USDTRY

The pair opened with gap-lower on Monday and extended weakness to the lowest level in 1 1/2 month in early European session trading. The dollar continues to weaken on Fed's signal of interest rate cut, while lira was boosted by renewed optimism after opposition candidate won on repeated vote in Istanbul.

Expectations that the government will focus on key economic reforms, inflates lira, while threats of US sanction on Turkey over Russian weapons and CBRT policy dilemma, continue to weigh. Markets turn focus towards end of June G20 Erdogan-Trump meeting, with increased uncertainty expected until then.

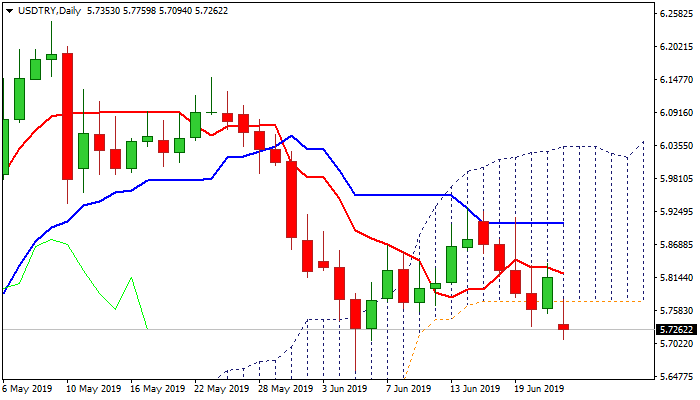

The pair extends weakness below daily cloud base (5.7736), on track to make clear break and attack series of key supports at: 5.6822 (100SMA); 5.6631 (Fibo 61.8% of 5.3037/6.2445) and 5.6102 (200SMA).

Rising bearish momentum and bearish setup of daily MA's (5;10;20;30) support scenario, but oversold stochastic warns of extended consolidation, however, bearish bias is expected to remain intact as long as the price holds below the base of thick daily cloud.

Res: 5.7736; 5.8122; 5.8283; 5.8851

Sup: 5.7094; 5.6822; 5.6631; 5.6575

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.