Dogecoin Price Prediction: DOGE’s 15% upside potential hinges on Bitcoin holding above $65K

- Dogecoin price has crossed above resistance due to a descending trendline amid growing bullish momentum.

- DOGE could make a 15% run to $0.18 if Bitcoin price holds above $65,000.

- A candlestick close below $0.12 would invalidate the bullish thesis.

Dogecoin (DOGE) price is trading with a bullish bias, leading meme coins north as sector bulls resurface. This show of hand comes after Bitcoin (BTC) price broke past the $65,000 threshold and could extend if the pioneer cryptocurrency holds above this level.

Dogecoin price eyes 15% climb

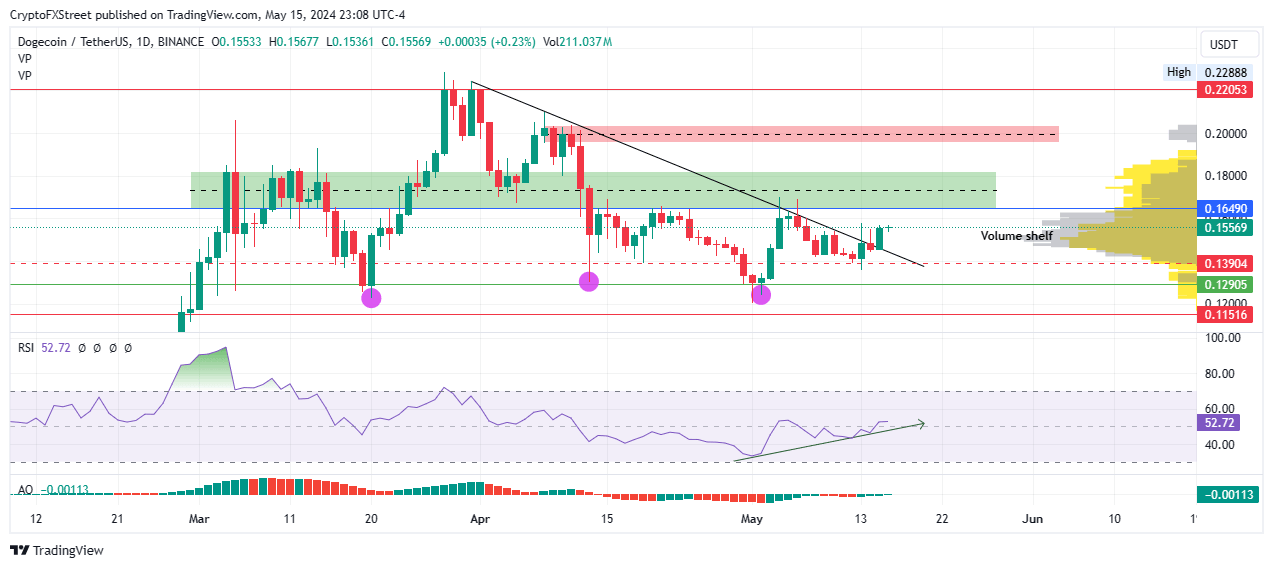

Dogecoin price has breached resistance due to the descending trendline for the first time since late March. It follows growing bullish momentum, shown by the higher lows on the Relative Strength Index (RSI).

If this momentum indicator manages another high low above the mean level of 50, Dogecoin price could extend the climb to shatter the $0.16 resistance level. Based on the volume profile, the spikes in the nodes shows there is more bearish than bullish activity waiting to interact with DOGE below this level.

If bull can haul above it, the $0.18 target would be reachable for Dogecoin price. In a highly bullish case, the bulls residing near $0.18 would push DOGE price to the $0.20 psychological level, last tested on April 12.

Besides the rising RSI, the Awesome Oscillator is also edging toward positive territory, showing a growing bullish momentum and therefore sentiment. A green Awesome Oscillator signals that the most recent market momentum is bullish. When it is climbing towards positive territory, it suggests that the bullish momentum is strengthening.

Noteworthy, investors should watch for the steepness of the climb towards positive territory, as it can also indicate the strength of the bullish trend. A sharp rise suggests strong buying activity and conviction among market participants.

DOGE/USDT 1-day chart

If early profit taking commences, however, Dogecoin price could retract. A breakdown below the descending trendline would effectively see DOGE lose the critical support at $0.13.

In a dire case where Dogecoin price breaks below $0.12, the bullish thesis would be invalidated. In such a turnout, the Bitcoin of meme coins could extend the fall to $0.11, 26% below current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.