USD/JPY

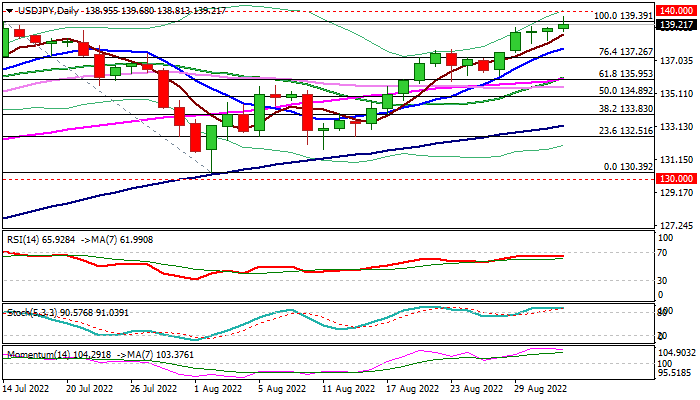

The USDJPY posted new 24-year high on break through former 2022 peak, posted in July.

The dollar remains strongly underpinned by a hawkish stance of Fed, as many market participants bet for another 75 basis points rate hike in the policy meeting later this month, as Fed expressed its strong commitment to restore price stability by tightening its monetary policy, even at cost of significant slowdown in economic growth.

On the other side, the Bank of Japan sticks to its ultra-loose policy and widening gap between the policies of two central banks would continue to be a main driver of the greenback against yen.

Although bulls cracked key barrier at 139.39, headwinds should be expected here as daily studies are overbought.

Limited dips (ideally to be contained at 128.00/137.80 zone) should offer better buying levels for clear break of 139.39 pivot and test of psychological 140 barrier, with further acceleration higher on break of 140 barrier, not ruled out on current conditions or more hawkish signals from the US central bank.

Res: 139.68; 140.00; 141.51; 142.82.

Sup: 138.63; 138.05; 137.80; 137.26.

Interested in USD/JPY technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.