EUR/USD

Making new lows.

EUR/USD has broken the key support area defined by 1.3503 (see also the long-term rising trendline from the July 2012 low) and 1.3477, confirming an underlying downtrend. Hourly resistances can be found at 1.3513 (21/07/2014 low) and 1.3549 (21/07/2014 high).

In the longer term, the break of the long-term rising wedge (see also the support at 1.3673) indicates a clear deterioration of the technical structure. A long-term downside risk at 1.3379 (implied by the double-top formation) is favoured as long as prices remain below the resistance at 1.3700. A strong support stands at 1.3296 (07/11/2013 low).

Await fresh signal.

GBP/USD

The support at 1.7039 has held thus far.

GBP/USD is in a corrective phase. The hourly support at 1.7039 has held thus far. A break of the hourly resistance at 1.7118 (18/07/2014 high) would improve the short-term technical structure. Another resistance stands at 1.7192, whereas another support lies at 1.7007 (see also the 38.2% retracement).

In the longer term, the break of the major resistance at 1.7043 (05/08/2009 high) calls for further strength. Resistances can be found at 1.7332 (see the 50% retracement of the 2008 decline) and 1.7447 (11/09/2008 low). A support lies at 1.6923 (18/06/2014 low).

Buy stop 2 units at 1.7202, Obj: Close 1 unit at 1.7328, remaining at 1.7435, Stop: 1.7158.

USD/JPY

Moving sideways.

USD/JPY is moving sideways within the horizontal range defined by the support at 101.07 and the resistance at 101.86. The succession of lower highs and the recent inability to break the hourly resistance at 101.58 (intraday high) indicate persistent selling pressures.

A long-term bullish bias is favoured as long as the key support 99.57 (19/11/2013 low) holds. However, a break to the upside out of the current consolidation phase between 100.76 (04/02/2014 low) and 103.02 is needed to resume the underlying bullish trend. A major resistance stands at 110.66 (15/08/2008 high).

Await fresh signal.

USD/CHF

Pushing higher.

USD/CHF has broken the resistance at 0.9013 (16/06/2014 high) and is now challenging the key resistance at 0.9037 (see also the declining channel). Hourly supports can be found at 0.9001 (intraday low) and 0.8969 (17/07/2014 low).

From a longer term perspective, the bullish breakout of the key resistance at 0.8953 suggests the end of the large corrective phase that started in July 2012. The long-term upside potential implied by the double-bottom formation is 0.9207. A strong resistance stands at 0.9156 (21/01/2014 high).

Await fresh signal.

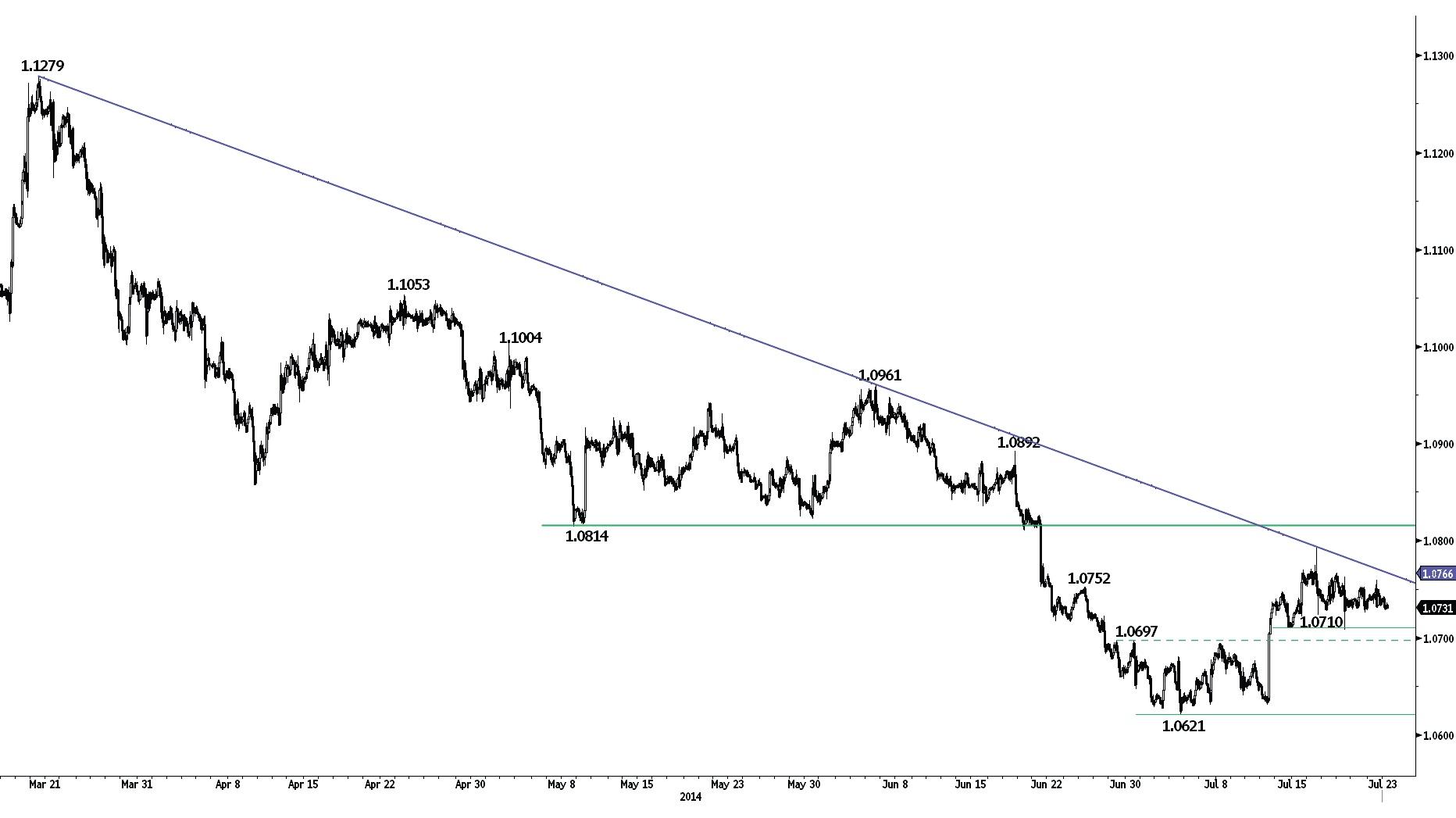

USD/CAD

Remains thus far capped by its declining trendline.

USD/CAD is fading near the resistance implied by its declining trendline. A break of the hourly support at 1.0710 (14/07/2014 low) would confirm exhaustion in the buying interest. Another hourly support lies at 1.0694 (08/07/2014 high). A key resistance lies at 1.0814 (previous support, see also the 200 day moving average).

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. However, a break of the support area implied by the long-term rising trendline (around 1.0637) and 1.0559 (29/11/2013 low) would invalidate this long-term bullish configuration.

Await fresh signal.

AUD/USD

Improving.

AUD/USD has broken the resistance at 0.9409 (see also the declining trendline), alleviating the concerns stemming from a potential bearish head and shoulders formation. Monitor the resistance at 0.9457. A key resistance stands at 0.9505. An initial support now lies at 0.9426 (intraday low). Another support stands at 0.9380 (intraday low, see also the rising channel).

In the longer term, the false breakout at 0.9461 confirms a limited upside potential, favouring a bearish bias. However, a break of the key support at 0.9206 (03/04/2014 low) is needed to open the way for a new significant phase of decline.

Sell stop 2 units at 0.9309, Obj: Close 1 unit at 0.9212, remaining at 0.9007, Stop: 0.9348.

GBP/JPY

Consolidating.

GBP/JPY is recently moving sideways (see potential symmetrical triangle). A break of the hourly resistance at 173.73 (see also the declining trendline) is needed to improve the short-term technical structure. Another resistance stands at 174.57. Hourly supports can be found at 172.68 (18/07/2014 low) and 172.38.

In the long-term, the break of the major resistance at 163.09 (07/08/2009 high) calls for further strength towards the resistance at 179.17 (15/08/2002 low). The long-term technical structure remains supportive as long as the key support area defined by 163.89 (04/02/2014 low) holds.

We have updated our strategy.

Buy stop 2 units at 174.67, Obj: Close 1 unit at 179.80, remaining at 183.85, Stop: 174.14.

EUR/JPY

Approaching the key support at 136.23.

EUR/JPY continues to weaken and is now approaching the key support at 136.23. Hourly resistances are given by 137.34 (22/07/2014 high) and the short-term declining trendline (around 137.77).

The bearish breakout of the 200 day moving average confirms a deterioration of the mediumterm technical structure. A key support stands at 136.23 (04/02/2014 low), while a strong resistance lies at 104.09 (09/06/2014 high).

The long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low) holds.

Await fresh signal.

EUR/GBP

Moving lower.

EUR/GBP is making (marginal) new lows, confirming an underlying downtrend. Hourly resistances are given by 0.7934 and the top of the declining channel (around 0.7955).

In the longer term, the break of the key support area between 0.8082 (01/01/2013 low) and 0.8065 (05/06/2014 low) opens the way for a full retracement of the rise that started at 0.7755 (23/07/2012 low). Another strong support stands at 0.7694 (20/10/2008 low). A break of the resistance at 0.8034 (25/06/2014 high) is needed to suggest some exhaustion in the medium-term selling pressures.

Await fresh signal.

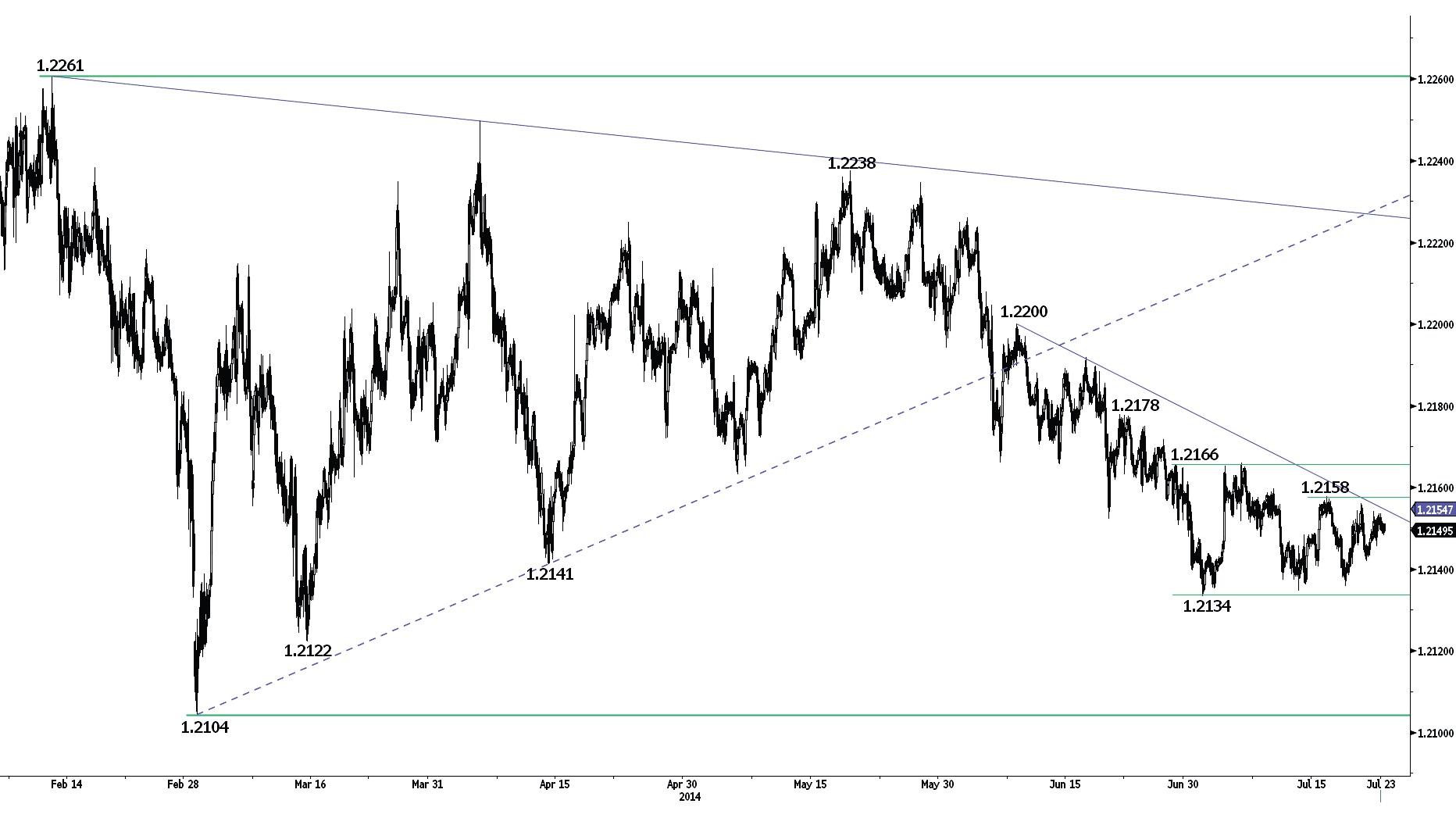

EUR/CHF

Consolidating.

EUR/CHF is moving within its horizontal range defined by the support at 1.2134 and the resistance at 1.2166. A break of the hourly resistance at 1.2158 (see also the declining trendline) would signal increasing buying interest. However, the aforementioned horizontal range needs to be broken to negate the downside risk at 1.2104 implied by the previous symmetrical triangle.

In the longer term, prices are moving in a broad horizontal range between the key support at 1.2104 and the resistance at 1.2261.

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the foreseeable future.

Long 3 units at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

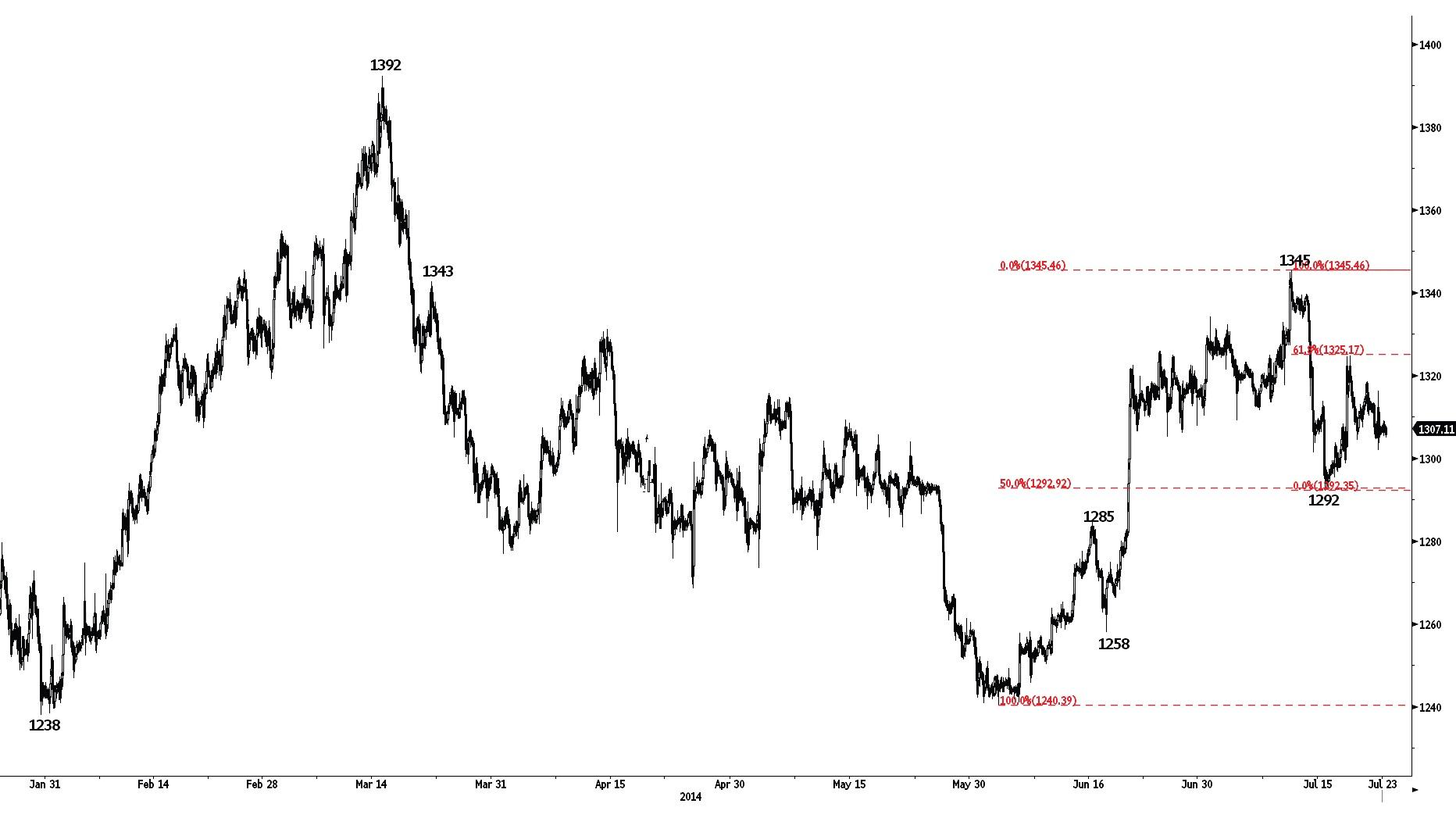

GOLD (in USD)

Consolidating.

Gold remains thus far stuck between the support at 1292 (see also the 50% retracement of the rise started in June) and the hourly resistance at 1325 (61.8% retracement of the recent decline). As long as prices remain below that resistance, a new leg lower is favoured. Another support can be found at 1285.

In the long-term, we are sceptical that the horizontal range between the strong support at 1181 (28/06/2013 low) and the major resistance at 1434 (30/08/2013 high) is a long-term bullish reversal pattern. As a result, a decline towards the low of this range is eventually favoured.

Await fresh signal.

SILVER (in USD)

Moving sideways.

Silver has successfully tested the support at 20.58. However, prices have thus far failed to decisively break the resistance at 21.23 (intraday high, see also the 61.8% retracement), suggesting a limited buying interest. Another resistance stands at 21.58, whereas another support lies at 20.00.

In the long-term, the trend is negative. However, the successful test of the strong support area between 18.84 and 18.23 (28/06/2013 low) and the break of the resistance at 20.41 (24/02/2014 high) indicate clear exhaustion in the selling pressures. A key resistance stands at 22.18 (24/02/2014 high).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.