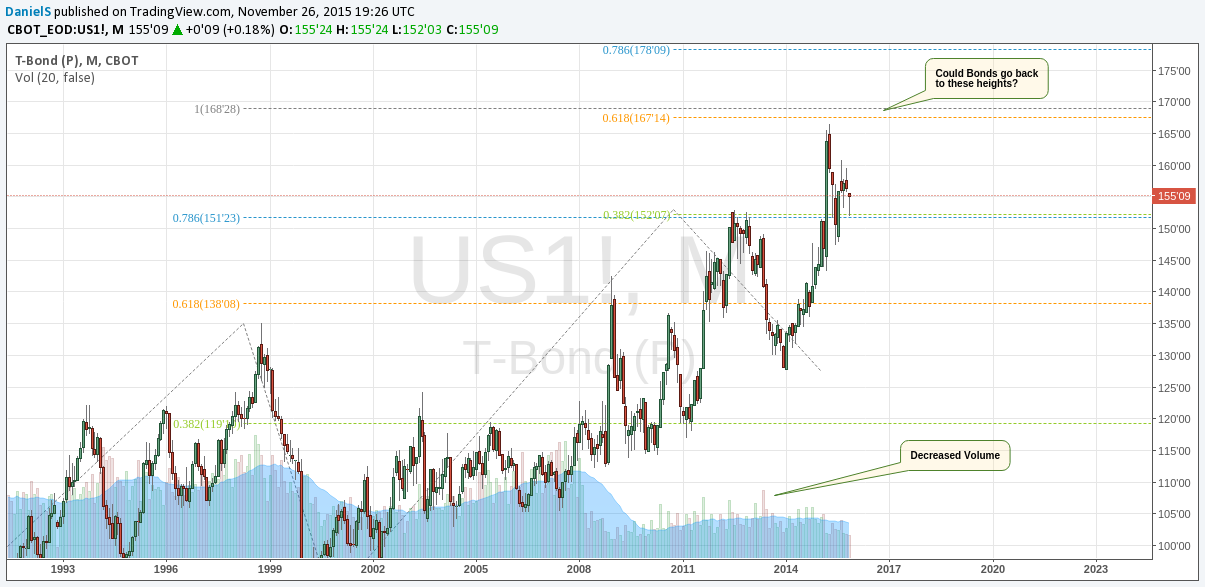

While the story for Europe is quite clear, the US treasury market should not be displaying the same symptoms. The lower futures market volume suggests a price move with no substance. That always brings a disturbing feeling in my gut. The truth is that despite the raging battle in Syria, investors are relatively confident that all hell does not break loose, no matter how many jets Turkey shoots down. As the Federal reserve meeting draws ever closer, the bond markets remain on high alert.

It is Thanksgiving in the US, the market is out of action as US traders take out their frustration on Turkeys. It will be interesting to see if all hell breaks loose on the FED interest D-day for bonds, but truth be told, even a 10 basis point hike will be enough to send bonds to the floor. US T-Bond futures are at their highest price since 1978 with no volume in sight. I wonder who is buying all those futures? Bonds away!!

Future stocks and stocks currently trending have large potential rewards but also large potential risk. You must be aware of the risk and be willing to accept them in order to invest in future stocks & FX markets. Don't trade with money you can't afford to lose. This video is neither a solicitation nor an offer to buy/sell future stocks or FX. No representation is made that any account will or is likely to achieve profits or losses similar to those discussed here. Past performace of indicators or methodology are not necessarily indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.