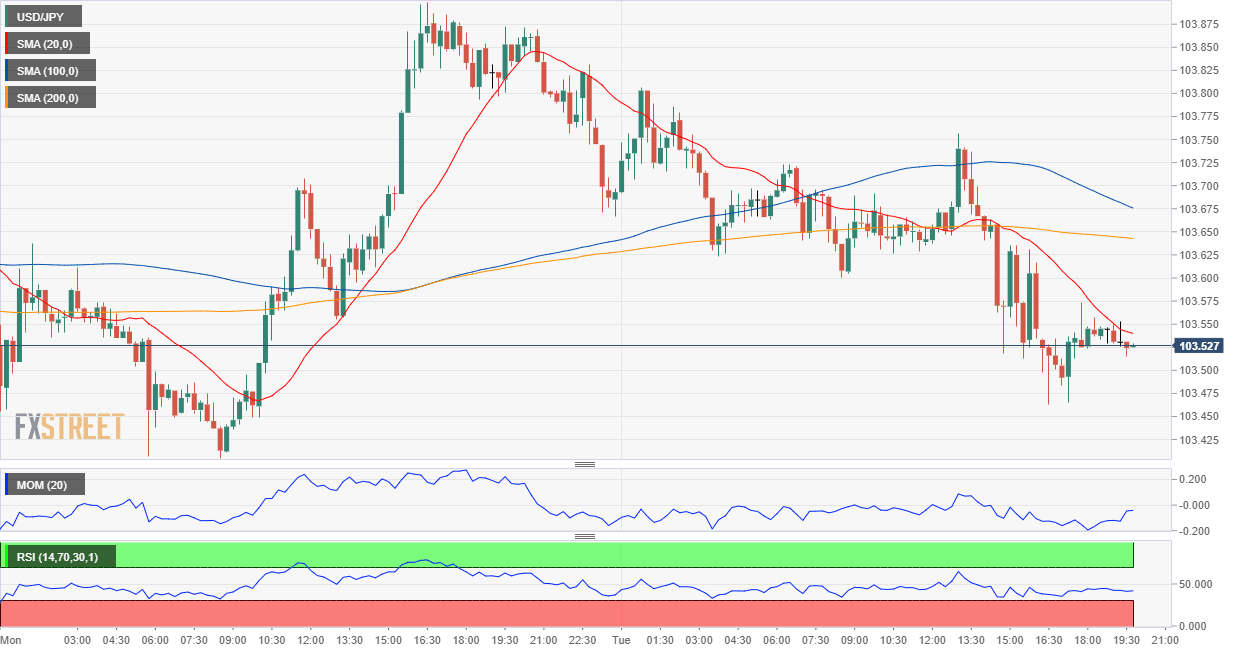

USD/JPY Forecast: Neutral-to-bearish stance persists

USD/JPY Current price: 103.52

- Wall Street changed course mid-US afternoon, falling into the red after reaching record highs.

- US Treasury yields hold in range as speculative interest monitors US stimulus checks’ developments.

- USD/JPY is poised to extend its decline but still needs to break below the 103.50 support.

The Japanese yen appreciated modestly against its American rival in a risk-on environment, with USD/JPY returning to the lower end of its latest range by the end of the US session. The decline gained momentum during US trading hours, as US indexes pulled off their daily highs and turned red. Meanwhile, US Treasury yields advanced as investors await US Senate approval on larger stimulus checks. Lawmakers´ decision will likely be known at the beginning of the Asian session.

Japan didn’t publish macroeconomic data this Tuesday, and the calendar will remain empty on Wednesday.

USD/JPY short-term technical outlook

The USD/JPY pair is neutral-to-bearish according to intraday charts, although a clearer negative picture will result from the break of the 103.15 support level. The 4-hour chart shows that a mildly bearish 100 SMA provided intraday resistance, rejecting advances. The pair now develops below all of its moving averages, while technical indicators are stable within negative levels.

Support levels: 103.15 102.70 102.25

Resistance levels: 104.05 104.40 104.80

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.