AUD/USD 1H Chart: Channel Down

Comment: AUD/USD did not manage to recover all losses after it slid to a four-year low of 0.8659 in the second part of January. Having touched this low, the pair followed an upside trend; however, the rally was short-lived and already on February 18 the currency couple entered a bearish channel, within which it has been locked for the last 175 hours.

At the moment the pair is in the uptrend that followed the third stab to the channel lower trend-line. At the same time, the pair’s future direction seems unclear, with proportion of long to short positions being 1:1. Technical indicators also are neutral for short and long terms but are bearish for medium term.

GBP/USD 1H Chart: Channel Up

Comment: After a short retreat from a five-year high of 1.6823 hit in mid-February, GBP/USD started to advance again, forming a 92-bar long bullish tunnel.

While trading within the channel, the pair has almost erased all earlier losses and now is heading towards the recent high. However, market players are not univocal, with a half of them being bullish and a half-bearish. Technical data is less bewildering, sending bullish signals for medium and log terms. To confirm the this, the currency couple has to bounce off the level of 1.6732 (daily PP, four-hour S1) and move to 1.6749 (daily R1) that is capable of stopping the advance for some time.

EUR/CAD 1H Chart: Channel Up

Comment: Since early November the single currency has been indefatigably rising against the Canadian Dollar. The latest part of the rally has been taking place within the area bounded by two parallel upward sloping lines that pushed the pair towards a four-year high of 1.5398 in last trading session of February.

Now the pair is trading near the lower trend-line that is considerably lower than the recent peak. However, the breakout is unlikely given a strong support pertaining to the 200-hour SMA that is meandering at the lower boundary of the channel. Technical data props up this, sending ‘buy’ signals in medium and long terms.

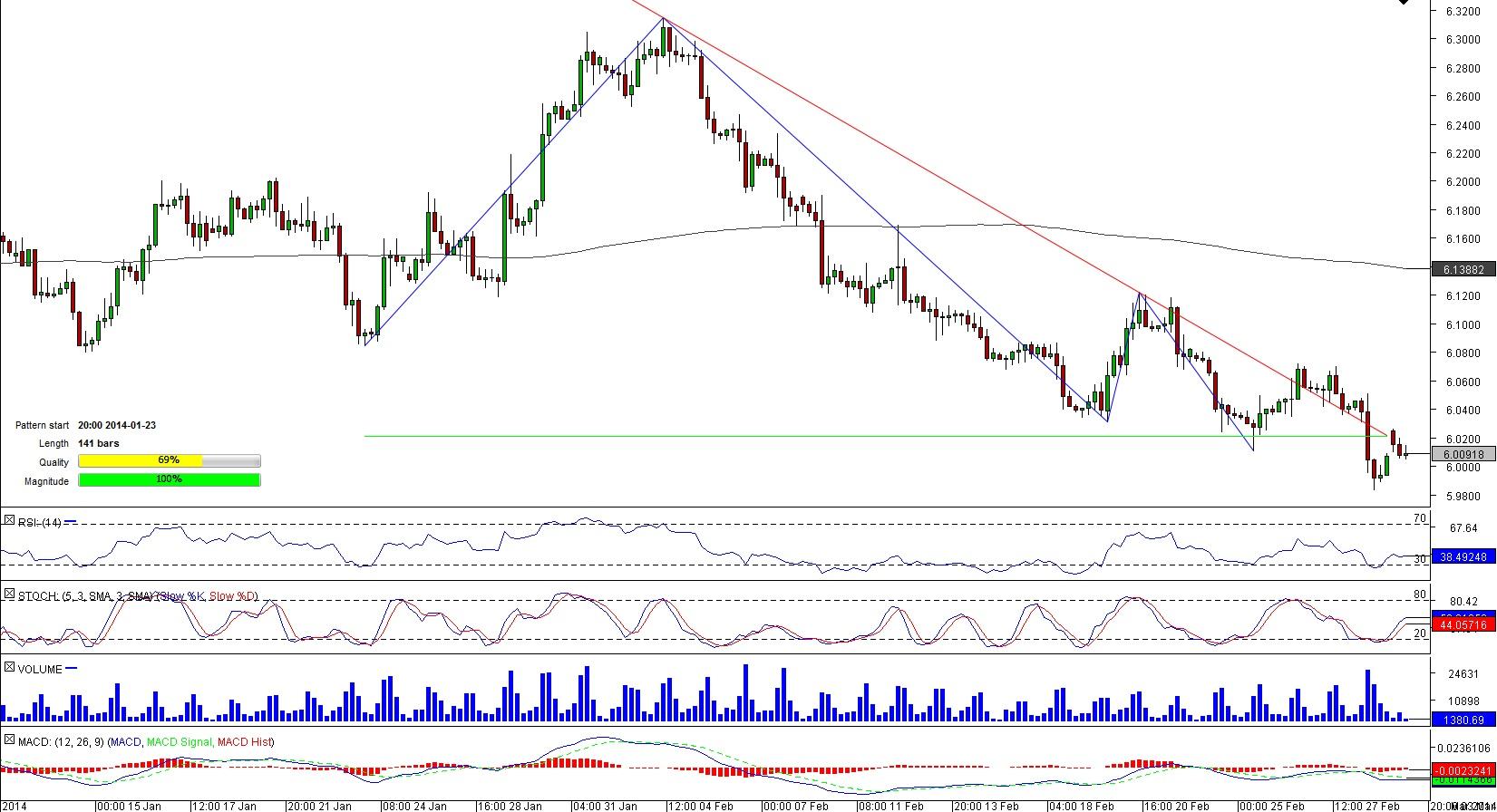

USD/NOK 4H Chart: Descending Triangle

Comment: The descending triangle pattern shaped by USD/NOK started on January 23, several days before the pair hit a four-year of 6.3134. Being a bearish formation, the channel was constantly pushing the pair lower to its support line at 6.0210 that was broken on February 28 when the pair approached the apex.

Currently the pair is vacillating below the triangle support, albeit slightly, meaning that now it represents a lucrative opportunity for traders as a sharp depreciation is likely to take place before long. This is also bolstered by SWFX data, indicating that 64.52% of all orders are to sell the pair.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.