Yesterday ECB decision was a bit of surprise. Mr.Draghi failed to deliver faster pace of QE measures and ECB has extended the program by 6 months – to March 2017. Deposit rate has been cut to -0.30% Main refi rate has been unchanged at 0.05% and marginal lending rate is also unchanged at 0.30%.

Money has moved to cash. We have to watch GOLD price in next couple of days, as we could see a rebound.

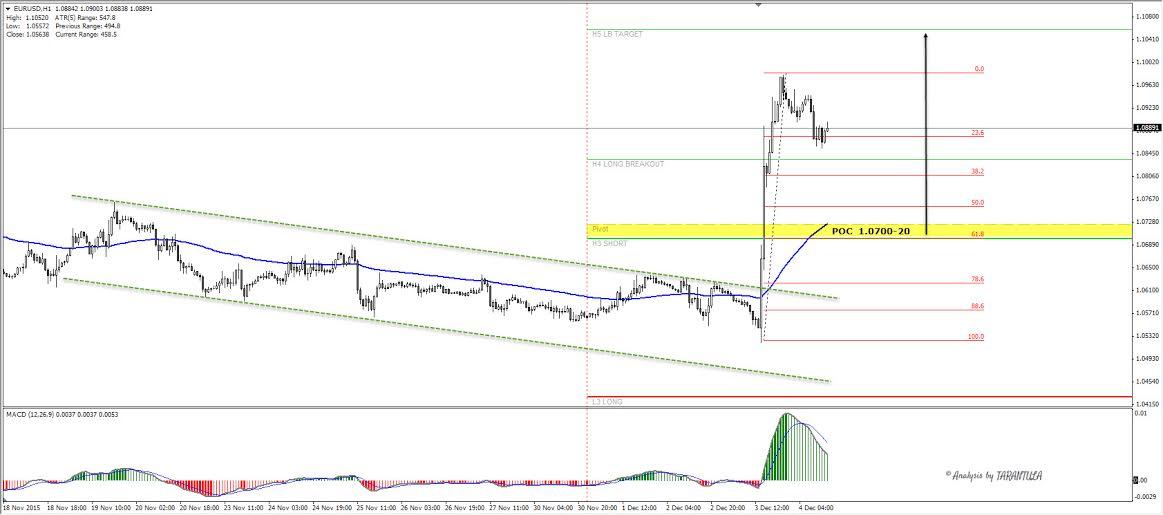

NFP today will move the price but that could be used for pullback trading. If we get a pullback to POC zone, there should be another leg of buying. POC comes in 1.0700-20 zone (EMA89, 61.8 %, MPP). We need to use monthly camarilla PP for EURUSD analysis, due to an almost 500 pip movement yesterday where all Weekly and Daily pivots have been broken.

If we get another leg of buying and 1.0650 stays strong we could see another retest of 1.0950 followed by 1.1000 and 1.1050 – H5 Monthly camarilla pivot.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

The Fed leaves rates unchanged, as expected. Focus now shifts to Powell’s press conference – LIVE

As largely anticipated by market participants, and in an unanimous vote, the US Federal Reserve maintained its policy rates unchanged at its event on Wednesday. The Fed announced a reduction in the balance sheet runoff pace and highlighted lack of progress in inflation.

EUR/USD climbs to daily highs on steady FOMC

The selling bias in the Greenback remained unchanged after the Federal Reserve left its interest rates unchanged on Wednesday, sending EUR/USD to daily highs near the 1.0700 barrier.

GBP/USD regains its smile after the Fed leaves rates unchanged

The resumption of the upward pressure lifts GBP/USD back above 1.2500 the figure, partially trimming Tuesday’s strong retracement and bouncing off earlier lows near 1.2470.

Gold accelerates its gains on unchanged rates by the Fed

The precious metal maintains its constructive stance near the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.