US Initial Jobless Claims Preview: The two-track labor market returns

- Unemployment claims forecast to fall to 725,000 from 745,000.

- Continuing claims to rise to 4.362 million from 4.295 million.

- February payrolls double expectations, January revision adds, 117,000.

- Improving US data brings higher Treasury yields, dollar.

For many small businesses the agony is not yet over.

After a year of lockdowns and empty offices that have hollowed out city centers, businesses continue to fail from the accumulated damage. In consequence, unemployment claims are expected to remain at historically high levels even as the labor economy is set to revive in the first quarter.

Requests for jobless assistance are forecast to drop to 725,000 in the March 5 week from 745,000 prior. Continuing Claims are predicted to rise to 4.362 million in the February 26 week from 4.295 previously.

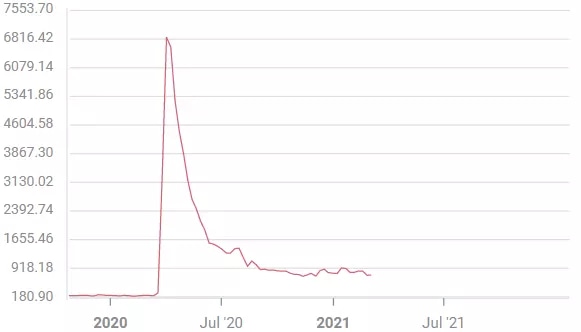

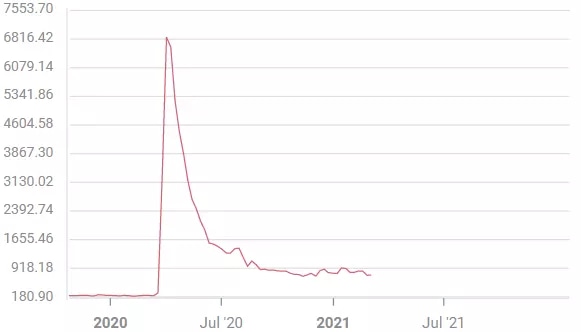

Initial Jobless Claims

Unemployment claims reached their pandemic low at 711,000 in the first week of November before renewed lockdowns in California and elsewhere drove claims back to 926,000 by January 8. In the two months since claims have neatly reversed.

Initial Jobless Claims

FXStreet

In the pandemic accounting claims are again headed in the right direction. But from a historical vantage more people are losing still their jobs every week, almost a year into the pandemic, than at the height of the 2008 financial crisis.

Nonfarm Payrolls and the recovery

Payrolls followed initial claims in December shedding 227,000 positions for the first loss since April. As claims retreated in January job creation resumed with the original payroll figure of 49,000 revised to 166,000 and February's total of 379,000 more than double the consensus forecast of 182,000.

California ended its lockdown in late January and the rapidly waning pandemic has encouraged Texas, Mississippi, Connecticut and others to end all business restrictions. Combined with Florida and the many states that never closed, rehiring in the service sector, particularly restaurants and similar establishments, fueled the February NFP totals. That employment wave can be expected to continue in the months ahead.

Conclusion

The $1.9 trillion stimulus package passed by Congress, its $1400 individual payment and the psychology of relief from the pandemic strictures are sure to fund another few months of explosive consumption.

The Atlanta Fed GDPNow model estimates annualized growth in the first quarter to be 8.4%. In Fed Chairman Jerome Powell's estimation the expansion could average 6% in 2021.

Such rapid growth will encourage retail hiring and and hopefully save many of the businesses crippled by the year-long shutdowns.

Almost 10 million people remain unemployed. For substantial improvement in that number people must be rehired and those that have jobs must keep them. Until both sides of the labor equation are active the recovery will be incomplete.

After the February NFP markets will be watching for the job revival to balance the claims side of the labor market. Interest rates and the dollar are primed for an swift repair of the US economy.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.