- The dovish BOC twist, oil, and trade weighed on the loonie.

- A lighter Canadian calendar leaves petrol and Powell in change

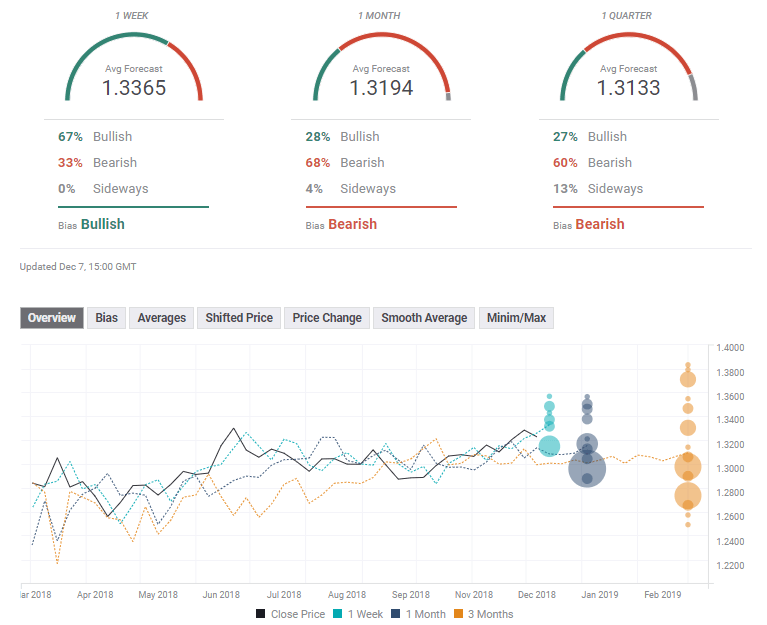

- The technical picture remains bullish after the pair recaptured uptrend support. The FX experts are bullish in the short term but bearish afterward.

This was the week: Oil and tumultuous trade

The Bank of Canada decided to leave interest rates unchanged as expected but surprised with a dovish shift. While they hope the new trade agreement to continue supporting the economy, they see non-inflationary growth. If there is no risk of higher inflation, there is no rush to raise rates. This shift sent the loonie lower.

The dovish shift may seem somewhat premature given the superb Canadian jobs report. The nation gained no less than94.1K positions and the jobless rate fell to 5.6% despite an increase in the participation rate. This is good news for the Canadian economy.

Earlier in the week, the C$ jumped on the reports from Buenos Aires about the Trump-Xi Summit. The Presidents of the world's largest economies agreed on a trade truce. However, there were differences between the statements coming out from both countries. Some respite was seen after China aligned most of its message with that of the US, but the arrest of Meng, Huawei's founder's daughter, and CFO at the Chinese firm dampened the atmosphere. CAD, a risk currency, suffered.

Oil remained central to the movements in the loonie. The province of Alberta decided to limit the production of oil as much of it is stuck in pipelines in the US. The abnormal move helped shrink the spread between Canadian crude, the Western Canadian Select (WCS) and America's West Texas Intermediate. This provides a bit of relief for the loonie.

Oil ministers from OPEC and non-OPEC countries gathered in Viena and tried to strike a deal to curb production and lift prices. Iran, struggling under US sanctions, refused to cut output and was reportedly the stumbling block to cutting a deal. Others blamed Russia. The slide in prices weighed on the C$.

US data mixed with the Non-Farm Payrolls missing with 155K and 0.2% salary growth MoM. However, yearly wages advanced by 3.1%, a healthy rate, and Fed Chair Jerome Powell expressed satisfaction with the general state of the labor market, on "many measures."

Canadian events: Mostly oil, but also housing data

The price of the black gold remains in the limelight. The loonie will initially react to the fallout from the OPEC meeting and will also await further developments on the production limits in Alberta. The weekly inventories report on Wednesday will likely remain of high importance once again.

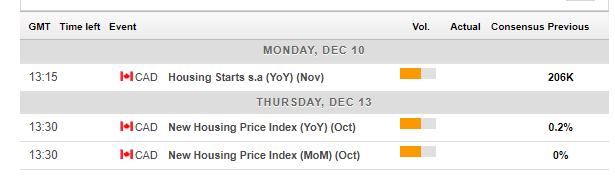

The Canadian calendar does not feature any top-tier events in the second week of September but provides some insights into the housing sector. Housing Starts and Building Permits stand out on Monday. The ADP NFP comes out after the official figures but is still of interest.

Another housing report is due on Thursday with an update on prices of new homes, which have been stuck of late.

Here is the Canadian calendar for this week:

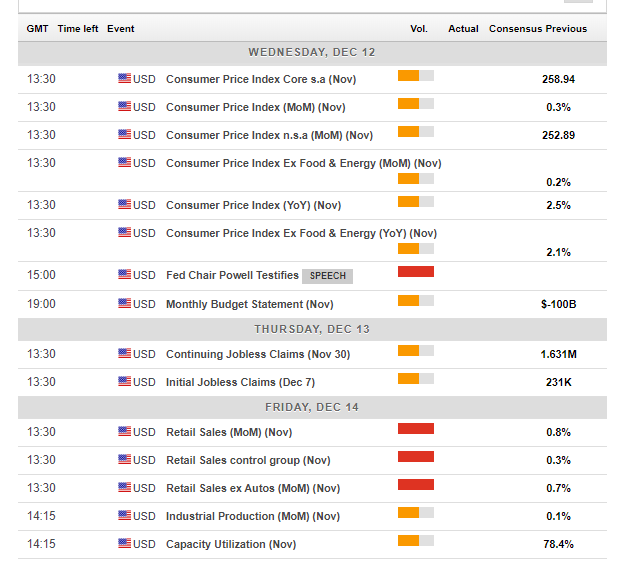

US events: Retail sales, inflation, Powell, and trade

Global trade remains high on the agenda. Talks between the US and China continue. Any official, non-official statements or tweets by Trump may have a significant impact on markets. The sides have fewer than 90 days to thrash out an agreement.

The US publishes inflation figures for November on Wednesday. The data disappointed in October with Core CPI slowing to 2.1% YoY. Another drop could impact the Fed decision in the following week and also the Fed Chair's testimony on the same day.

Jerome Powell will release his prepared remarks and then face lawmakers in a testimony postponed due to the funeral of former President George H. W. Bush. Powell will provide a comprehensive update on the economy and may hint about the path of rate hikes moving forward. Markets will scrutinize every word.

Retail sales are due on Friday. The American consumer is critical to the economy. The report for October was quite upbeat. It will be interesting to see if consumption continued growing in November, the month that includes Black Friday. The data also feeds into Q4 GDP.

Here are the critical American events from the forex calendar:

USD/CAD Technical Analysis

Dollar/CAD suffered a dramatic drop below the uptrend support line that accompanies it since October 1st. However, the pair quickly recaptured the line and then hit the highest levels since 2017.

Momentum remains upbeat, and the Relative Strength Index (RSI) is still below 70, thus not indicating overbought conditions. All in all, the picture remains bullish.

1.3405 was a temporary cap on the way up in early December. The December 6th peak of 1.3442 is the next level to watch. Further up, we are back at levels seen in 2017. 1.3545 was a stubborn resistance line in the spring of 2017. It is followed by 1.3650 which was a swing high earlier last year.

1.3380 was the previous high point of this year. 1.3360 was a swing high in late November and 1.3320 capped the pair earlier last month. Next down the chart are 1.3265 which capped USD/CAD on its way up in November and 1.3225 which was a peak in September.

USD/CAD Sentiment

Falling oil prices and concerns about a global slowdown will likely weigh on sentiment in the markets. The Canadian Dollar could come under further pressure, and USD/CAD has room to rise.

The FXStreet forex poll of experts shows a bullish sentiment in the short term with a bearish one in both the medium and long terms. The average forecasts have been pushed higher for the short term but mostly unchanged later on.

Related Forecasts

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.

-636797918811340382.png)