USD/CHF 1H Chart: Channel Up

Comment: A two-month decline performed by USD/CHF ended late March when the pair entered a bullish channel, within which it is trading at the moment. The formation has average quality and magnitude and is about 195-bar long. According to the SWFX numbers, more than 57% of market participants bet on further appreciation of the pair that means the instrument is likely to prolong the pattern. Additional stimulus may come from disposition of the SMAs, with the short-term SMA being on the verge of jumping above the long one. Moreover, technical indicators are sending ‘buy’ signals for short and lone terms.

CAD/CHF 1H Chart: Channel Up

Comment: Like in the previous case, the Swiss Franc commenced depreciation against its peer, the Canadian Dollar, in the second part of March when a drop to a three-year low of 0.7808 underpinned CAD/CHF. Since then, the pair has been on the rise, being locked between two upward sloping lines for more than 235 hours.

Now the pair is vacillating not far away from the lower boundary of the corridor as heavy downside pressure prevailing after CAD/CHF hit a one-month high of 0.8090 late March is restricting the upswing. However, the pair has some potential for a climb as technical data points to a possible strength in sort and long terms.

EUR/JPY 1H Chart: Channel Up

Comment: A short, only 51-bar long, channel up pattern formed by EUR/JPY represents a part of a sharp rally started on March 28. The advance has already sent the pair from a three-week low of 139.97 to a one-month high of 143.47 in less than a week.

Now the pair is sitting near the lower limit of the pattern and if it manages to bounce off this level, it may re-approach the recent high. Traders neither support bullish scenario nor disagree with it-proportion of long to short positions on the SWFX is almost 1:1. Technical data sheds some light on the obscurity of the future pair’s moves, sending bullish signals for short and medium perspectives.

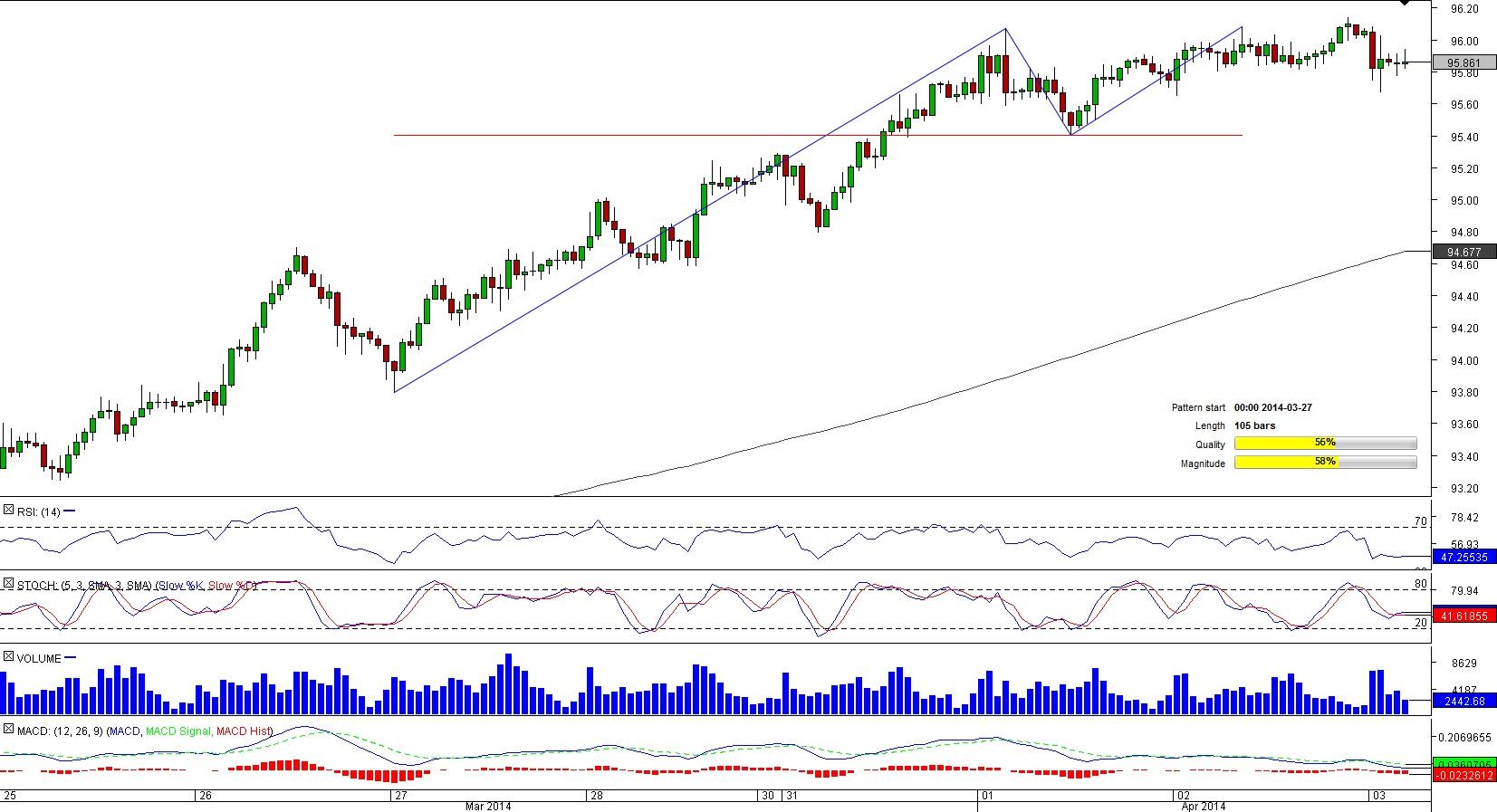

AUD/JPY 1H Chart: Double Top

Comment: Another double top pattern formed by the Australian Dollar cross is worth examining today. The trajectory of AUD/JPY is very similar to AUD/USD moves we described earlier-the Australian Dollar started to gain versus the Yen in mid-March and then peaked at a one-year high of 96.06 early April.

Now the pair is on the brink of falling beneath the 50-hour SMA at 95.84, below which there are only two levels-95.75/65 (daily S1; four-hour S1) and 95.46 (daily S2; four-hour S2) capable to stop the pair from nearing the neck-line at 95.40. If AUD/JPY breaches these support zones and the neck-line, the breakout followed by a massive sell-off is likely to happen.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.