USD/CAD Weekly Forecast: Oil prices and US rate policy undermine outlook

- USD/CAD reverses as WTI gains 5.9% on Monday, 10.9% on the week.

- Fed Chair Jerome Powell says a taper is coming, markets want to know when.

- Dollar falls even though US Treasury yield curve steepens modestly.

- FXStreet Forecast Poll predicts weakness ahead.

West Texas Intermediate (WTI), the North American pricing standard, jumped 9.3% from Monday’s open at $61.82 to $67.57 on Tuesday’s close. The Canadian dollar’s extreme sensitivity to the price of oil showed immediately with the USD/CAD falling 1.8% from Monday’s 1.2820 to 1.2590 at the finish on Tuesday. About 11% of Canadian GDP is tied to the energy sector.

Oil prices continue higher, with Friday’s close at $68.57 bringing the week’s gain to 10.9%.

Federal Reserve Chair Jerome Powell added to the US dollar’s woes on Friday by affirming that the bank expects to begin tapering its bond purchases by the end of the year but providing no clues to the timing and insisting that the reduction in bond purchases is not a rate hike.

He also warned that the spread of the Delta variant may have negative economic effects that bear watching

In the bond assertion Mr. Powell is technically correct. Tapering the program has nothing to do with the fed funds rate set by the central bank, which has been at 0.25% since March 2020.

Mr. Powell is trying to prevent a surge in Treasury interest rates when the bank does finally announce the starting date of its taper, expected by many at the September 21-22 Federal Open Market Committee (FOMC) meeting. Many commercial interest rates key in on the Treasury market, and a sharp rise in interest costs could inhibit consumer and business spending and the economic recovery.

The US 10-year Treasury yield rose 83 points from 0.916% on January 4 to 1.746% on March 31, as markets anticipated that an accelerating economy would force a change in rate policy.

Since then that yield has fallen by more than half to 1.310%.

The Treasury yield curve steepened modestly on the week with the 10-year adding 6 basis points to 1.31%, the 30-year rising 5 points to 1.921%, and the 2-year sliding less than a point to 0.219%.

Canadian economic statistics gave no direction with industrial and raw material prices for July the only data.

Aside from Fed Chair Powell’s highly anticipated speech to the central bank’s annual Jackson Hole symposium on Friday, US data was minimal.

Durable Goods Orders held up in July despite falling Retail Sales, suggesting that the collapse in Consumer Sentiment in August may not presage a general drop in consumption.

Covid cases continued to climb in many US states, though there are signs of a peaking in the first affected areas. Lockdowns and economic restrictions have not been instituted anywhere, though some states and locales have resorted to requiring masks in all public venues.

USD/CAD outlook

With the two most important factors for the USD/CAD, crude prices and Federal Reserve policy entering against the US dollar, the USD/CAD will be hard-pressed to move higher.

Friday’s finish at the upward three-month trend line is telling. If that support is crossed, the line at 1.2500 becomes the goal.

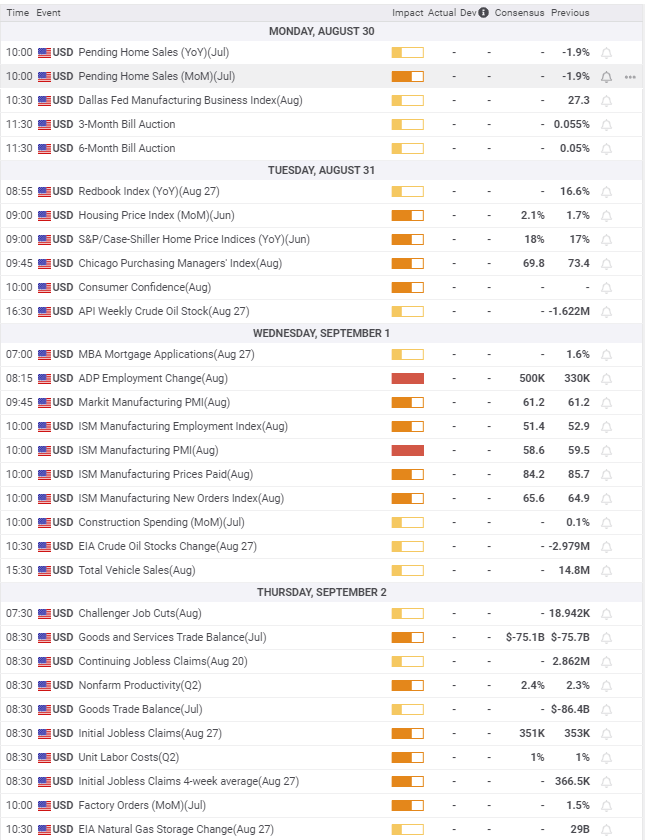

August US Nonfarm Payrolls on Friday, September 3 are the main statistical event in the week ahead.

If they are better than expected, the current forecast is 665,000, the greenback will benefit, but the promise of payrolls will not be enough to keep the USD/CAD from falling earlier in the week.

Purchasing Managers’ Indexes from the Institute for Supply Management on Wednesday and Friday for August may suggest that the concerns over the deep slide in Consumer Sentiment that month are not impacting business outlook.

But with the US rate picture unclear, positive economic statistics have limited ability to improve the US dollar.

For Canada the most important information will be on Thursday with International Merchandise Trade data and Imports and Exports for July. The results will not move markets.

Canada statistics August 23–August 27

US statistics August 23–August 27

FXStreet

Canada statistics August 30-–September 3

FXStreet

US statistics August 30–September 3

FXStreet

USD/CAD technical outlook

The steep sell-off this week has given the True Range its largest negative momentum this year. In contrast, the Relative Strength Index (RSI) is nearly neutral and the MACD (Moving Average Convergence Divergence) is only a weak sale, as they incorporate more of the gains of the last three months.

The 21-day moving average (MA) at 1.2603 is minor support with much more substantial lines at the 50-day MA at 1.2532 and the 200-day MA at 1.2540 working in concert. If those averages are crossed it will engender notable weakness. The 10-day MA at 1.2380 is out of the picture.

Resistance: 1.2660, 1.2685, 1.2750, 1.2820, 1.2860

Support; 1.2575, 1.2535 (50-day MA 1.2532, 200-day MA 1.2540), 1.2500, 1.2445, 1.2400

FXStreet Forecast Poll

The FXStreet Forecast Poll is negative in three time frames, having dropped below the one-week prediction on Friday. Technical support is weak.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.