USD/JPY Weekly Forecast: Volatile consolidation is not an oxymoron

- USD/JPY trades lower on Wednesday and Thursday, reverses on Friday.

- US Treasury yields slip from recent highs, aiding yen, then recover.

- Recession fears are behind the equity sell-off and the dollar safety trade.

- FXStreet Forecast Poll is bearish out to one quarter.

The two-month run in the USD/JPY has stalled as falling Treasury yields undermined the pair’s most potent logic, while slowing growth in China, equity turmoil and the anticipated drag of Federal Reserve rate increases on the US economy brought a modest revival to the yen safety trade.

From Monday’s open at 130.55 the USD/JPY had lost 1.5%% to Friday’s Asian open at 128.60. The bulk of the loss came with Thursday's 1.1% plunge only four days after the USD/JPY traded to a two-decade high at 131.25. Yen’s reversal occurred even as the dollar moved sharply higher against all other majors and in the Dollar Index. Plunging equity prices around the world, the war in Ukraine, China’s lockdowns and soaring inflation and food prices have sent investors flying to the safety of the US dollar and assets over the past weeks.

Treasury yields had turned lower through Thursday aiding the yen recovery as investors sought the safety of the US government debt. The exploding spread between US and Japanese government debt since January had been the chief fuel for a higher dollar.

Friday’s USD/JPY recovery above 129.00 came with a sharp rise in the Treasury yield curve. In early New York trading, the 10-year yield had gained 9.1 basis points to 2.909%, the 30-year 8.3 points to 3.054% and the 2-year 9.3 points to 2.615%.

The EUR/USD closed at 1.0380 on Thursday, down 1.3% on the day, its weakest against the dollar in five years.

American consumer prices and sentiment weighed on the market outlook for the US economy. April CPI at 8.3% overall and 6.2% for core were slightly lower than the March figures but higher than the forecasts. Combined with producer prices at 11%, inflation is looking more and more as a long-term phenomenon, bringing the Federal Reserve's aggressive rate policy to the fore. The Michigan Consumer Sentiment Index for April dropped to 59.1, well below the 64.0 forecast, the weakest reading since August 2011, and the second poorest since the financial crisis.

If the US consumer falters in the second quarter, a recession as traditionally defined, becomes ever more possible.

The summary of the Bank of Japan (BoJ) April meeting underlined the extreme accommodation policy of the central bank. The contrast to US, British and Canadian central banks, is the main source of yen weakness. Japanese economic sentiment indexes showed a small improvement in April but not enough to impact market views.

Technical considerations also helped the yen recovery. Wednesday’s modest 50 point loss and close at 129.98 breached the up-channel that had been the controlling formation since March 7 for the 14.0% gain in USD/JPY. Thursday’s fall confirmed the break and Friday’s rebound stayed well beneath the lower border of the channel now just over 131.00.

USD/JPY Outlook

The fundamental interest rate factors that have propelled the USD/JPY higher since early March remain intact. Inflation in the US shows few signs of diminishing and the longer it remains elevated the more difficult it will be to eradicate. The Federal Reserve will persist in raising rates as long as US economic growth permits.

If US growth fades, the pervasive recession fear evident in stock markets globally, will fund the safety trade to the dollar.

Treasury rates have pulled back from their highs and the USD/JPY moved with them. Concerns over US economic growth in the second and third quarters are likely to cap Treasury rates in the immediate future and that in turn will retard a further ascent in the USD/JPY.

Japan's annualized first quarter GDP is forecast to be -1.8% and -1.2% (YoY). Growth was negative in the first and third quarters and the expected continuation of the pattern into a second year is underlines the fragile state of the Japnese economy. Imports for April are projected to show the sixth straight month of more than 30% expansion.

Retail Sales for April in the US are expected to exhibit continued moderate growthh. Any sign of weakness will undermine equities and tend to the safety dollar trade. Existing Home Sales, 90% of the US market, were already down 11.5% in March from the November recent high as mortgage rate have climbed, a further drop is expected for April.

Consolidation in the band between 127.00 and then 128.00 and 131.00 is the USD/JPY outlook.

Japan statistics May 9–May 13

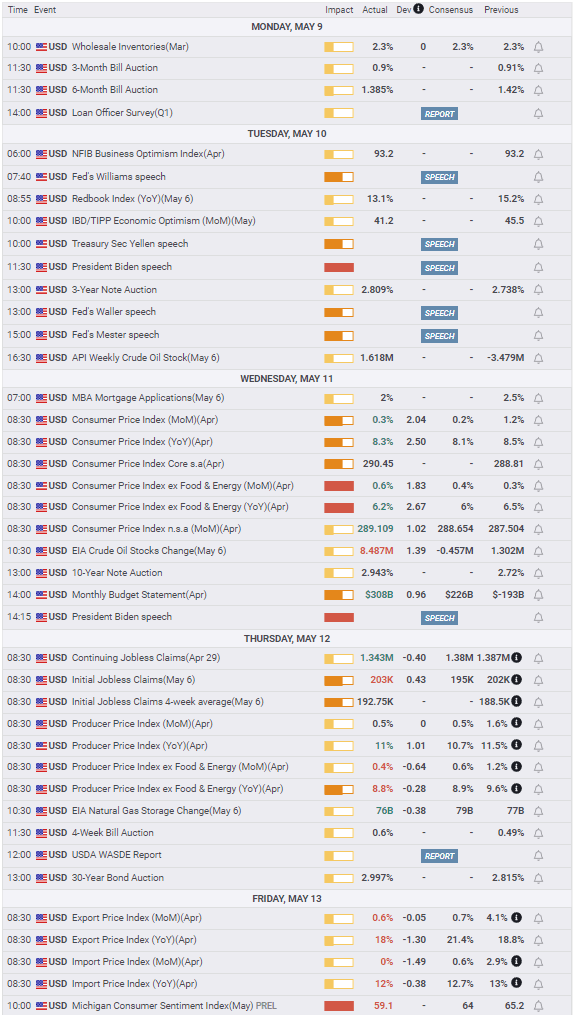

US statistics May 9–May 13

FXStreet

Japan statistics May 16–May 20

FXStreet

US statistics May 16–May 20

FXStreet

USD/JPY technical outlook

The MACD (Moving Average Convergence Divergence) and Relative Strength Index (RSI) signals on May 3 have proved accurate. The MACD price line crossed the signal line, the RSI dropped out of overbought status and the USD/JPY duly tacked lower. The lack of follow-through underscores the fundamental, interest rate nature of the USD/JPY’s six-week climb. Volatility in the Average True Range (ATR) has stayed high even though the movement of the six sessions from May 3 until Thursday was relatively limited. This highlights the potential for movement above and below the market.

The 21-day moving average (MA) at 129.04 is part of support at 129.00. The area between 127.00 and 129.00 has been well-traveled and the support should hold.

Resistance: 130.00, 130.50, 130.85, 131.35

Support: 129.00, 128.40, 127.70, 127.00

Moving Averages: 21-day 129.04, 50-day 124.44, 100-day 119.24, 200-day 115.98

FXStreet Forecast Poll

With almost no profit having been taken on the USD/JPY 14.3% rise from March 7 to April 28, the FXStreet Forecast Poll predicts technical factors favor a move lower. These will gain increasing weight the longer the USD/JPY fails to push above 131.00.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637880503200817058.png&w=1536&q=95)

%20tech%201-637880578951005750.png&w=1536&q=95)

%20tech2-637880579231258737.png&w=1536&q=95)