Global Markets

The US Stock markets took a hit on Tuesday as the vulnerability from the Shanghai Composite Index dispersed into the US trading session. With manufacturing data in China falling to a threeyear low, market participants received confirmation that the nation was in a period of deceleration and this weighed on investor sentiment throughout the global markets. The weak US manufacturing PMI combined with the events of China translated into temporary USD weakness. Saying that, the USD has recovered some of its momentum during the overnight Asian session. The US economy needs an impressive NFP result this Friday to strengthen the data on which a US rate hike taking place by the end of the current year is dependent.

WTI has experienced a hefty decline over the past 24 hours. The gains following the unexpected comments from OPEC regarding finding a fair price for suppliers were looked upon positively by market participants, but they were later erased. Investors might begin to monitor the news from Nigeria, where two major pipelines have been shut down over the last week for clues on how this could impact the oversupply in the markets. From a technical standpoint, WTI has experienced an engulfment on the daily timeframe thus reentering bearish territory. The events of China and appreciation of the USD appear to have put a limit on how high WTI can rally.

Although the GBP was previously unaffected by the global market events, it has taken a serious hit over the past couple of days. Even though the United Kingdom has a minor trading relationship with China, the increased financial volatility and riskoff trading environment have added bearish pressure onto the GBP. The GBPUSD is looking very weak technically and has recently extended below its 50, 100 and 200 MA. Investor sentiment towards the pair is clearly weak and although the UK economic outlook remains robust, external factors such as the riskoff environment can lead to further losses.

Gold continues to range in the background with some of the momentum of its safehaven attraction looking weak. The events of last week saw the precious metal sold off, whilst other safe haven currencies like the JPY and an unexpected EUR are in demand. Fundamentally Gold still remains bearish simply because of the low inflation expectations and continual speculation that the FED will begin tightening monetary policy before the end of 2015.

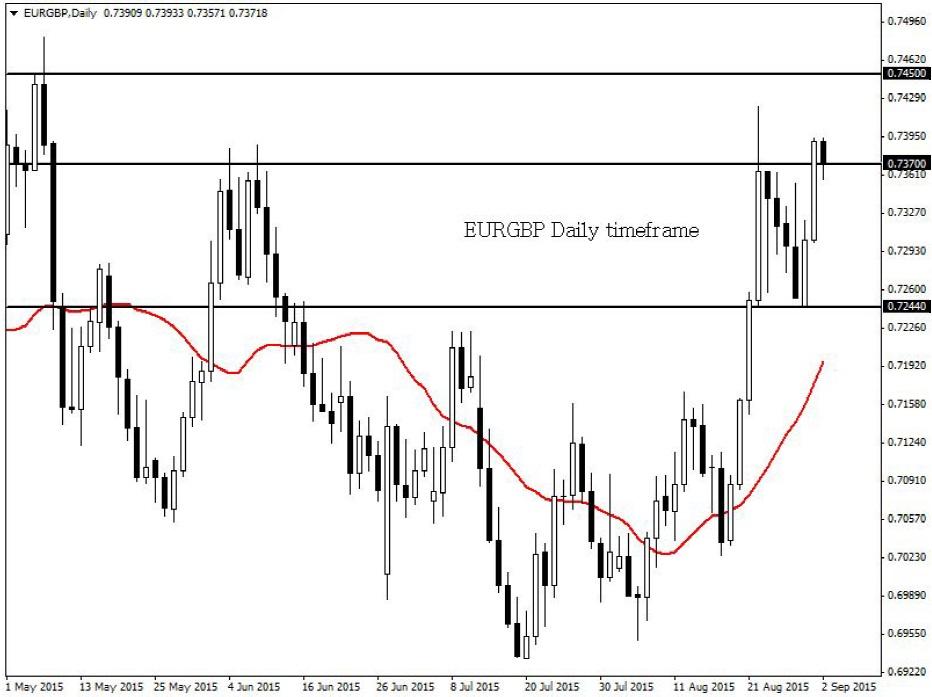

EURGBP

The current weakness within the GBP has given an opportunity for the EURGBP bulls to surge. This pair is technically bullish on the daily timeframe because lagging indicators such as the 20 SMA and MACD point to the upside. Yesterday’s session offered a break above the 0.7370 resistance; this may open a path to the next relevant level at 0.7450. A move back below 0.7244 invalidates this daily bullish outlook.

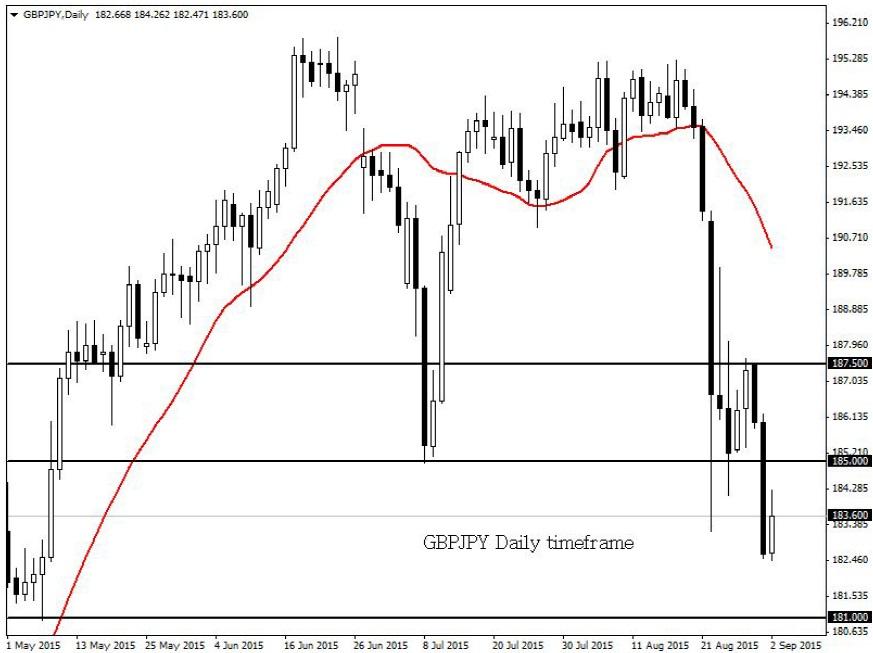

GBPJPY

This riskoff environment has provided the JPY with consistent strength. GBPJPY is technically bearish on the daily timeframe. Previous support at 185.0 may become resistance which may send prices to the next relevant support at 181.0. A move back above 187.50 invalidates this daily bearish outlook.

NZDUSD

Sentiment for the NZD still remains bearish because of the ripple effect coming from the developments in China. Leading and lagging indicators suggest that the NZDUSD is technically bearish on the daily timeframe. Prices have breached the previous 0.6500 support which has become resistance. There may be a further decline to the 0.6050 on the condition that the 0.6500 resistance holds.

CADJPY

Falling prices of oil have put pressure on the CAD as a whole. This pair is bearish and may trade back to the lows of 87.40 on the condition that the 92.40 resistance holds. With the candlesticks below the daily 20 SMA the bearish view has been reconfirmed.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.