Canadian GDP data for March was released on Tuesday, revealing a second consecutive month of economic contraction at -0.2%, further disappointing prior expectations of -0.1%. The previous month of February had shown a smaller contraction at -0.1%. The resulting pressure on the Canadian dollar on Tuesday was exacerbated by a pullback in crude oil prices ahead of Thursday’s highly anticipated OPEC meetings. This combined pressure on the Canadian dollar was coupled with continued support for the US dollar from increased anticipation of an impending Fed rate hike, prompting an early surge for USD/CAD.

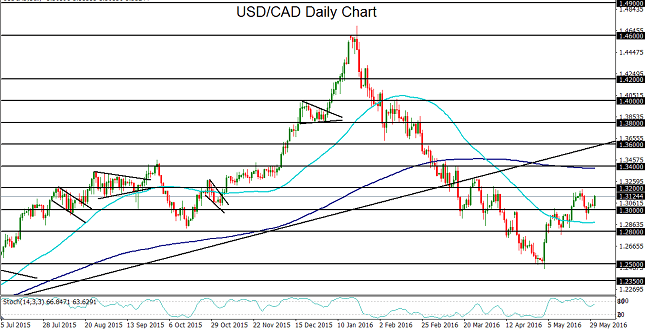

The currency pair has been trading within a pronounced rebound and recovery for most of May after having dropped down to a 10-month low around key 1.2500 support in the beginning of May. This month-long recovery saw its latest culmination in last week’s high just short of 1.3200 resistance. Currently, USD/CAD continues to trade within a range between its 50-day moving average to the downside and 200-day moving average to the upside in anticipation of key events this week that could either help extend the currency pair’s recovery or prompt a return to re-test recent lows.

As noted, Thursday’s meetings of OPEC nations could have a major impact on oil prices, with a strong correlated effect on the Canadian dollar. The meetings will occur within an environment of major oil producers in the Middle East maintaining high levels of output and continuing to compete for market share. Beyond crude oil, USD/CAD is also very likely to be impacted by Friday’s employment numbers from the US, most notably the Non-Farm Payrolls data. In addition, Canadian trade balance figures for April will also be released on Friday.

With respect to these major economic events potentially affecting both the US and Canadian dollars, possible breakout points for USD/CAD are well defined, especially to the upside. In the event of further Canadian dollar pressure and continued support for the US dollar, a USD/CAD breakout above the noted 1.3200 resistance level would confirm a continuation of May’s recovery trend. In that event, the next major upside target is around the 1.3400 level, which is also near the current location of the 200-day moving average. Any further rise could prompt a move towards a higher resistance objective around 1.3600. To the downside, any strong breakdown below the 1.3000 psychological support level could prompt a move back down towards 1.2800 support.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.