Global Market

The already vulnerable Dollar received multiple sharp blows in Wednesday’s trading session as an array of unimpressive economic data releases from the States rapidly decreased the expectations of a US rate hike in 2015. Other than the positive unemployment claims last week, economic data in October from the US has been nothing but disappointing, with optimism about the world’s second largest economy slowly fading away. Whilst the Fed remain divided on the possibility of a rate hike before 2016, the latest chain of soft economic data from the States combined with the renewed concerns over China’s growth, offer a compelling argument as to why the FED may not raise US rates in 2015.

The main focus in Thursday’s US trading session will be the CPI m/m release which has been branded as a lifeline for the sensitive Dollar. If both Core CPI m/m and CPI m/m fail to meet expectations, then the USD may be left vulnerable yet again with additional losses expected. Sentiment still remains bearish on the USD as anxious market participants reduce their bets on a 2015 US rate hike and this can be reflected in the Dollar Index which declined to the 94.00 support. Additional Dollar weakness attained from soft economic data releases from the States may invite another decline in the Dollar Index to the next relevant support at 93.30.

Despite the negative close in Wednesday’s trading session, global equity markets have managed to claw back some losses with major Asian equities journeying into green territory. A divided Fed on a rate hike decision for 2015, combined with the escalating expectations that further monetary policy from China may be impending in the near future, has resulted in the Shanghai Composite Index concluding Thursday’s trading session +2.32% higher. This positivity has rippled into the European equity division with the FTSE100 erasing Wednesday’s losses currently trading +0.86% as of writing. Whilst the FTSE100 remains technically bullish on the daily timeframe, a breach back below the 6250 support may open a path to the next relevant support at 6100.

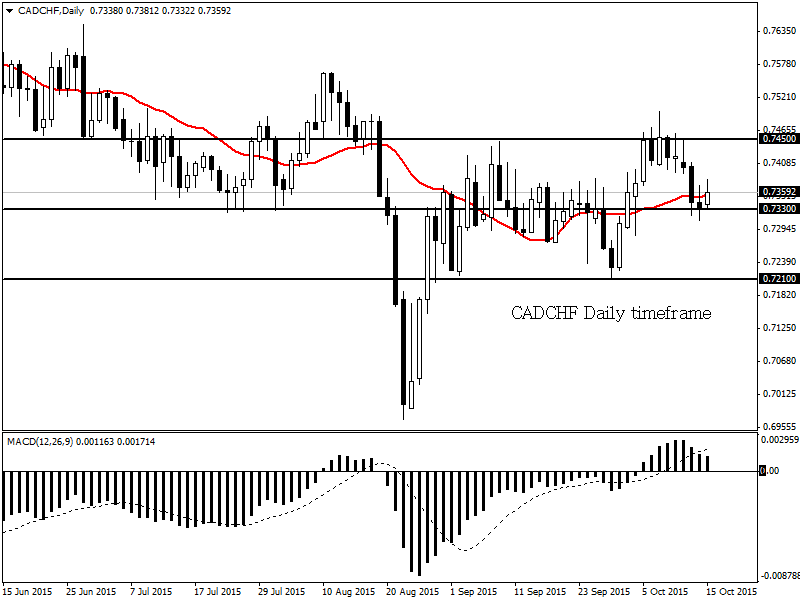

CADCHF

The CADCHF currently exists in a wide range. Resistance can be found at 0.7450 whilst support may be found at 0.7210. The 0.7330 level remains a pivotal point but a breakdown below this level may open a path to the 0.7210.

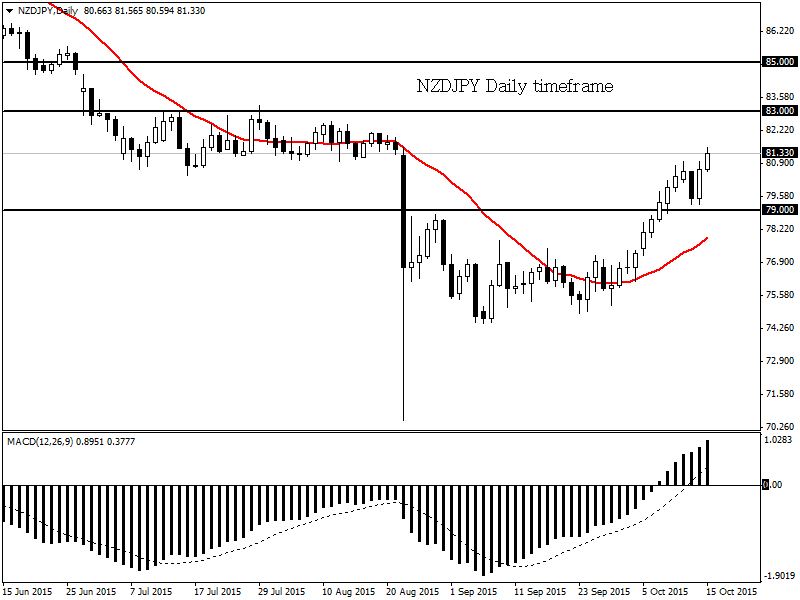

NZDJPY

The NZDJPY is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. As long as prices can keep above the 79.00 level, there may be an incline to the next relevant resistance at 83.00.

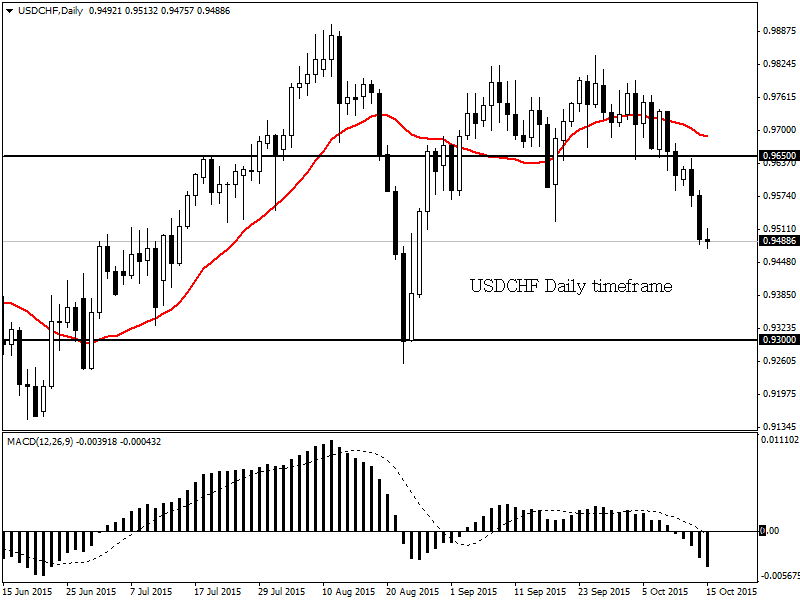

USDCHF

The USDCHF is technically bearish on the daily timeframe as long as prices can keep below the 0.9650 resistance. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. The next relevant support is based at 0.9300.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.