UK election special:

Why this election could be the turning point for the pound, how it could impact the FTSE 100, and what it may mean for the long-term UK political landscape and its position in the EU.

The UK political landscapes:

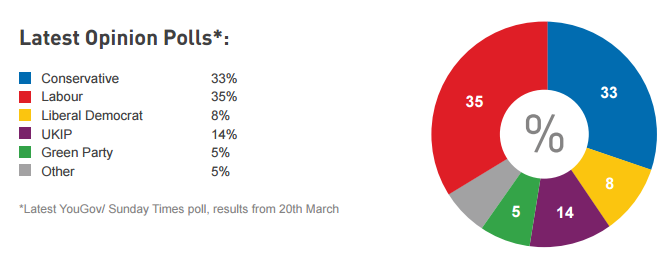

The UK election scheduled to take place this May is one of the most uncertain elections in British history. Unlike the last election in 2010 when the two main parties, Labour and the Conservatives, garnered the majority of support, this time around we have seen a fracturing of the UK’s political landscape with smaller parties coming to the fore. As you can see above, although Labour and the Conservatives have the largest amount of support, it may not be enough to give them the 326 MPs needed to form a majority government. Instead we have seen support for UKIP, a far-right party, and the Green party, a leftist party, surge in recent months. The other political development has been a large increase in support for the Scottish Nationalist Party (SNP), with 43% of adults in Scotland pledging to vote for them.The challenges faced by the two main parties make this election particularly diffi cult to predict. Both Labour and the Conservatives have a fairly equal share of the vote, making it hard to say which of the two parties could gain the most support.

A 101 on UK elections:

- General elections are held following the dissolution of parliament

- The UK voted on its electoral voting system at the last election, so FPP is here to stay

- Each constituency elects one MP (one single seat in Parliament)

- The UK operates a fi rst-past-the-post (FPP) electoral system, whereby the candidate has to win more votes than any other

- The FPP single seat system tends to favour larger parties over smaller parties

- Traditionally, the FPP system encourages tactical voting, as voters are pressured to vote for a candidate who could win rather than the candidate they actually prefer

- The UK voted on its electoral voting system at the last election, so FPP is here to stay

Potential outcomes:

Due to the high levels of uncertainty around this election, we have decided to come up with four potential outcomes and analyse what they may mean for fi nancial markets.A “stable” coalition:

A coalition government could come in two guises. The first is a relatively “stable” coalition like the one that we have seen for the past five years between the Conservatives and the UK’s “third party”, the Liberal Democrats. A “stable” coalition this time around could be between the Conservatives and the Lib Dems or between Labour and the Lib Dems. This would probably be the most market-friendly outcome as the Liberal Democrats are considered a neutralising force as they tend to sit in the political centre. This could stop the next UK government from lurching too far to the left or the right. It is also a pro EU party, so if it held the balance of power in this election then we could see the Brexit (EU exit) fears dissipate.

A fractious coalition:

At this stage, the chances of a “stable” coalition are fairly slim, as the Lib Dems have seen their support eroded in recent years and they may not win enough seats to hold the balance of power. If this happens then we could find the party with the most votes struggle to form a coalition. A fractious coalition could also require more than two parties, which could draw out the negotiation process and risk a prolonged period of political uncertainty. There are two potential scenarios for a fractious coalition:

1, Conservatives, UKIP, independents: This would cause a shift to the political right. UKIP is an anti-EU party, so the prospect of a Brexit could rise dramatically. We would expect that a Conservative-led coalition would stick to its fiscal path to eradicate the UK deficit by 2018/19. While this could be pound positive, we believe that uncertainty about the UK’s position in the EU could lead to long-term pound weakness (see more in the EU section).

2, Labour, Greens, Lib Dems potentially SNP: This would cause a shift to the left. We believe that the Lib Dems would not form a coalition with the Conservatives if it included UKIP due to their contrasting stances on EU membership. A shift to the left could throw the UK’s fiscal and economic plans into disarray, although it would dramatically reduce the prospect of a Brexit, as all three parties are pro UK EU membership. While this would be pound positive, we think the good news could be diluted by Labour’s economic policy, which could delay fiscal consolidation plans and introduce policies which may be considered market-unfriendly. Although Ed Miliband, the Labour leader, has ruled out a coalition with the SNP, if he falters and invites them to join a coalition government then Scottish independence could be back on the agenda, which could also weigh on the pound and UK assets.

We think that a fractious coalition is the most likely at this stage, if the latest opinion polls are to be believed.

A single-party win:

Due to the nature of UK politics this would most likely mean a win for the Conservatives or the Labour Party. The same problems as above would persist. While the market may initially react positively, we think that any upside would be short-lived. As we mention above, both the Conservatives and Labour could cause concern for the markets and weigh on sterling in the months after an election.

A hung parliament

This would happen if neither of the main parties could form a coalition and would ultimately lead to a re-election. However, expectations for a hung parliament have receded in recent weeks as the Fixed Term Parliament Act of 2011 makes it harder for the prime minister to call a snap re-election to try and form a majority government the second time round. However, it could happen if there were a vote to repeal the act or if Parliament were dissolved. These options would require a majority of MPs to agree, which could be tough to achieve in a very mixed parliament. If we do get a hung parliament we would expect large losses for the pound, due to the prolonged period of uncertainty this may cause. Of note, the UK Treasury has said that a government needs to be formed by August or it won’t release further funds. So, on the bright side, there is pressure to form a government in the event of a hung parliament.

Aside from the opinion polls, it is also worth looking at what result the bookmakers are pricing in. Currently, the bookmaker Paddy Power believes that Labour will lead a minority government, with an approximate 25% chance of a Hung parliament.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.