In case investor expectation does not happen then there can be a weakness in the rupee and also a correction in the Indian stock markets. One needs to be prepared for the best and the worst for next week.

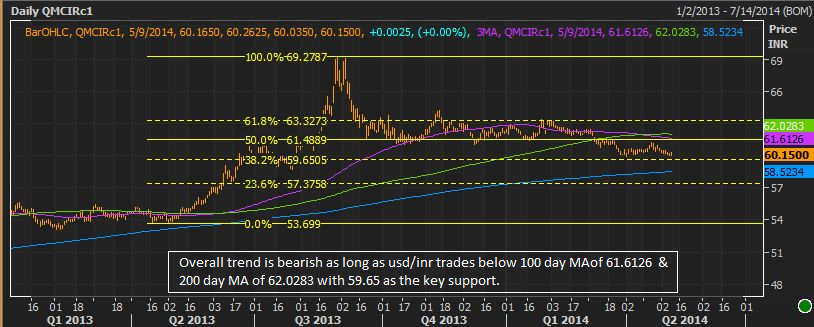

- Usd/inr is trading below the 100 day moving average as well as 200 day moving average. (100 day moving average: 61.6125, 200 day moving average: 62.0283,400 day moving average: 58.5250).

- In case usd/inr does not break 200 day moving average of 62.083 before the close of this month, then the chances of a fall to the 400 day moving average of 58.5250 are very high.

- The Reserve Bank of India (RBI) is very much prepared for huge outflows should there be a hung parliament. There will not be any 2013 style of weakness for the rupee. On the contrary if the expected NDA alliance gets a thumping majority then RBI will not be able to prevent sharp gains in the rupee.

- The best way to prevent rupee gains (if the need arises) is to open up gold imports. Opening up gold imports will result in very huge US dollar outflows.

- Fundamentally things have not changed for Indian economy. Food prices inflation is still a headache. Milk prices are being increased by Rs.1-Rs.2 per liter every three months on an average. There are lot of other examples of living essentials which keep on rising over ten percent every year and which if sustained will affect the masses. Continued rise in living essentials will result in a fall Indian savings rate. The long term effects of falling savings rate and increasing consumer debt can be devastating for the Indian economy.

- Emerging market like India are preparing for higher interest rates in USA around a years time from now. Taper by the Federal reserve has been more or less factored in by the markets. Uncertain circumstances leading to a huge emerging market outflows can never be judged. Central bankers like that of India and other still have fresh memories of the great 2013 outflows and the subsequent currency depreciation. Globally emerging markets are still not out the woods yet.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.