USD/CAD Weekly Forecast: Momentum can be an elastic property

- USD/CAD drops to lowest in two-and-a-half years on employment data.

- West Texas Intermediate closes at $46.26, highest since March 4.

- USD/CAD technical support levels now from the first half of 2018.

- US dollar stays out of market favor as COVID-19 spreads.

- FXStreet Forecast Poll preicts a potential reversal.

Unexpectedly strong Canadian employment helped propel the loonie to its best level in more than two years as US job creation fell by more than half in November, pressured by the business closures ordered by several state governments. The USD/CAD closed at 1.2778 on Friday its lowest finish since May 10, 2018.

Statistics Canada's November Employment Change reported 62,100 new workers, more than triple the 20,000 forecast, bringing the total hired to 80.9%, 2.430 million of the 3.004 million layoffs in March and April. In contrast, US Nonfarm Payrolls rose by just 245,000, its lowest addition of the pandemic and less than half the 469,000 projection. Total US re-employment is about 55%.

West Texas Intermediate(WTI) easily stayed above its $43.50 support closing at $46.15 on Friday. The best finish since $46.34 on March 5 gave the resource heavy Canadian economy and its currency a potential boost. Crude prices remained bid even though the oil producers partial cartel, known as OPEC Plus (Organization of Petroleum Exporting countries and Russia), agreed to a modest production increase of 500,000 million barrels a day in January.

Last Friday's (11/27) USD/CAD close at 1.2990 seemed to promised an imminent test of the 1.3000 and 1.2930 support lines. Monday's attempt to move back above support failed with a close at 1.3000 and Tuesday's trading completed the hypothetical finishing at 1.2924. Wednesday trading repeated the performance, failing to hold above 1.2930, with a high of 1.2958 and a close at 1.2918. It was followed by Thursday's drop to 1.2848 and then the week's largest decline on Friday aided by Canadian employment data.

The steep descent of the USD/CAD since the middle of November has not yet produced any appreciable rebound. The combined Thursday and Friday drop has returned the pair to the ranges of the second quarter of 2018 and earlier. Technical references at that distance are weak and more signposts than records of trading interest.

USD/CAD outlook

USD/CAD outlook

Trading in the USD/CAD this week was, as it has been for at least three months, a US dollar story.

Currency markets continue to punish the greenback for the pandemic resurgence in much of the country, though it is largely true that the areas that had the worse infections in the spring, as New York and New Jersey, do not have as numerous an outbreak this time.

The difference between the States, Europe and Canada seems to be a matter of timing, with the later surge in the US dominating headlines. It is the potential for economic damage that is the most relevant. The weakness in US payrolls underlined the negative possibilities even though Initial Jobless Claims reverted to trend at 712,000 in the November 27 week after rising to 778,000 in the previous release.

The November employment data was a clear win for the Canadian dollar but the balance of economic information is much more ambiguous. Canadian third quarter annualized GDP was weaker than expected while manufacturing PMI was on a par with that in the US. The Fed is far more active in restraining US rates, but in reality its intervention is effective against the yield curve in both markets.

The outlook for the USD/CAD is lower. A combination of momentum, weak support from two-year-old levels, and the general negative bias for the US dollar will continue to weigh on the pair. However, the speed of last week's descent and the untraversed ranges leave the USD/CAD open to a profit-taking bounce. A possible catalyst could be a completed stimulus package in the US Congress.

Technically, the USD/CAD is heavy and the descending channel is the main formation. Support lines are weaker and far less important since they date from over two years ago and all of the resistance levels except the first at 1.2800 are of recent vintage.

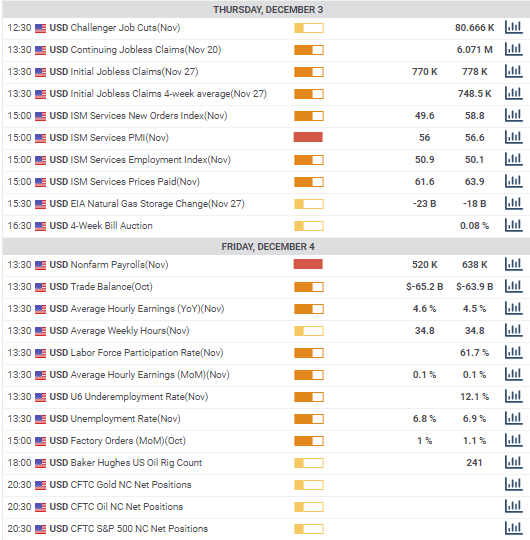

Canada statistics November 30-December 4

Monday

Raw Material Price Index for Canadian manufacturers rose 0.5% in October after a 2.2% gain in September. The Industrial Prices index fell 0.4% in October, missing its 0.1% forecast and September's -0.1% result.

Tuesday

Third quarter annualized GDP rose 40.5%, less than the 47.6% prediction but ahead of the prior 38.1% decline. On the month in September GDP gained 0.8% following Augusts revised 0.9% increase. Markit's Manufacturing PMI climbed to 55.8 in November from 55.5. It was the highest score since August 2018.

Friday

The Unemployment Rate in November fell to 8.5%, forecast and prior had been 8.9%. The Net Change in Employment added 62,000 jobs, more than three-times the 20,000 projection though less than October's 83,600. Average Hourly Wages rose 4.84% on the year in November down from 5.25% in October. The Participation Rate was 65.1 in November and 65.2 in October. The International Merchandise Trade Balance in October was -C$3.76 billion on a -C$3 billion forecast and September's -C$3.25 billion. Exports rose to C$46.47 billion in October from C$45.54 billion and Imports climbed to C$50.23 billion from C$48.79 billion.

US statistics November 30-December 4

Service and Manufacturing PMIs were largely as expected and though the New Orders Indexes in both sectors were much stronger than forecast they gave the dollar no support. Weak Nonfarm Payrolls and the unemployment rate also did not impact the dollar's decline.

Tuesday

ISM Manufacturing PMI for November came in at 57.5, below the 58 estimate and October's 59.3. The six-month average of 55.8 is the best in two years. Employment dropped below 50 to 48.4, lower than the 51.4 forecast and October's 53.2. New Orders at 65.1 were much stronger than the 53.4 prediction, following October's 17-year high at 67.9. Construction Spending rose 1.3% in October, beating the 0.8% estimate but September was revised sharply lower to -0.5% from 0.3%

Wednesday

The Fed's Beige Book, an anecdotal rendering of the US economy prepared for the December 15-16 FOMC meeting, said the US recovery picked up to a “modest or moderate' pace in the fall but that growth began to slow in November as COVID-19 diagnoses spread in many parts of the country.

Thursday

Services PMI slipped to 55.9 in November from 56.6, just missing the 56 forecast. The New Orders Index dropped to 57.2 from 58.8, but it was far better than the 49.6 forecast. Employment improved unexpectedly to 51.5 from 50.1, besting the 50.9 forecast. Initial Jobless Claims reverted to trend after rising for two weeks, falling to 712,000 in the November 20 week from 787,000. Continuing Claims fell to 5.52 million from 6.089 million. The forecast was 5.915 million. Challenger Job Cuts for November fell to 64.797 million form 80.666 million in October

Friday

Nonfarm Payrolls dropped to 245,000 in November from October's revised 610,000, missing the 469,000 forecast. The unemployment rate (U-3) fell to 6.7% from 6.9%. The underemployment rate (U-6) dropped to 12% from 12.1%. Average Hourly Earnings rose 0.3% on the month and 4.4% on the year. Average Weekly Hours were unchanged at 34.8 and the Labor Force Participation Rate dropped to 61.5% from 61.7%. Factory Orders rose 1% in October on a 0.8% forecast and September was revised to 1.3% from 1.1%.

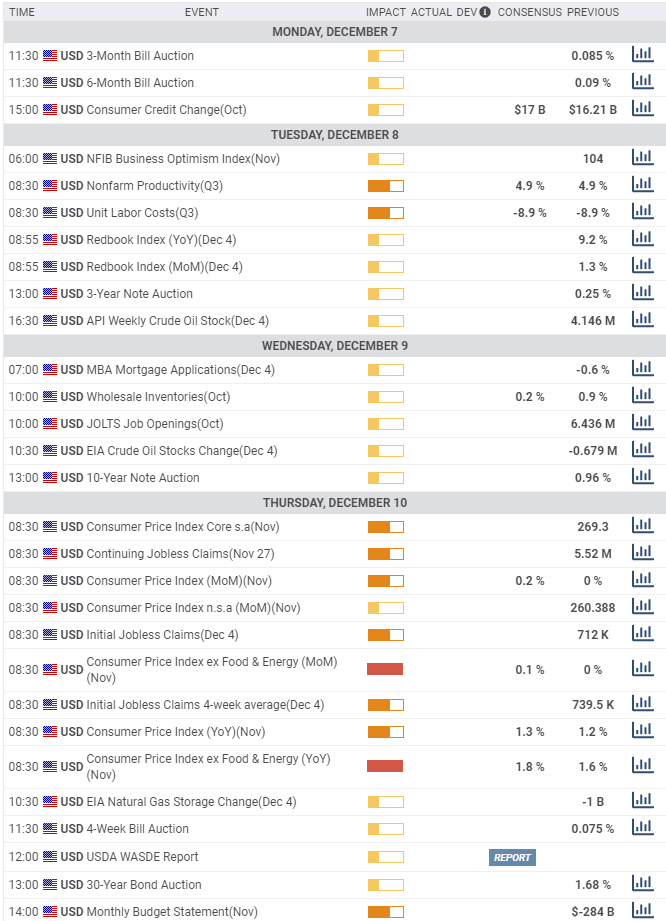

Canada statistics December 7-December 11

The Ivey PMI will have some interest, though not market moving, for its take on November business.

The Bank of Canada rate decision is a foregone conclusion but Governor Tiff Macklem's remarks on the Canadian recovery will warrant attention. The more optimistic he is the better for the Canadian dollar.

Monday

Ivey Purchasing Managers' Index for November is expected to fall to 51.5 from 54.5.

Tuesday

The Bank of Canada will issue its rate decision, no change from the current 0.25% is expected.

Friday

Capacity Utilization for the third quarter is expected to drop to 70.2% from 70.3%.

US statistics December 7-December 11

Initial Jobless Claims we be the focus after the poor November NFP, higher results will weaken the dollar. Michigan Consumer Sentiment for December will be eyed for indications on holiday shopping and fourth quarter growth.

Tuesday

National Federation of Independent Business Small Business Optimism Survey for December is issued, November was 104.

Wednesday

The Job Openings and Labor Turnover Survey (JOLTS) for November is out, October was 6.436 million.

Thursday

The Consumer Price Index (CPI) for November is forecast to rise 0.2% on the month from flat and 1.3% from 1.2% on the year. The core index will rise 0.1.% from flat and 1.8% from 1.6% for the year.

Initial Jobless Claims will drop to 700,000 in the December 4 week and Continuing Claims will fall to 4.98 million in the November 27 week.

Friday

The Producer Price Index for November is forecast to add 0.2% monthly and 0.4% annually. The core index is expected to rise 0.4% on the month and 1.1% on the year.

The Michigan Consumer Sentiment Index is predicted to edge up to 77 in December from 76.9 in November.

USD/CAD technical outlook

The predominant technical factor is the weak support with no relevant lines of more recent origin than May 2018. Given the overwhelmingly negative sentiment on the US dollar momentum should continue to test lower. But the rapidity of the recent decline makes it vulnerable to a profit-talking bounce. The fundamental picture is not truly biased against against the US currency, but without a catalyst to change sentiment a purely technical reversal of fortune is unlikely.

Support: 1.2750; 1.2705; 1.2650; 1.2600

USD/CAD Forecast Poll

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.