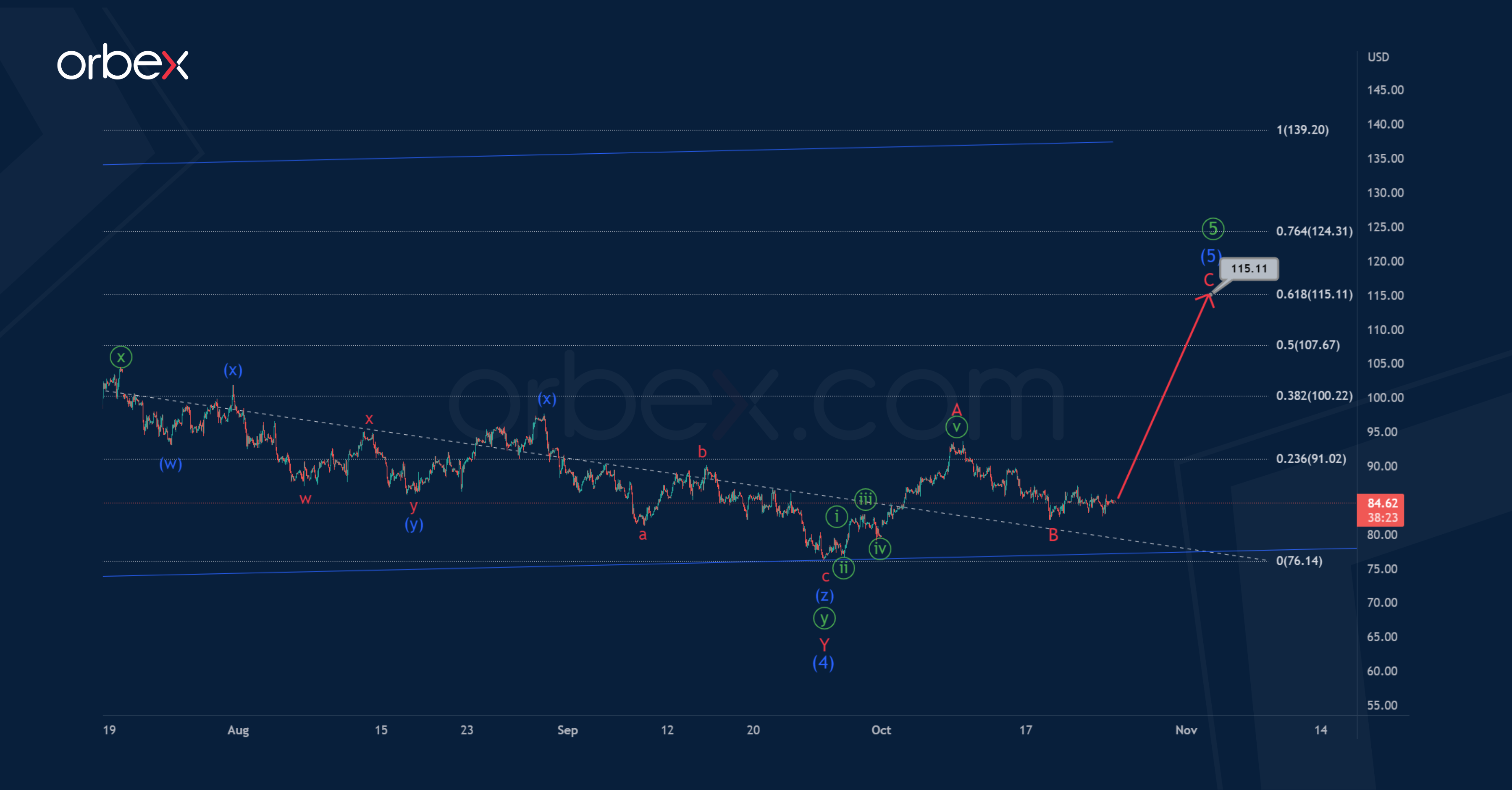

In the long term, USOIL seems to be forming a primary wave ⑤, which takes the form of an intermediate ending diagonal. On the 1H timeframe, we see its second half.

An intermediate correction (4) in the form of a minor double zigzag may have been completed recently.

Thus, at the moment the price may move within the intermediate wave (5). It is assumed that the intermediate wave (5) will take the form of a standard 3-wave zigzag A-B-C

The end of this construction is possible near 115.11. At that level, wave (5) will be at the 61.8% Fibonacci extension of impulse (3).

Alternatively, the construction of the intermediate correction (4) can be continued. Perhaps it will have the form of a triple zigzag W-X-Y-X-Z, where the minor sub-waves W-X-Y-X can be completed.

Thus, in the near future, the downward movement is expected to continue in the final actionary sub-wave Z, which can be completed in the form of a minute triple zigzag ⓦ-ⓧ-ⓨ-ⓧ-ⓩ.

The oil price may fall to 69.50, at which the minute waves ⓨ and ⓩ will be equal.

After reaching this level, the market is expected to grow above the maximum – 123.72.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.

-638022797205359438.png)