USD/CAD Weekly Forecast: US interest rates vs commodities

- USD/CAD reverses at the end of the week from three-year low.

- US intermediate and long- term Treasury rates help USD/CAD higher.

- Stimulus in US expected to further the consumer spending surge.

- WTI stalls at $63.50, falls 2.9% on Friday.

- BoC Governor Tiff Macklem warns of “excessive exuberance” in housing.

- FXStreet Forecast Poll overtaken by late week USD/CAD momentum.

The USD/CAD rebounded crisply on Thursday and Friday, climbing 1.7% to 1.2727 after closing at a three-year low of 1.2510 on Wednesday.

Rising US Treasury rates fronting a potentially expansive American economy, a dip in oil prices and a general US dollar surge were responsible for the turnaround.

Treasury rates backed somewhat on Friday but yields from the middle to long end of the curve have increased substantially this year.

The 5-year bond has gained 37 basis points from its close on December 31 to 0.73% (2/26), the 10-year 49 points to 1.407% (2/26) and the 30-year 51 points to 2.154% (2/26). All three are at at their pandemic highs.

At the short end of the spectrum, where the Fed has concentrated its repression efforts, the 2-year bond has added less than1 point to 0.129% (2/26). Fed Chairman Jerome Powell repeated his promise in Congressional testimony that interest rates would remain low until the bank has met its employment and inflation goals.

Credit markets are reacting to evidence of a strengthening US recovery with notice from the US retail sector, to a rise in global commodity prices and a doubling of the US Producer Price Index in January.

In the US the population may be ready to celebrate the end of the pandemic.

Durable Goods Orders jumped 3.4% in January, three times the 1.1% forecast and Retail Sales soared 5.3%. Excluding the up and down around the spring pandemic lockdowns, it was the second highest monthly retail increase in a generation.

American families are slated to receive another $1400 in government stipends in addition to the $600 that helped fuel the January boom in spending. Personal Income jumped 10% in January up from 0.6% in December, incorporating the December stimulus awards.

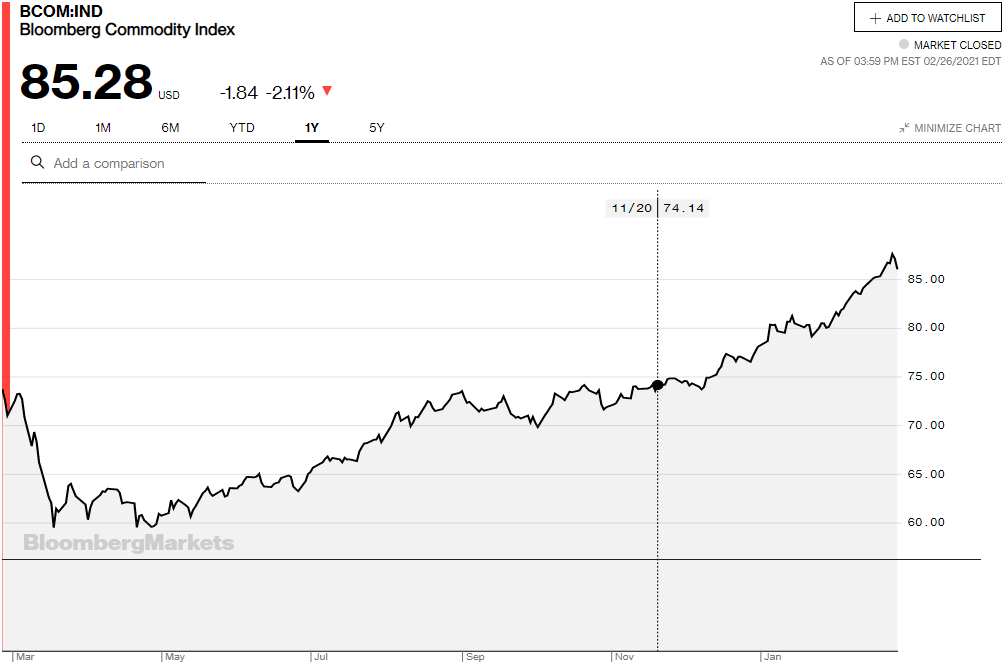

West Texas Intermediate (WTI) and commodities have been signaling an expected increase in demand since at least the New Year and have been another major driver for the strength in the Canadian dollar and its resource intensive economy.

The North American crude oil pricing standard had been up an even 30% this year to the close on Thursday at $63.28. The Bloomberg Commodity Index (BCOM) had been 12% higher to the 87.58 close on Wednesday. Friday's reversal in both items, WTI lost 2.9% to $61.46 and BCOM 2.6% to 85.28 provided additional impetus to the USD/CAD ascent.

Bank of Canada Governor (BoC) Tiff Macklem warned that monetary stimulus may be inducing a bubble in the Canadian housing market.

"In that low-for-long world, there are risks that housing could get carried away, so that is something we will be looking at very carefully," he said in answer to a question after his virtual speech to the Edmonton and Calgary Chambers of Commerce on Tuesday.

The New Housing Price Index rose 5.4% on the year in January up from 4.6% in November and December for the highest rate in over a decade. The BoC base rate has been at 0.25% since March 2020.

Even though the bank expects the economy to recover forcefully by the end of the year, Macklem said that high unemployment among women and youth warrants continued policy support. Inflation is not a factor, he observed, because there is a great deal of slack in the economy and the labor market.

USD/CAD outlook

The USD/CAD is reaching a decision point. The two-month surge in US Treasury rates, most evident in the sharp yield increases this week, has caused the steepest rise in the USD/CAD since June 11 last year. The commodity and oil price trends that have supported the Canadian dollar since the third quarter have not reversed but they have been much in advance of any actual improvement in the US, Canadian or global economies. Having priced the expected growth, commodity markets may well pause, waiting for concrete signs of the recovery. If US Treasury rates continue to rise then that differential will become the energy for the USD/CAD rise.

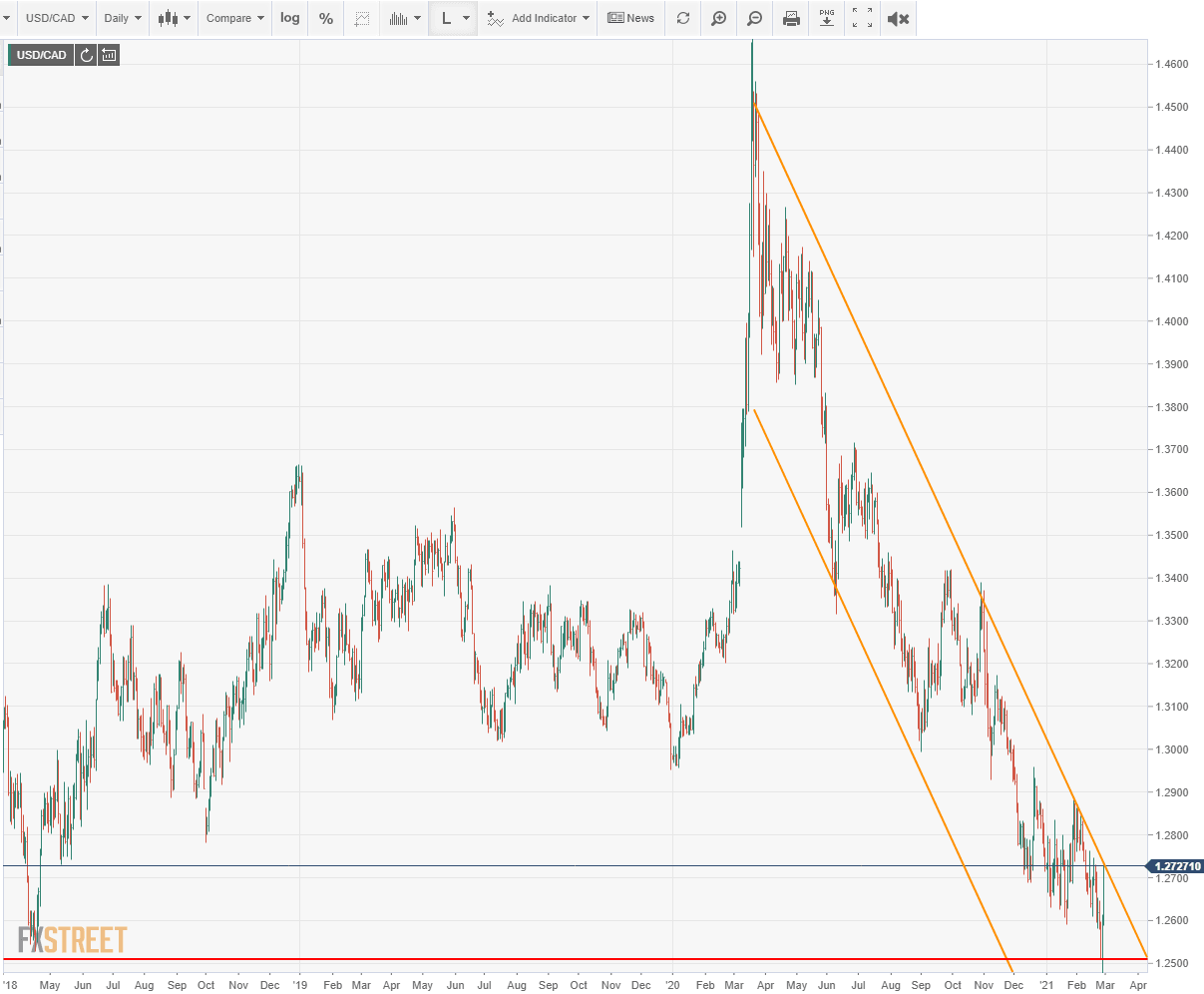

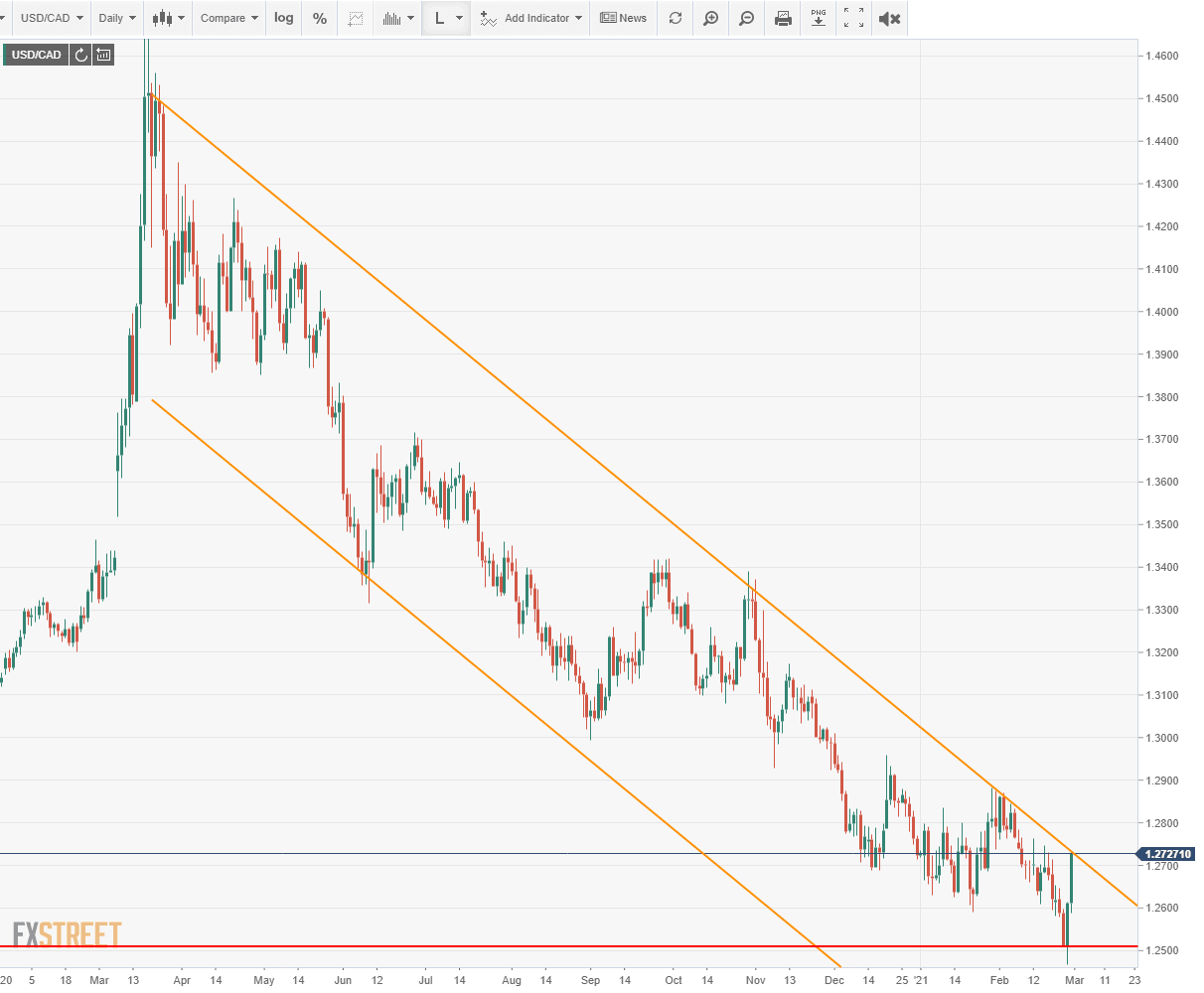

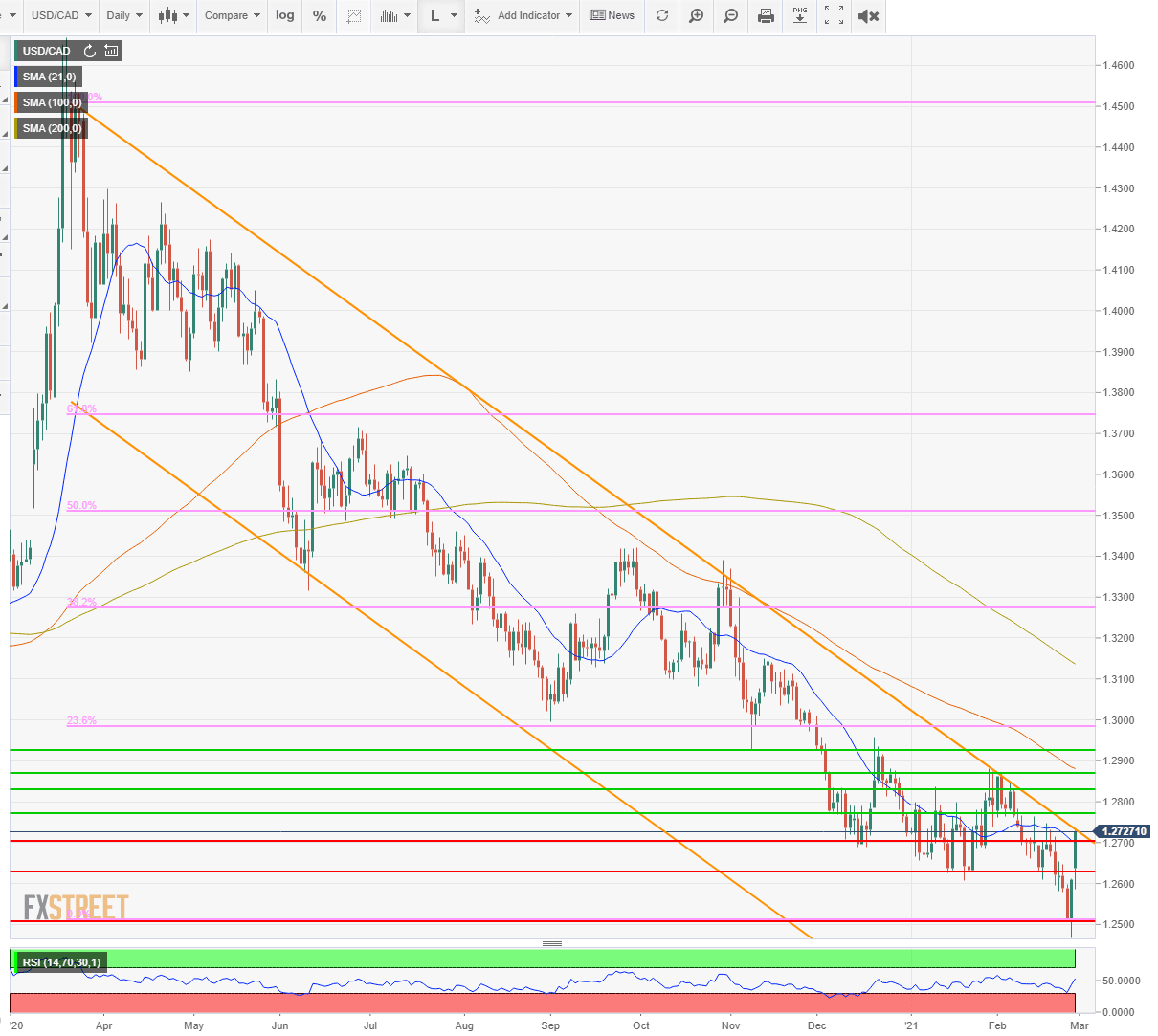

Technically, the reversal on Thursday and Friday brought the USD/CAD to the border of the descending channel that has been running since the end of last March. The day's high of 1.2730 touched but did not breach that limit.

Given that the sharp rise in the US dollar has been from a shift in interest rate fundamentals, it is necessarily more potent than the aging technical formation. But the Canadian dollar has its own fundamental strength, that of its resource economy.

In the competition between commodity pricing and US interest rates the outcome is undecided. Treasury rates may have the edge as they have a longer way to rise and they are the more recent change. But they also have their own impediment, a central bank bent on a keeping yields low. Even if US bankers have not, as yet, attempted to quell the gains in the middle to far reaches of the yield curve.

The bias of the USD/CAD is higher, but its ultimate direction is undetermined awaiting the influence verdict between US interest rates and commodity prices.

Canada statistics February 22-February 26

Nothing of market note this week.

Tuesday

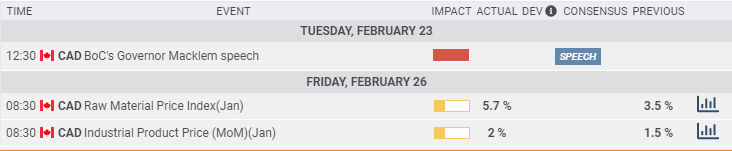

Bank of Canada Governor Tiff Macklem warned of an overheating housing market. He noted that even though there are early signs that low interest rates are distorting the residential home market it was likely that the economy would need stimulus support through 2023.

Friday

Raw Material Price Index for January 5.7%: December 3.5%. Industrial Product for January 2% (MoM): December 1.5%.

FXStreet

United States statistics February 22-February 26

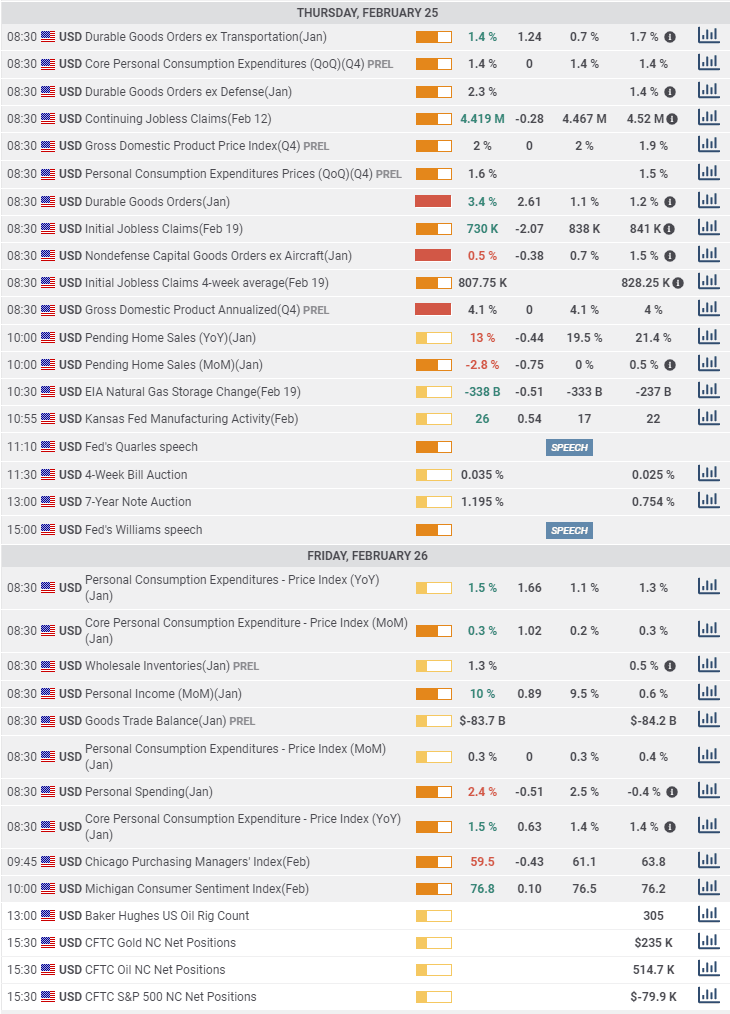

Federal Reserve Chairman Jerome Powell's Congressional testimony on Tuesday and Wednesday reassured markets that even if all goes well and the economy sees the a growth spurt in the next few quarters policy will remain accommodative for some time. Durable Goods confirmed the Retail Sales surge in January, the housing market continued hot and Personal Income rose the most since April.

Monday

Dallas Fed Manufacturing Business Index for February rose sharply to 17.2 from January's 7. The forecast was 8.3.

Tuesday

Case-Schiller Home Price Index (YoY) increased 10.1% in December, just over its 9.9% forecast and November's 9.2% rate. The Richmond Fed Manufacturing Index for February was 14 as expected. Conference Board Consumer Confidence at 91.3 in February was better than January's revised 88.9 reading.

Wednesday

New Home Sales rose 4.3% in January, double the 2.1% projection to 923,000 annually from 885,000.

Thursday

Durable Goods Orders in January jumped 3.4%, on a 1.1% forecast and December was revised to 1.2% from 0.2%. Durable Goods Orders ex Transportation rose 1.4% on a 0.7% prediction and December was adjusted to 1.7% from 0.7%. Nondefense Capital Goods ex Aircraft: January 0.5%, forecast 0.7%, December 1.5% from 0.6%. Initial Jobless Claims for February 19 week 730,000, estimate 838,000, prior week 841,000. Continuing Claims for February 12 week 4.419 million: prior 4.52 million. Gross Domestic Product (GDP) for the fourth quarter 4.1% as expected from 4%.

The Kansas Fed Manufacturing Activity Index: February 26, forecast 17, January 22.

Friday

The Personal Consumption Expenditure Price Index (PCE) inJnauary rose 0.3% (MoM) and 1.5% (YoY): forecast 0.3% and 1.1%, December 0.4% and 1.3%. Core PCE Index: 0.3% (MoM), 1.5% (YoY), forecast 0.2% and 1.4%, December 0.3% and 1.4%. Personal Income: January 10%, forecast 9.5%, December 0.6%. Personal Spending: January 2.4%, forecast 2.5%, December -0.4%. Wholesale Inventories: January 1.3%, December 0.5% from 0.3%.

FXStreet

Canada statistics March 1-March 5

Building Permits and the January trade figures are the salient numbers this week.

Monday

Canada's Current Account deficit is expected to rise to C$9.1 billion in the fourth quarter from C$ -7.53 billion prior. Markit Manufacturing PMI for February: January 54.4.

Tuesday

December GDP is forecast to rise 0.4% after the 0.7% gain in November. Quarterly, expansion in the final three months is expected to be 47.6% annualized after the 40.5% pace in the prior.

Wednesday

Building Permits for January should fall 5% following the 4.1% drop in December.

Thursday

Labor Productivity in the fourth quarter: Q3 -10.3%.

Friday

Imports and Exports for January: December C$48.98 billion, C$47.32 billion. International Merchandise Trade for January: December C$-1.67 billion. Ivey PMI for February: January 55.7.

FXStreet

United States statistics March 1-March 5

Nonfarm Payrolls followed by the ISM Indexes for Services and Manufacturing and the Fed's Beige Book assessment for the March 16-17 FOMC meeting are center stage. Markets expect a US growth acceleration in the next few months and will be looking for its earliest signs. The dollar and Treasury rates should rise and fall with the data.

Monday

ISM Manufacturing PMI for February is forecast to be 58.6 in February, little different than January's 58.7. The Price Index is expected to fall to 77 from 82.1. The Employment Index was 52.6 in January and the New Orders Index was 61.1. Construction Spending is projected to fall 0.7% in January after 1% in December.

Tuesday

Total Vehicle Sales for February: January 16.6 million annualized.

Wednesday

ADP Employment Change for February is expected to produce 168,000 positions. January was unexpectedly strong at 174,000. ISM Services PMI is predicted to drop to be unchanged at 58.7 in February. The Employment Index is forecast to drop to 51.7 from 55.2 in January. New Orders should be 55.4 from 61.8 and Prices 64.7 from 64.2. The Fed Beige Book anecdotal rendering of the economy for the March 16-17 FOMC meeting is out at 2:00 pm EST.

Thursday

Initial Jobless Claims for the February 26 week are predicted to rise to 755,000 from 730,000. Continuing Claims for the week of February 19: prior week 4.419 million. Factory Orders are predicted to rise to 1.9% in January from 1.1% in December.

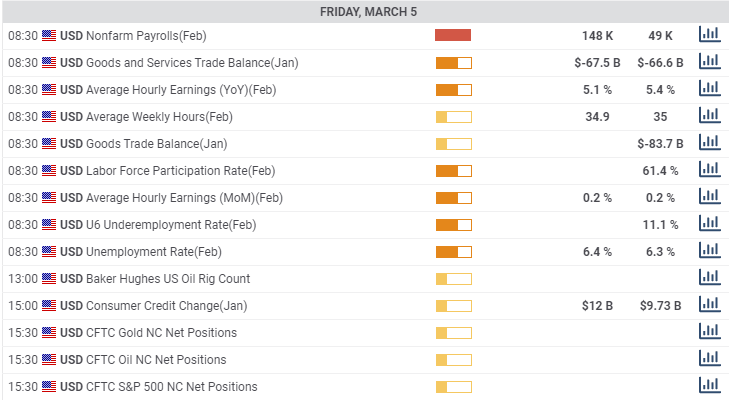

Friday

Nonfarm Payrolls are forecast to add 148,000 new positions in February after 49,000 in January. The Unemployment Rate (U-3) is expected to rise 0.1% to 6.4%. The Underemployment Rate (U-6) was 11.1% in January. Average Hourly Earnings are projected to rise 0.2% on the month and 5.1% on the year in February from 0.2% and 5.4% in January. The Labor Force Participation Rate was 61.4% in January. Consumer Credit is anticipated to expand $12 billion in January after climbing $9.73 billion in December.

USD/CAD technical outlook

The magnitude of the USD/CAD decline over the last 11 months is such that even after this week's two figure and 1.7% gain the 50% Fibonacci level is still nearly 800 points away at 1.3511. Friday's run crossed the 21-day moving average at 1.2705 which then joined support at 1.2700, holding in the afternoon. Immediate resistance is the upper border of the descending channel at 1.2730. The late day approach and close at this resistance line suggests a Monday morning breach in Sydney and Auckland.

Continued upward movement in the USD/CAD will depend on the interplay betwen competing fundamental factors--higher commodity prices supporting the Canadian dollar and higher US Treasury rates backing the US dollar.

The technical structure, resistance lines, moving averages and the descending channel favor a lower USD/CAD. The two-day surge in the USD/CAD speaks to the promise of the fundamental change in US Treasury yields, if, and it is a large contingency, they continue to rise. A break of the upper border will not trigger a stop run higher because the area from1.2700 to 1.2900 has been well traversed over the last three months.

The 100-day moving average at 1.2885 is part of the resistance limit at 1.2870, the 200-day average at 1.3143 is alone. The Relative Strength Index at 53.06 is neutral in position but bid in its two-day movement.

Resistance: 1.2730; 1.2770; 1.2830; 1.2870; 1.2905

Support: 1.2700; 1.2630; 1.2510

USD/CAD Forecast Poll

The week's fast finish has overtaken all three predictions of the FXStreet Forecast Poll. The one-quarter view is surpassed, the one-month view is at Friday's close and the one-quarter outlook cannot be bullish below the current market.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.