USD/JPY Price Forecast: Further rangebound looks likely

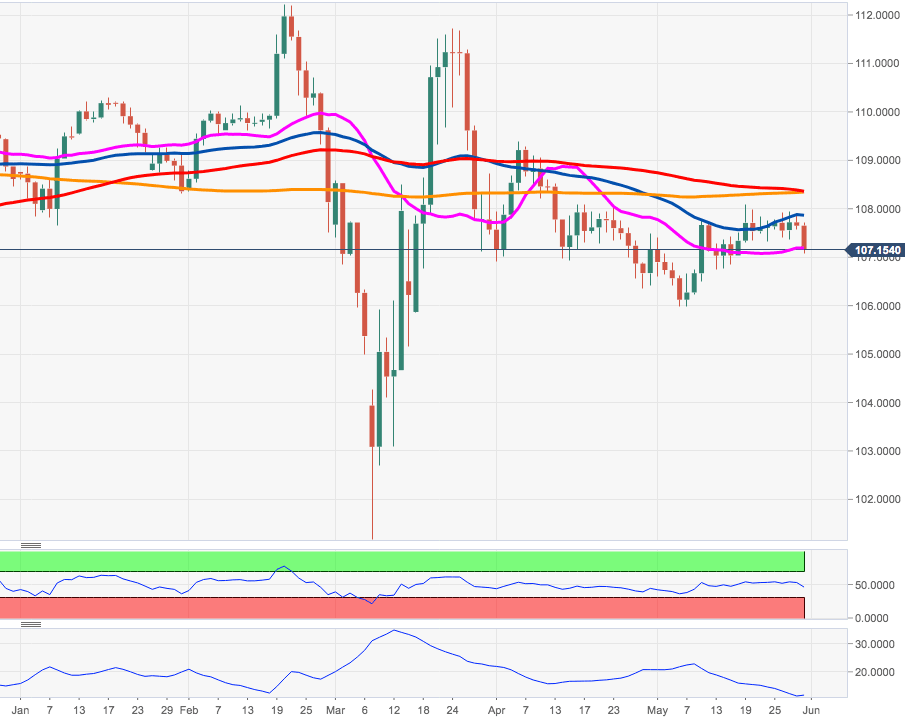

- USD/JPY stays consolidative above 107.00 so far.

- Solid support emerges in the 106.00 neighbourhood.

USD/JPY is receding for the second session in a row at the end of the week, as the selling mood continues to hurt the greenback, mainly in response to month-end flows.

The resurgence of the US-China + Hong Kong effervescence promises to lend support to the demand for the Japanese safe haven amidst the expected “flight-to-safety” environment.

In addition, and despite the spread of the COVID-19 looks somewhat subsided, its impact of the global economy are far from abated. This is, at the same time, kind of limiting the selling pressure on the yen and leaves the upside in the cross limited by the 200-day SMA in the 108.30 region (the upper end of the prevailing consolidative theme).

Near-term Outlook

The rangebound mood in USD/JPY appears unchanged at least in the very near-term. Occasional bullish attempts should meet a solid barrier at the 108.30 zone, where sits the 200-day SMA; on the opposite side, May’s low in the 106.00 neighbourhood is expected to hold the downside for the time being. Furthermore, the broader risk appetite trends (coronavirus, re-opening of the economy, US-China trade) plus domestic issues (BoJ’s easing, economic recession) are predicted to keep driving the sentiment around the pair for the time being.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.