US Initial Jobless Claims Preview: Rising unemployment undermines US recovery

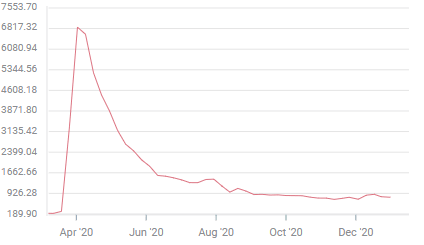

- Claims forecast to rise to 833,000 in the January 1 week from 787,000.

- December filings averaged 837,000 up from 740,000 in November.

- Continuing claims expected to reach 5.39 million from 5.22 million.

- Strict lockdown in California and surging cases has economy on edge.

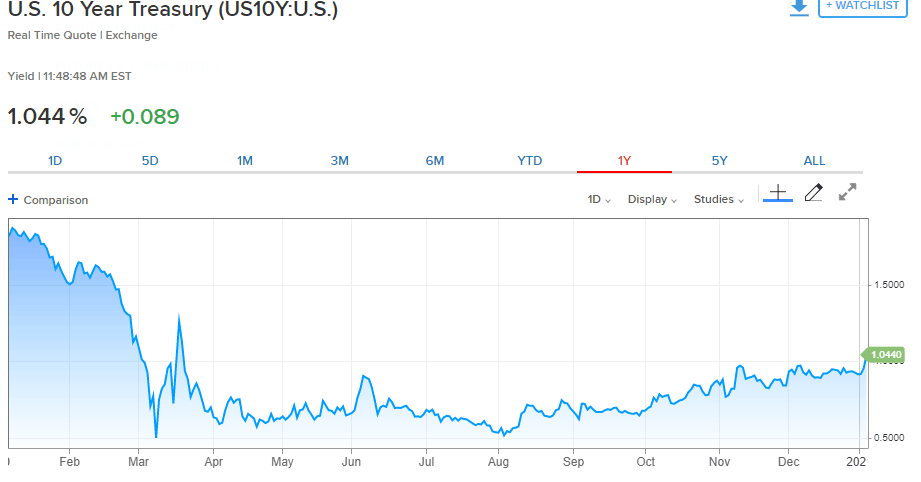

- Rising Treasury yields, anticipating greater economic stimulus, support the US dollar.

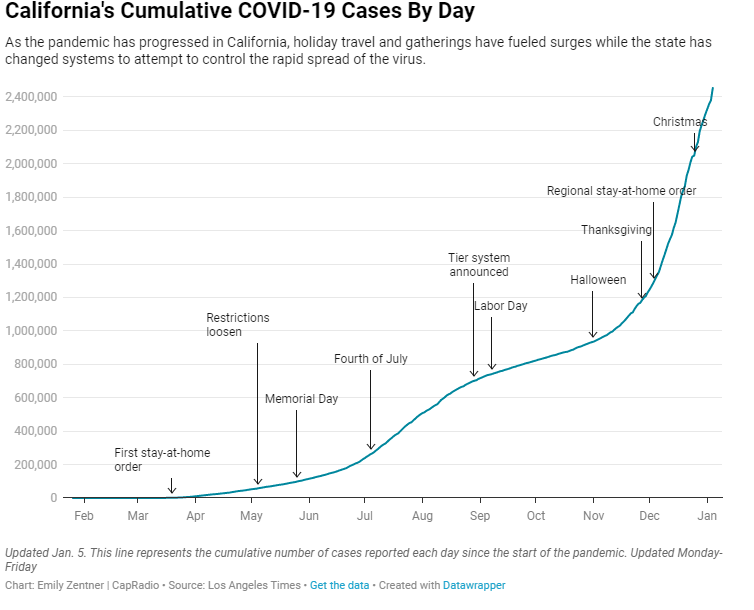

The surging pandemic cases and hospitalizations in California are threatening to reverse the direction of the US labor market recovery.

Initial Jobless Claims are expected to rise to 833,000 in the January 1 week from 787,000 prior. The monthly average for filing climbed to 837,00 in December from November's 740,000 for the first monthly increase since the original surge in March.

Initial Jobless Claims

Continuing claims are projected to climb to 5.39 million in the week ending December 25 from 5.219 million the previous period. These claims averaged 5.94 million in November and 5.35 million in the three reported weeks of December.

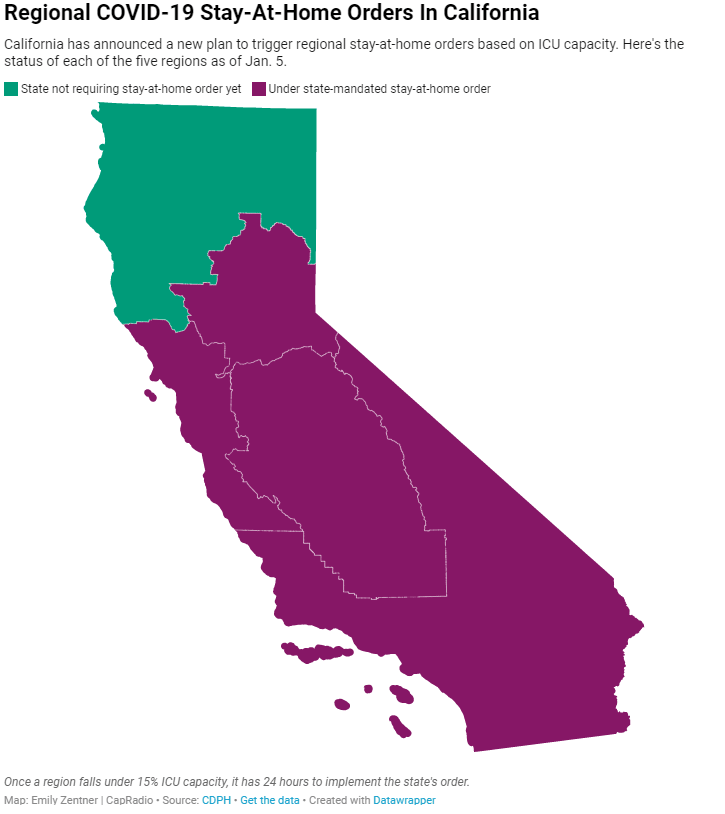

California's lockdown

The Golden State's economy is languishing under the most draconian business and socialization restrictions in the country. Parts of California have been under stay-at home orders since December 6 with the southern two-thirds of the state currently locked down. Closure is determined by intensive care unit utilization. When regional capacity falls below 15%, it has 24 hours to implement the state's restrictions.

These measures have not, so far, had a noticeable effect in slowing the worst outbreak of COVID-19 in the course of the US pandemic. They are, however, starting to effect the national employment figures.

ADP and NFP

December employment numbers from the private payroll company Automatic Data Processing (ADP) were much worse than expected with a loss of 123,000 positions instead of the predicted gain of 88,000.

The reversal of November's 304,000 increase and the rising claims figures do not bode well for the December national job numbers of Nonfarm Payrolls due on Friday. The current consensus forecast predicts 100,000 new positions but claims and ADP make for substantial downside risk.

ADP Employment Change

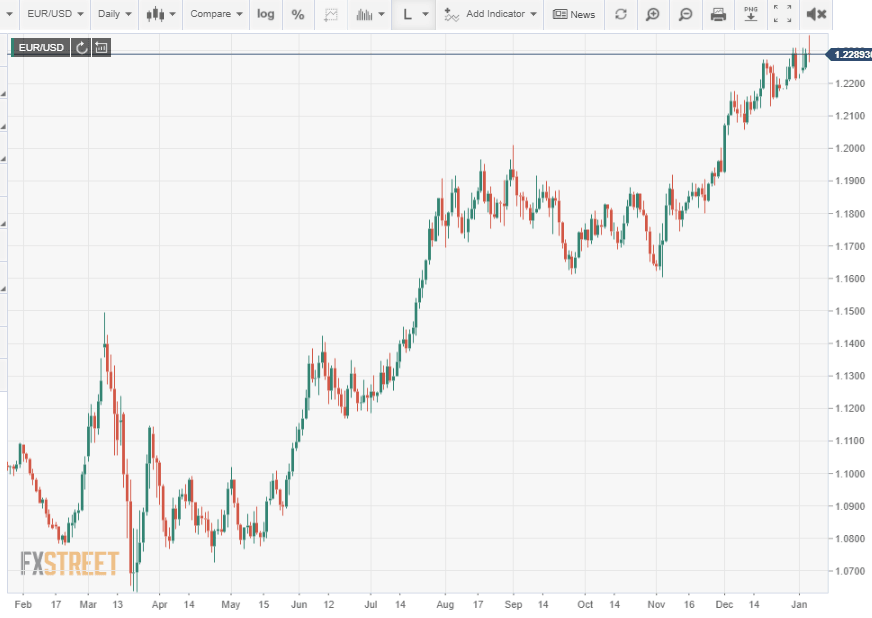

Conclusion and the dollar

The dollar was pummeled in December as the US jobless claims numbers turned south.

The EUR/USD touched 1.2349 on Wednesday its highest since April 2018, but reversed sharply as US Treasury rates rose in the wake of the apparent Democratic victory in two Georgia Senate races.

The 10-year Treasury yield was at 1.044% (11:49 am EDT) its first rise above 1% since the Fed's pandemic intervention in March.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.