EUR/PLN 4H Chart: Channel Up

Comment: The upward-sloping channel that is currently developing on the hourly chart may be deceiving. In fact, the currency pair is closing in on the resistance line at 4.11, which may well trigger a strong sell-off, and the weekly technical indicators are in favour of this scenario. The decline is expected to result in a breach of all the support levels until 4.04, where EUR/PLN is likely to meet the lower edge of the pattern, along with the 200-period SMA.

Meanwhile, the SWFX market participants are strongly convinced that the Euro is going to appreciate further relative to the Polish Zloty, as evidenced by a high percentage of longs—71% of all open positions.

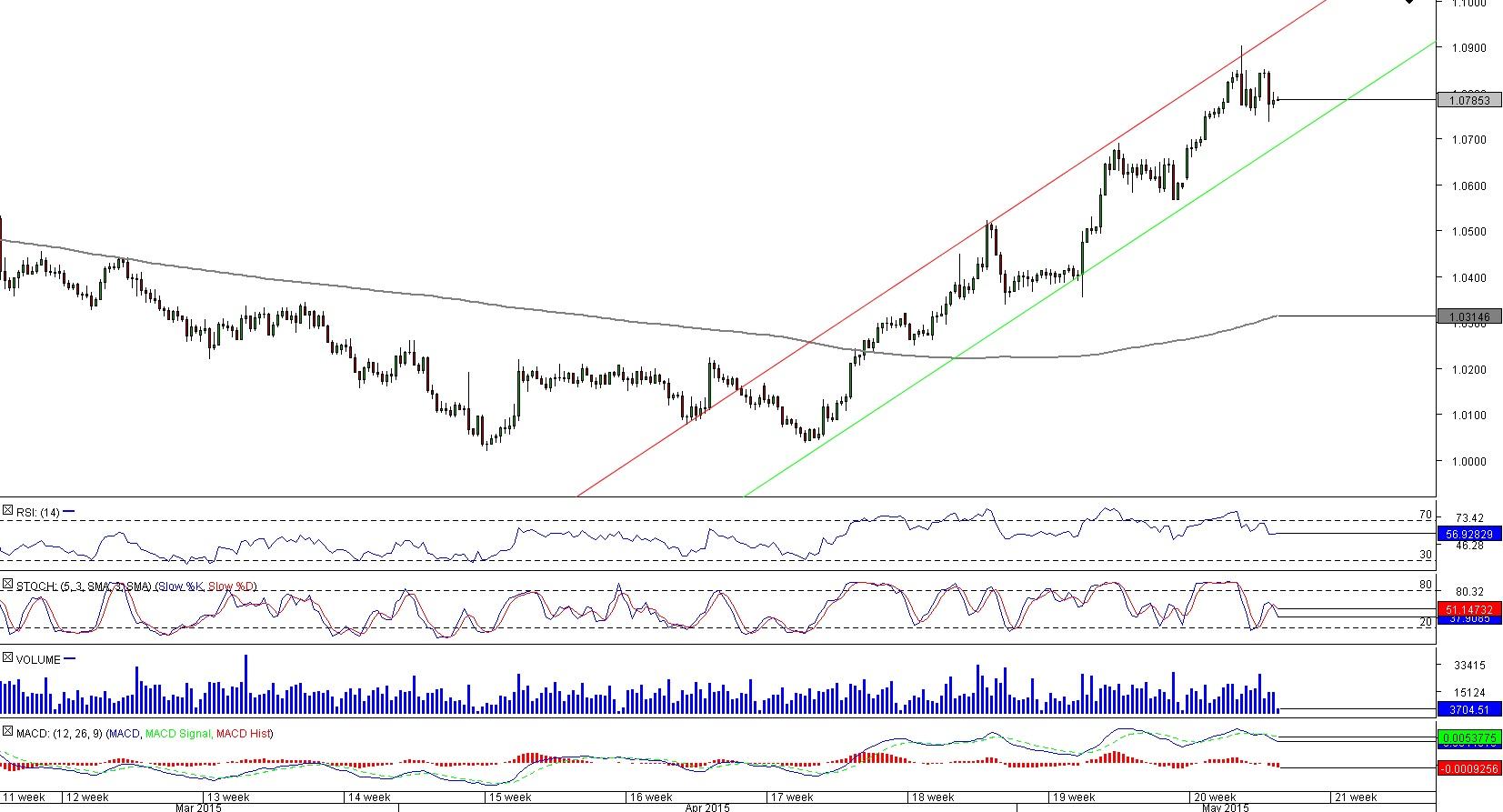

AUD/NZD 4H Chart: Channel Up

Comment: After demand at 1.00 stopped the bears who had been in control of the pair since the beginning of November, AUD/NZD started to climb upwards, and eventually the currency pair formed a bullish channel. For now the currency pair is consolidating, but the dips should be limited by the rising support line together with the weekly R1 at 1.0739. Once this phase is completed, the target will be 1.11, the current location of the weekly and monthly R3 level, but more importantly, this is where upper boundary of the pattern is likely to be challenged. At the same time, the SWFX traders share the positive sentiment towards the Aussie, being that as many as 68% of positions are long.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.