Dollars bulls were instilled with inspiration as a hawkish FOMC statement renewed the possibility of a US rate hike in 2015. A striking change to the statement was the removal of a line that discussed how global developments may threaten growth in the US. With the Fed’s focus shifted away from global developments such as China’s deceleration and falling commodity prices, the pressure is back on US economic data as the trigger for when the Fed will move forward with a rate rise. According to the Central bank, despite the consecutive soft NFP announcements from September, the US economy has expanded at a moderate pace. This strong hawkish bias has offered a lifeline to the vulnerable Dollar, and with most investors swayed on the possibility of a US rate hike in 2015, the USD may keep appreciating until the next FOMC statement in December.

As a result of the statement’s hawkish bark, the Dollar Index cleared 10 week highs. With sentiment for the Dollar experiencing a sharp change in polarity, market participants may continue to bet on the possibility of a December hike which in turn should result in the Dollar Index appreciating to the next relevant resistance at 100.00.

Dollar strength has caused the EURUSD to decline below the 1.100 psychological support; a scenario most desirable for the ECB. Although the dovish Mario Draghi has threatened further QE if needed, a strong Dollar may encourage an environment that will benefit European exporters; the first steps to reinvigorating economic growth within the Eurozone. I have always felt that the ECB was operating in standby mode with the catalyst to move forward being none other than the Fed. There may be a scenario where the ECB observes the actions of the Fed in December, before then acting in 2016.

Despite the change of events, questions may be raised on how much more bark the Federal Reserve can give before investors impatiently await the bite that is a rate hike. If the Fed fails to move forward with a US rate hike in 2015, this will not only have a damaging impact on its already bruised credibility but may also result in an unprecedented selloff in the Dollar.

EURNZD

The EURNZD is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. As long as prices can keep below the 1.6950 resistance, there may be a decline to the next relevant support at 1.6000.

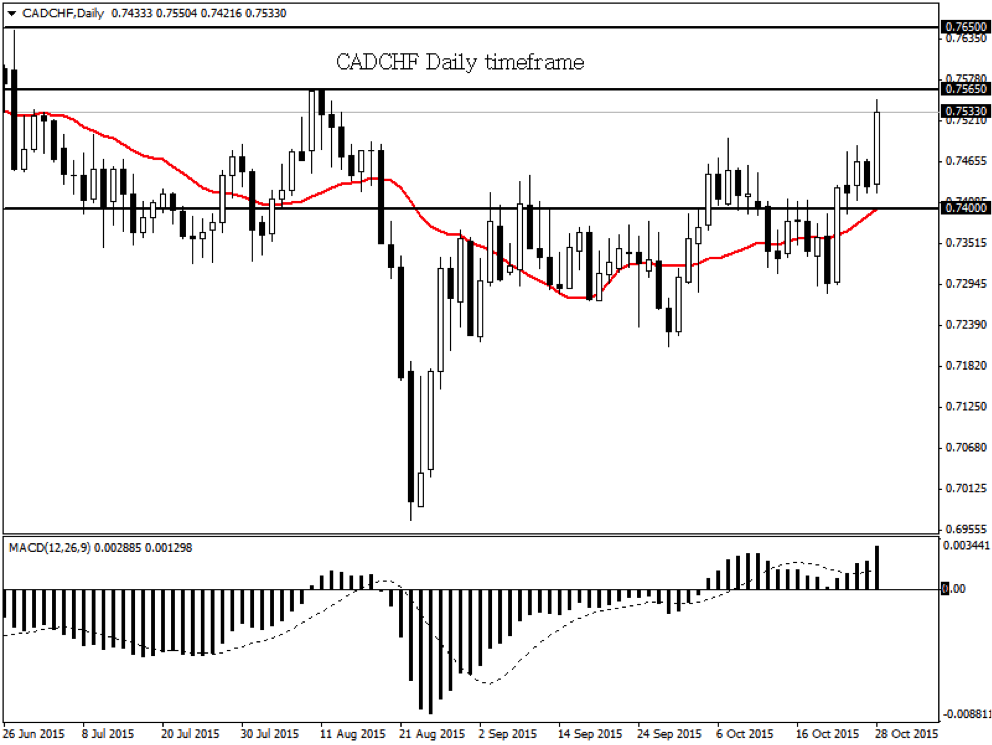

CADCHF

The CADCHF is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. A breakout above the 0.7565 resistance may open a path to the next relevant resistance at 0.7650.

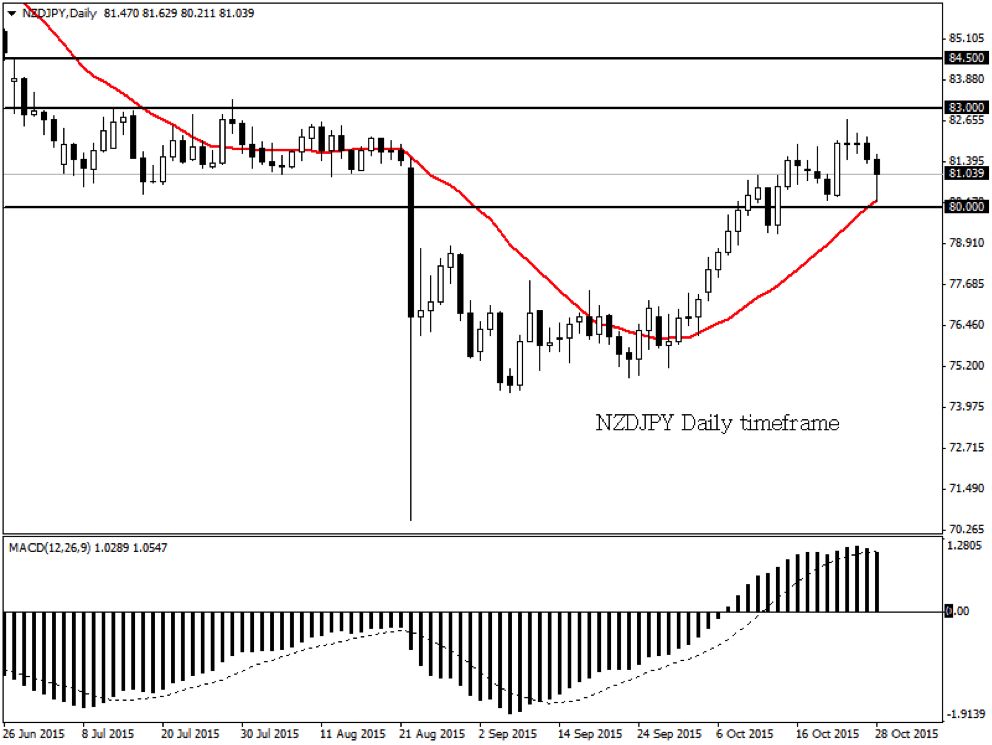

NZDJPY

The NZDJPY remains technically bullish on the daily timeframe as long as prices can keep above the 80.00 support. The candlesticks are above the daily 20 SMA and the MACD has crossed to the upside. A breakout above the 83.00 resistance may open a path to the next relevant resistance at 84.50.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.