USD/JPY Price Forecast: Bears await ascending channel breakdown after hawkish BoJ rate hike

- USD/JPY retests one-month low in reaction to the BoJ’s hawkish rate hike on Friday.

- Bets for more Fed rate cuts weigh on the USD and also exert pressure on the major.

- The divergent BoJ-Fed outlook supports prospects for further near-term weakness.

The USD/JPY pair attracts sellers for the second straight day and drops back closer to over a one-month low touched earlier this week after the Bank of Japan (BoJ) announced its policy decision. As was widely expected, the BoJ decided to hike interest rates by 25 basis points (bps) – the most since February 2007 – to 0.50%, or the highest since the 2008 global financial crisis. Moreover, the central bank revised up its inflation forecast amid expectations that annual springtime wage negotiations will yield bumper wage hikes again in 2025. This comes amid signs of broadening inflation in Japan and supports prospects for further policy tightening by the BoJ, which, in turn, provides a goodish lift to the Japanese Yen (JPY).

In fact, data released by the Japan Statistics Bureau this Friday showed that the National Consumer Price Index (CPI) rose 3.6% YoY in December, compared to the previous month's reading of 2.9%. Further details of the report revealed that Japan's core consumer prices climbed from 2.7% to 3.0% during the reported month – marking its highest level since mid-2023. Adding to this, a core reading, which strips out the effect of both fresh food and energy prices, remained above the BoJ's 2% annual target and held steady at 2.4% in December from a year earlier amid strong private consumption. Moreover, the BoJ also raised its inflation forecast and does not expect the CPI to drop back under its target anytime soon.

Meanwhile, the BoJ's hawkish outlook marks a big divergence in comparison to rising bets that the Federal Reserve (Fed) will lower borrowing costs twice in 2025 amid abating inflationary pressures in the US. The expectations were further lifted by US President Donald Trump's comments on Thursday, saying that he will demand that interest rates drop immediately. Adding to this, Trump said on Friday that he would rather not use tariffs on China and that he could reach a trade deal with the world's second-largest economy. This eases inflation concerns and triggers a fresh leg down in the US Treasury bond yields, dragging the US Dollar (USD) to a one-month low and further exerting pressure on the USD/JPY pair.

Moving ahead, investors now look forward to the release of the flash US PMIs, which might influence the USD later during the early North American session. Apart from this, Trump's remarks on tariffs will play a key role in driving demand for the buck and provide some impetus to the USD/JPY pair. Nevertheless, spot prices remain on track to register losses for the second consecutive week. Moreover, the fundamental backdrop favors bearish traders and suggests that the path of least resistance for the currency pair is to the downside.

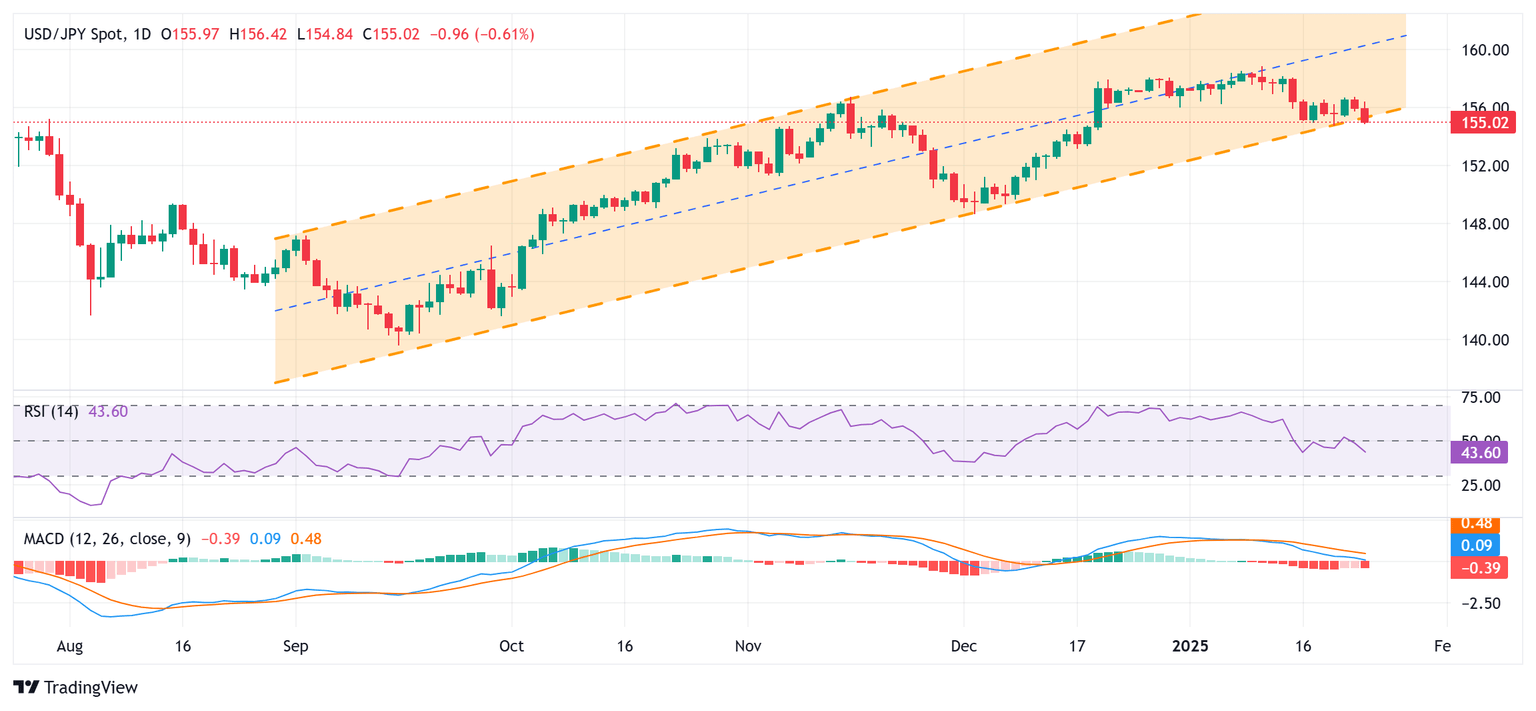

USD/JPY daily chart

Technical Outlook

Spot prices, so far, have been showing resilience below the 155.00 psychological mark and finding some support near the lower boundary of a multi-month-old ascending channel. Hence, it will be prudent to wait for some follow-through buying below the weekly low, around the 154.75 region, before positioning for further losses. Given that oscillators on the daily chart have just started gaining negative traction, the USD/JPY pair might then accelerate the fall towards the the 154.00 round figure en route to mid-153.00s and the 153.00 mark.

On the flip side, any attempted recovery might now confront some resistance near the 155.50-155.55 region, above which a bout of a short-covering could allow spot prices to reclaim the 156.00 mark. The momentum could extend further towards the overnight swing high, around 156.75 region, or over a one-week high. Some follow-through buying, leading to a subsequent strength beyond the 157.00 mark, should pave the way for a move towards the 157.55 area en route to the 158.00 mark. The USD/JPY could eventually climb to the 158.35-158.40 region before aiming to retest the multi-month peak, around the 159.00 neighborhood touched on January 10.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.