An undeniable feeling of disappointed engulfed the global markets during trading on Monday following the unsuccessful Doha meeting on Sunday which erased any remaining credibility OPEC had to offer. Despite Iran’s absence in the meeting, expectations were high for a freeze deal to be struck, but the visible dispute between Saudi Arabia and Iran sabotaged all efforts consequently causing WTI crude to plunge more than 5%. While realistically the effects of an output freeze would have had a minimal impact on the supply glut, even a symbolic gesture from OPEC to deal with the oversupply could have boosted optimism for future deals.

This string of events almost suggests that the major players in the cartel had no real intention of curbing production, but simply exploited the explosive levels of volatility to manufacture speculative boosts in prices based on false expectations. Sentiment remains bearish towards oil, and with market participants losing hope in the ability of OPEC to work together in battling the excessive oversupply in the markets; bearish investors have been provided a platform to install another round of selling. The last time oil prices sunk to the 13 year lows of $26.20 in February, oil producers felt the pinch and prices may need to trade back below $25 for desperation to kick in which could force a real output deal to be struck.

With the fundamentals of an unrelenting oversupply in the markets still present and concerns that demand may be waning, WTI crude remains heavily depressed. Expectations are rapidly fading over the cartel working together and this should leave prices vulnerable in the short and medium term. From a technical standpoint, the steep decline experienced in Monday’s session could provide enough momentum for WTI crude to trade back towards $38.

Stock markets sink

Global stock markets tumbled during trading on Monday following the disappointing Doha meeting that renewed a wave of risk aversion, consequently limiting investor risk appetite. Asian markets were at the mercy of the meeting’s failure with previous gains relinquished as a reestablished appetite for the safehaven Japanese Yen dragged the Nikkei 3.4% lower. The bearish contagion from Asia ventured into Europe and may likely affect America as investors frantically scattered away from riskier assets to safehavens. With concerns over the state of the global economy already elevated, this Doha disappointment adds to the horrible mix of events that have periodically eroded global sentiment. Oil prices may be poised for further declines as the markets drown in the oversupply and this should expose stock markets to more pain.

ECB Press conference looms

The Eurozone continues to be trapped in an ongoing battle with very low inflation levels, while tepid economic growth in Europe has left the European Central bank under noticeable pressure to take further action. A catalytic combination of falling commodity prices and eroding global growth have obstructed the ECB’s 2% inflation targets with the central bank possibly trimming inflation forecasts once again amid the ongoing global woes. Sentiment remains bearish towards Europe and with the International Monetary Fund slashing Eurozone growth forecasts it seems likely that the ECB may unleash further stimulus measures to jumpstart growth.

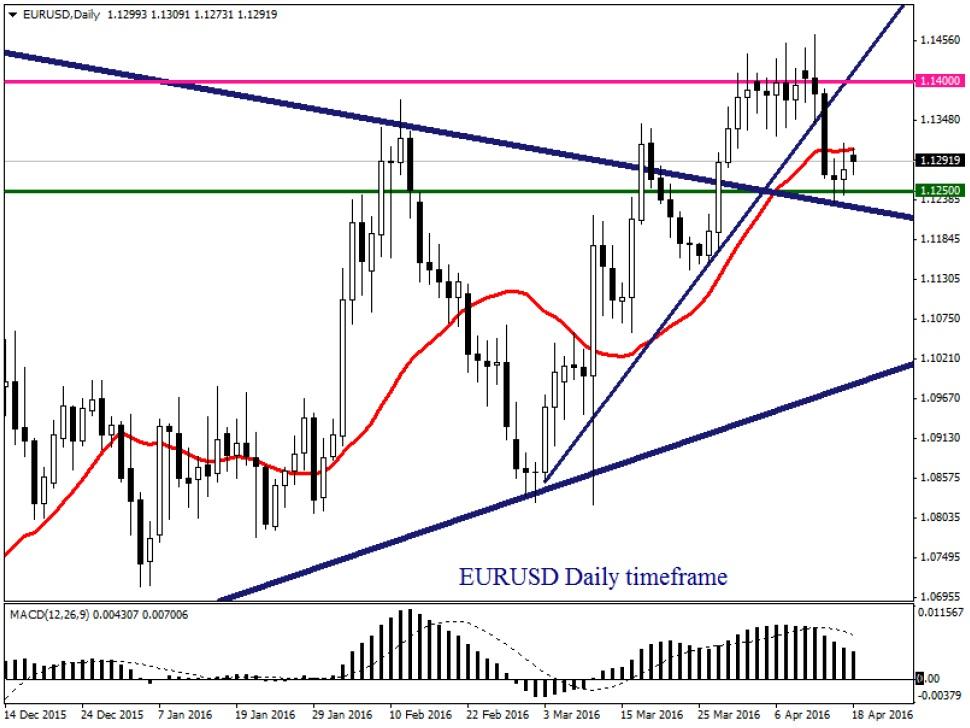

A short period of Dollar appreciation may have created a higher low on the EURUSD at 1.1250 which could potentially offer an opportunity for bullish investors to install another round of buying momentum. This pair remains remarkably bullish and the paradigm shift that has seen investors flock to the EUR, amid risk aversion, could act as an attribute which ensures that prices remain buoyed. From a technical standpoint, prices are trading back towards the daily 20 SMA while the MACD has crossed to the downside. A breakout above 1.1300 could invite a further incline towards 1.140, on the condition that the 1.1250 support defends.

Commodity spotlight – Gold

Gold bulls were offered a welcome boost following the Doha disappointment which renewed a wave of risk aversion and consequently encouraged investors to flock to safehaven investments. Despite the sharp declines in prices last week, the current change of developments coupled with ongoing concerns over slowing global growth could provide a foundation for bullish investors to install a fresh round of buying. With ongoing Dollar vulnerability acting as the final ingredient for bulls to take the front seat once again, a solid break above $1240 should clear a path towards $1250. From a technical standpoint, prices are trading above the daily 20 SMA while the MACD has crossed to the upside. Potential resistance at $1240 could transform into a dynamic support for a drive up towards $1250.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.