USD/CAD Weekly Forecast: Waiting for the catalyst?

- USD/CAD remains stalled at 1.2075, near six-year low.

- WTI closes at two-and-a-half-year high on Friday.

- US and Canadian payroll reports arrive on Friday.

- FXStreet Forecast Poll sees technical rebound.

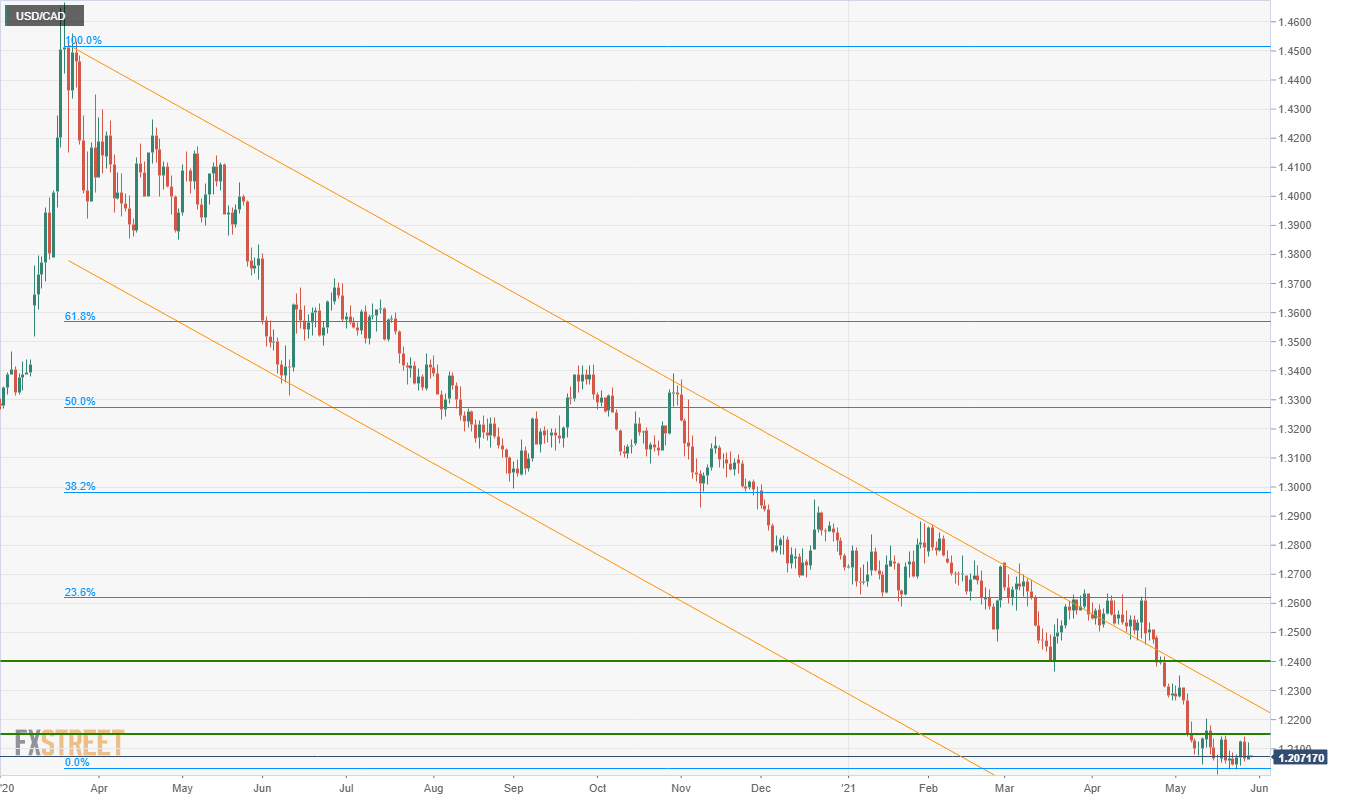

Since closing at 1.2150 on May 6, then a more than three-year low, the USD/CAD has stalled. The pair has finished above that 1.2150 level once, on May 13 at 1.2163, but has closed no lower than 1.2045 and ended on Friday at 1.2078, just 11 points above the week’s open.

Since breaking through 1.2400 on April 28, the USD/CAD has fallen 2.6% in a month. In the 13 months from March 2020 to April this year, the total drop was 14.5%, or 1.1% a month, less than half what has befallen it over the last 30 days.

Fundamental factors have heavily favored the Canadian dollar for the past month.

West Texas Intermediate (WTI) has gained 7.5% since April 26 and closed on Friday at its highest price since October 2018. The oil sector represents 11% of the Canadian economy.

The Canadian vaccination program has finally caught up to the United States with a comparable percentage of adults protected. Surging US growth, estimated by the Atlanta Fed to be 9.3% annualized in the second quarter, is a boon north of the border; about 20% of Canadian GDP can be tied to the US economy.

Lastly, the Bank of Canada became the first major central bank to reduce its pandemic accommodation when it cut its government bond purchases by one-quarter, from C$4 billion a week to C$3 billion on April 21.

In light of the Federal Reserve’s steadfast commitment to its massive liquidity provision, even with the sharply higher US inflation and straining economy, this has provided a strong interest rate base for the loonie.

Despite these natural advantages, the Canadian dollar has advanced less than a figure since the first week of May. The lack of follow through to the May 6 break may simply be an acknowledgement that the loonie rally is very long in the tooth, with no profit-taking selling at all, and that the fundamental trends that have prevailed for more than a year have run their course.

The consolidation for the last three weeks is not necessarily a precursor to a reversal, but it is an indicator that the USD/CAD requires a fresh reason to resume its fall. Without that enhanced logic, the case for a technical rebound in the USD/CAD strengthens the longer it is unmoved at these levels.

A potential catalyst for that reversal is the upcoming Federal Reserve meeting on June 15-16. The minutes of the April Federal Reserve Open Market Committee (FOMC) meeting have raised the possibility that the bank may reconsider its bond purchases program in view of the vaulting inflation and economy.

Federal Reserve Chair Jerome Powell has been insistent, especially at the April press conference, that its accommodative policy will remain until there is, in his phrase, “substantial further progress” toward the bank’s employment and economic goals.

Still, no policy is forever, even one answering a historically unique economic calamity. It would only take one hint from Mr. Powell to send Treasury rates and the dollar flying higher.

Markets in the US and around the globe are being slowly prepared for a reduction in bond purchases. The Fed will issue new economic and rate projections at its June meeting. Any improvement to the GDP estimate of 6.5% for 2021 will accrue to Treasury yields and the dollar.

There were no Canadian statistics this past week.

American statistics for the most part underlined the fast-improving US economy.

New Home Sales fell more than predicted in April but remained very active. Business investment and consumer spending in Durable Goods were healthy in April with upward revisions to March. Even the unexpected 1.3% decline in the headline number was due to a 6.2% drop in automobile and truck sales. Many manufacturers have had to reduce production due to the pandemic-induced worldwide computer chip shortage.

Initial Jobless Claims fell to a pandemic low at 406,000, pointing to a vibrant labor market despite the weak April payroll numbers.

The Personal Consumption Expenditure Price Index, the Fed’s preferred inflation measure, was higher than forecast in April at 3.6% (YoY) overall and 3.1% for the core rate. Both rates were the highest in over a decade.

Comments from US officials also gave the dollar modest general support though this did not move the USD/CAD.

Treasury Secretary Janet Yellen said that inflation would remain elevated through 2021. Dallas Fed President Robert Kaplan noted that improving labor markets might warrant taper talks. Perhaps it was Mr. Kaplan who was cited, among others, in the FOMC minutes last week that excited markets with consideration of a potential change in Fed policy.

USD/CAD outlook

May’s consolidation should extend into June, probably until the Fed meeting in three weeks.

The lower tendency for the USD/CAD, a product of more than a year of losses, will remain at least until Friday's US payroll report.

The current forecast for US Nonfarm Payroll is 621,000. A stronger report will provide only modest support for the greenback, at least until the Fed weighs in eight sessions later. A weaker than expected number could sink the USD/CAD further, coming after the vastly disappointing April result and raising the puzzling aspect of a booming economy unable to put people back to work.

Canada’s employment report, issued the same day, normally takes a far second place in market attention.

Technical support for the USD/CAD is weak. The relevant lines are from April and May 2015 and bear little on current trading. The largest impediment to a lower USD/CAD may be exhaustion. The USD/CAD is in the unusual situation of a trend for 13 months and a 17% move without any appreciable profit-taking.

Canada statistics May 24–May 28

FXStreet

US statistics May 24–May 28

FXStreet

Canada statistics May 31–June 4

Employment numbers for May, even though overshadowed by their equivalent in the US, are the main statistics, followed by the Ivey PMI.

US statistics May 31–June 4

Nonfarm Payrolls for May is the crucial number and most of the holiday-shortened week will be spent waiting for it.

April's deficit of almost three-quarters of a million jobs was a huge surprise, because all other indicators point to effervescent US growth and ADP private payrolls recorded 742,000 hires. It is a puzzle how a partial survey could report more new positions than one that covers the entire economy. In addition, the unadjusted April payroll was 1.089 million. This will be a very interesting and watched employment report.

The Institute for Supply Management (ISM) Purchasing Managers' Indexes for services and manufacturing in May will also be carefully vetted.

USD/CAD technical outlook

Momentum indicators suggest the USD/CAD is a buy; but that has been true for most of the month. Given the strength of the Canadian dollar, a technical reversal without an accompanying change in one of the fundamental conditions is unlikely. Support lines are excessively weak, only the nearest has any recent trading, the others stem from six years ago and are much too tenuous to thwart a strongly trending pair. The 21-day moving average (MA) at 1.2123 is a minor resistance line ahead of the first major at 1.2150. The 100-day MA at 1.2507 and the 200-day at 1.2780 are out of the picture.

Resistance: 1.2150, 1.2270, 1.2315, 1.2400

Support: 1.2048, 1.1970, 1.1865

USD/CAD Forecast Poll

The FXStreet Forecast Poll takes the sensible and technical view that the USD/CAD is due for a rebound. However, that has been true for almost a month and has been overridden by a fundamental picture that has not yet changed.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.