Global Markets

The Shanghai Composite Index received further punishment today following factory activity in China falling to a threeyear low. It is clear that China’s manufacturing sector is in a period of deceleration with all previous measures taken by the PBoC to reinvigorate data having no impact as of yet. With the Shanghai Composite showing further vulnerabilities, investor sentiment has been dragged lower throughout other major markets. This has rippled across Australia and Japan, while also weighing heavily on European equities. The domino effect could also stretch to the US session, which could put the USD at risk and make the Fed further hesitant towards raising US interest rates.

The IMF’s Christine Lagarde has suggested that global markets should brace themselves for the China slowdown, meaning economies should prepare for a decline in trade from China and that the global markets may still have yet to feel the full brunt of this.

The renewed appetite for WTI has continued, following the news that OPEC are willing to discuss with producers about achieving a fair price for the commodity. Most market participants have looked upon this positively, and WTI has now gained 25% from its milestone lows less than a week ago. From a technical standpoint, WTI has entered bullish territory but the fundamental outlook remains bearish. The current supply glut combined with the diminishing demand from China, the world’s second greatest oil consumer, may have a gravitational impact on further gains.

In the commodity currency arena, the pressures of China can be seen with weakness conveyed on both the AUD and NZD. The RBA decided to keep rates unchanged at 2.00% which caused the AUD to gain slightly before tensions radiating from China resulted in the single currency weakening across the board. The AUDUSD was bearish fundamentally, but the technical break below the 0.7100 has suggested for a further decline to 0.7050. Sentiment for the New Zealand economy still remains bearish, but a positive GDT Price Index today may lift some of the load off its economy.

Euro manufacturing PMI for Spain was released below expectations, while German unemployment change printed positive with fewer people unemployed. The EUR appreciated on the back of this, but tensions of the ECB being unable to fulfill its 2% inflation target are brewing in the background. With the ECB threatening another batch of QE, this may be the next big theme in the markets after the developments in China subside.

The focus today in the US session will be the ISM manufacturing index. The forecast is lower than the previous release of 52.7, but I expect a positive result. The sentiment is healthy for the US economy with economic data remaining robust. A continuation of robust US data should keep hopes of a Fed rate hike before the end of 2015 alive.

EURUSD

USD weakness has allowed the EURUSD bulls to breach a relevant resistance at 1.1130. Prices found support above the daily 20 SMA and 1.150 support level. With the MACD trading to the upside, prices may continue to incline to the next relevant resistance at 1.1450. A move back below 1.115 would invalidate this daily bullish outlook.

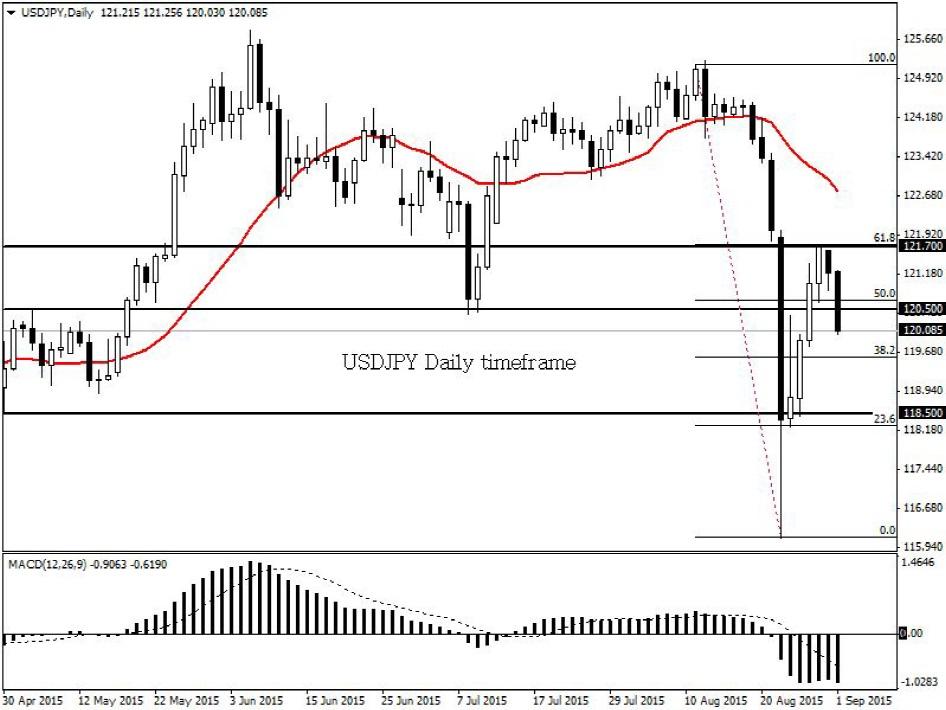

USDJPY

The uncertainties in China have provided strength to the JPY as a safe haven instrument. USDJPY was already technically bearish, but the breakdown below the 120.50 support may open a path to the 38.2% Fibonacci level at 119.68. Previous support at 120.50 may now become resistance and because of this, the new trend defining level stands at 121.70. A move back above here invalidates this daily bearish outlook.

GBPUSD

GBPUSD remains technically bearish with prices below lagging indicators such as the 20 SMA and MACD all point down. The pair is currently in a range with resistance at 1.5450 and support at 1.5300. A breakdown below 1.5300 may open a path to the next relevant support at 1.5170.

USDCAD

Supply side attributes caused a strong surge in demand for oil which in turn appreciated the CAD against the USD. Fundamentally and technically this pair still remains bullish. There have been higher highs, higher lows and most lagging indicators point to the upside. If support at 1.3110 holds, then an incline back to the highs of 1.3350 may be expected. A move below the 1.3110 support invalidates this daily bullish outlook.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.