Sentiment Surprise

European Commission surveys showed that morale remained uplifted in the month of January. According to the commission’s survey on consumer sentiment, optimism over the fading European Union fiscal crisis added 1.4 points to the overall reading of 89.2 – a six-month high. Subsequently, the tick higher is serving as confirmation, once again, that a silver lining is being presented despite anticipated lower growth in the first three months of the year. The brighter results are being coupled with a 2.5 point recovery in the Eurozone PMI survey, which now stands at 48.2 for the same month.

Although still widely contractionary, the improvement in the PMI survey is helping to reinforce the notion that underlying fundamentals are forming a base of sorts, lending to speculation of a EU recovery in the second half of 2013.

Dropping Debt Costs

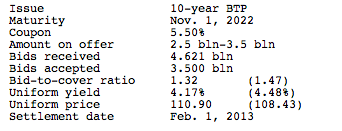

Debt yield costs continued their downward spiral as the Italian Treasury held its 10-year benchmark bond auction earlier today. Selling the maximum 6.5 billion euros offering, the Treasury saw tepid demand as the bid to cover ratio stood at 1.32. Although not all too bad, the lower figure simply reflects thinning demand on the heels of the nation’s second major auction this week. As a result of the auction target being reached, yields on the 10-year note fell to 4.17% compared to 4.48% in a previously similar auction – the lowest since 2010.

All in all, the bond auction can be considered a success as it bolsters the notion that market concern is dissipating on evidence that the EU has stabilized – albeit for now. The sentiment additionally supports the notion that Mario Monti may be set to take the limelight as Italy’s PM once again when national elections are held next month – considered Euro bullish.

What To Watch Out For

With the EURUSD now higher above the 1.3550 figure, it’s plausible that the single currency will be able to advance towards near term resistance at 1.3716. A break higher through the figure would prompt a likely test of medium term targets at 1.3890.

Source: Dow Jones Newswire

Source: Dow Jones Newswire

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.