USD/JPY Forecast: At the lower end of its weekly range

USD/JPY Current price: 106.36

- Japan’s Jibun Bank Services PMI plunged to 21.5 in April.

- The US is expected to have lost 22 million jobs in the past month.

- USD/JPY bearish, a critical resistance level at 106.90 should cap advances.

The USD/JPY pair consolidates at the lower end of its weekly range, not far above the 106.00 figure, ahead of the release of the US Nonfarm Payroll report. The market mood is positive, after Thursday’s setback when speculative interest started priced in negative US rates early 2021, amid easing tensions between the US and China. Representatives from both countries held phone talks and vowed to continue to support phase one of the trade deal. Equities in Asia and Europe are in the green, while US Treasury yields stabilised, with the yield on the 10-year note at 0.63%.

Japan released overnight Labor Cash Earnings for March, which increased by 0.1% when compared to a year earlier, missing the market’s expectations. Overall Household Spending in the same period decreased by 6.0%. Also, the Jibun Bank Services PMI plunged to 21.5 in April after printing 33.8 in March.

The US is expected to have lost 22 million jobs in April, while the unemployment rate is foreseen at 14%. It is the first report that fully compiles lockdown´s data, and the market won’t be shocked, even if the numbers are worse than anticipated.

USD/JPY short-term technical outlook

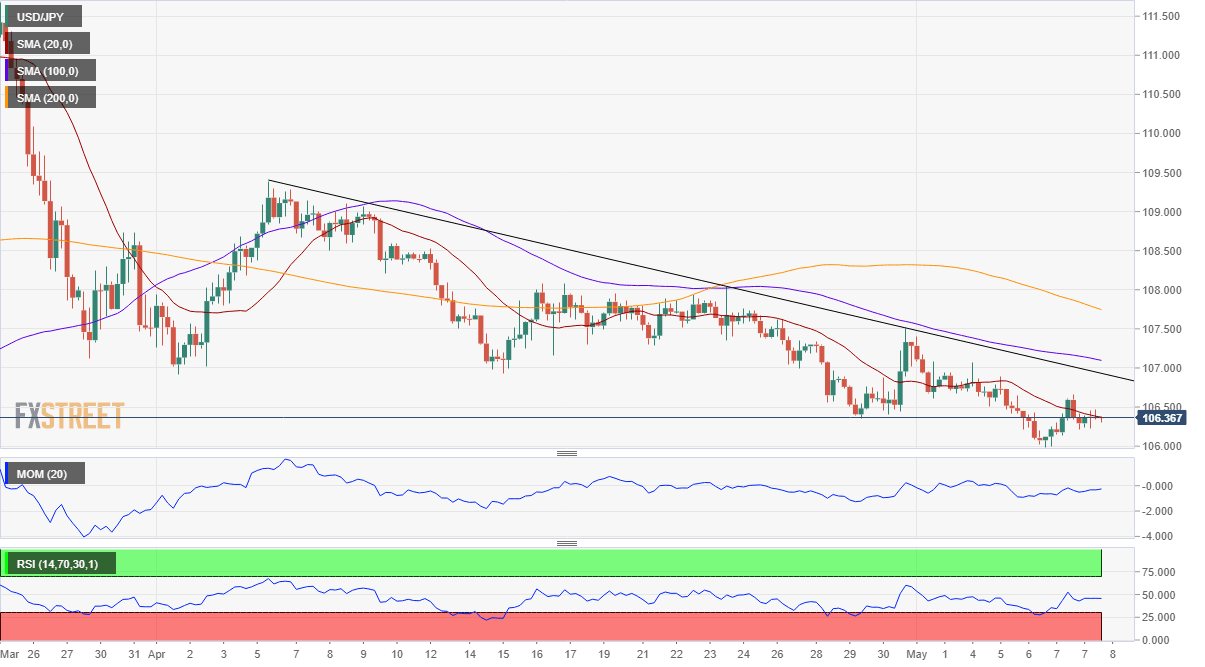

The USD/JPY pair has been on a downward path since early April, slowly but steadily heading south. A daily descendant trend line is coming from April’s high at 109.37 stands today at around 106.90, a critical resistance that the pair needs to surpass to lose its bearish tone. Nevertheless, the 4-hour chart shows that the risk remains skewed to the downside, as the pair is unable to advance beyond a bearish 20 SMA, while the larger ones gain downward strength above it. Technical indicators remain flat around their midlines, reflecting the current lack of interest.

Support levels: 106.00 105.65 105.20

Resistance levels: 106.50 106.90 107.30

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.