US Initial Jobless Claims Rise for the Third Week: Was August's NFP a fluke?

- Unemployment Claims quietly reach a seven-week high.

- Claims have climbed 50,000 in three weeks.

- September NFP forecast at 333,000 by a JP Morgan team.

First time filings for unemployment benefits have increased for three straight weeks, making next Friday’s September payroll report somewhat of a wild card, especially after August’s NonFarm Payrolls disappointment.

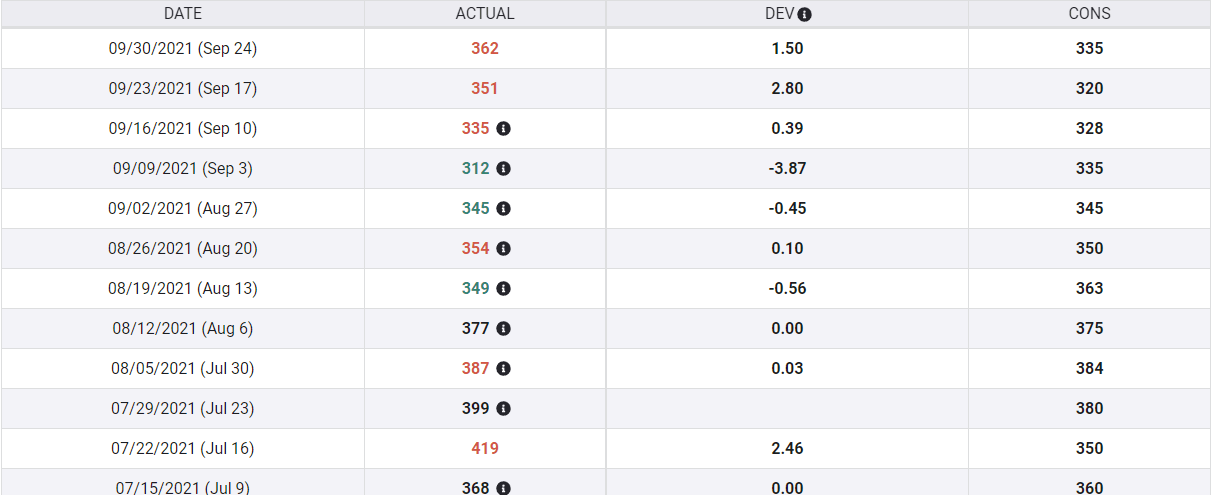

Initial Jobless claims reached 362,000 in the September 24 week, well over the 335,00 forecast and the highest total since August 6.

Initial Jobless Claims

FXStreet

In June and July Nonfarm Payrolls (NFP) averaged over one million hires for the first time since August and September 2020, during the initial recovery from the spring economic closures. Job creation in August had been expected to continue near that level with a consensus estimate of 750,000. The 235,000 result, less than one-third of the projection, released on September 3 was a complete surprise. Not the least because jobless claims, normally considered a reliable indicator for the labor market, had continued to improve in August. Jobless filings had dropped from 377,000 at the month’s open to 345,000 at the end, then 312,000, the lowest of the pandemic, in the first week of September.

Initial Claims and NFP

In the beginning of the pandemic lockdowns in March and April 2020, the explosion in claims was a flare that the economy had been hit by a tsunami of job losses. In April more than 20 million people were fired or furloughed as most state governments ordered wide-ranging restrictions on economic activity.

Once the recovery was underway, the connection between jobless claims and NFP has become far less predictive.

In July the 4-week moving average of jobless claims dropped from 384,500 in the first week to 394,500 in the last. Despite this but minor improvement, payrolls rose from 962,000 in June to 1,053,000 in August..

Initial Jobless Claims, 4-week moving average

In August the 4-week average of benefits fell from 396,750 to 356,250, yet payrolls plunged by 818,000 to 235,000.

Conclusion

The modest increase in unemployment claims in the past month is not an ironclad indication that the September payrolls will continue at August levels.

Claims for the past month of 340,000 are comparable to filings in many of the months from 2011 to 2015, years where a month with 300,000 new jobs was considered excellent.

The US labor market is far from normal. With almost 11 million unfilled positions and a huge pool of unemployed, do higher claims mean businesses are again shedding employees? Or are workers choosing to leave, knowing that the labor market is hot and unemployment insurance will tide them over?

Initial Claims are one of the paramount examples of trend statistics. The week to week and month to month variations have small predictive value. It is the trend that matters. In that context the overall claims tendency remains lower and thus has little bearing on the September payroll numbers.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.