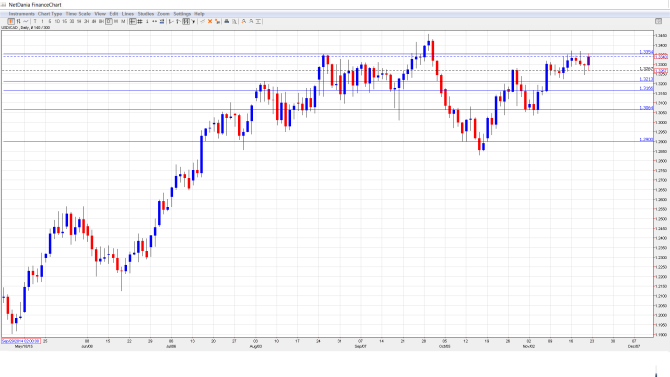

USD/CAD daily chart with support and resistance lines on it.

BOC Deputy Governor Lynn Patterson Speaks: Tuesday, 20:30. Patterson will speak at an event in Regina. A speech that is more hawkish than expected is bullish for the Canadian dollar.

Corporate Profits: Thursday, 13:30. Corporate Profits provides a snapshot of the strength of the business sector. The indicator posted a gain of 12.9% in Q3, after two straight declines.

RMPI: Friday, 13:30. The Raw Materials Price Index measures inflation in the manufacturing sector. The index posted a gain of 3.0% in September, easily beating the estimate of 1.2%. This marked the first gain since May. Will the index repeat with a gain in the October report?

* All times are GMT.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3318 and climbed to a high of 1.3371. The pair then reversed directions, dropping to a low of 1.3246, as support held firm at 1.3213. USD/CAD closed the week at 1.3340.

Technical lines, from top to bottom

We begin with resistance at 1.3759.

1.3587 was a cap in March 2004.

1.3443 has held firm since late September.

1.3353 was tested and remains a weak resistance line.

1.3213 held firm in support for a second straight week.

1.3165 is the next support line.

1.3063 is protecting the symbolic 1.30 line.

The very round line of 1.2900 is the final line of support for now.

I am bullish on USD/CAD

With speculation rising that the Fed could press the rate trigger in December, the US dollar is in an excellent position to post broad gains. Revisions to the Preliminary GDP will be released during the week, and a strong reading could bolster the US dollar.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.