The oil prices could extend their rally which has been prompted by the end of last week by rising speculations of watching harsher winter in US, after the snow storms hit its east coast.

The oil rebound could prop up again the risk appetite which has been extended also into the first Asian session of this week sending the Japanese yen down across the broad.

From another side, the greenback has been exposed to selling pressure on the speculations of watching US economic slowdown in the first quarter of this year because of the bad weather to delay the next tightening step of the Fed which will by closely watched this week to show the markets how concerned is it about the global economy, after the turmoil in the beginning weeks of this year because of the Chinese economic slowdown and the oil prices slide.

While BOJ chief Kuroda said during the weekend from Davos that BOJ is not so much concerned about the real economy because of the financial market turmoil, however we need to be careful.

Kuroda indicated that if the underlining inflation is to be seriously affected capping reaching the 2% inflation target, there will be expanding of the QE by many ways. The markets will be closely watching this week, the Japanese inflation data of December and BOJ's meeting outcome to know more about the impact of the Japanese yen strength in the recent weeks with the oil prices slide which can place the Japanese economy under deflation pressure again.

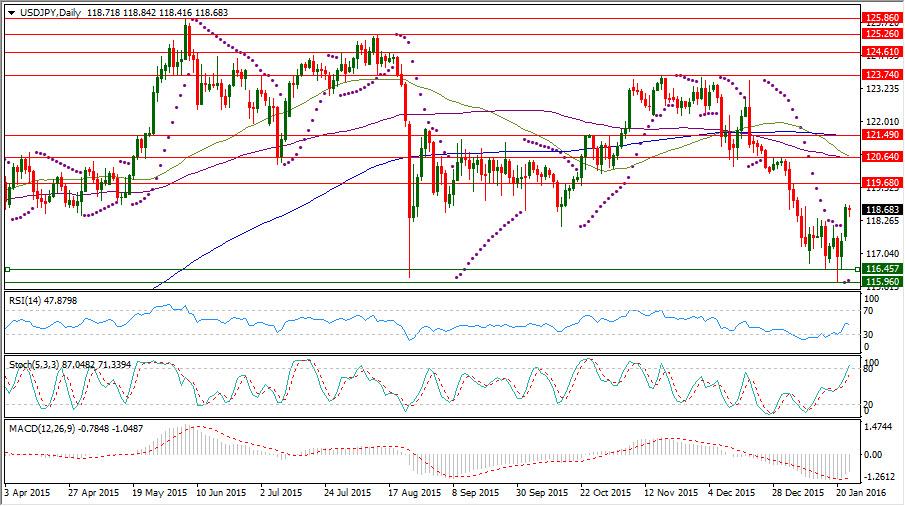

Instrument in Focus: USDJPY

USDJPY could extend its rebound from 115.96 to be traded currently near 118.70, after breaking 118.36 which could cap its previous rebound from 116.67. USDJPY daily Parabolic SAR (step 0.02, maximum 0.2) is reading now 116.01 in its second day of being below the trading rate, after rebound extension to 118.86 last Friday.

While USDJPY daily RSI is referring now to existence in the neutral region reading now 47.879, while its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in the overbought area above 80 reading now 87.048 leading its signal line which is still in the neutral region reading now 71.339.

Important levels: Daily SMA50 @ 120.69, Daily SMA100 @ 120.65 and Daily SMA200 @ 121.48

S&R:

S1: 116.45

S2: 115.96

S3: 115.55

R1: 119.68

R2: 120.64

R3: 121.49

USDJPY Daily Chart:

Commodities: Brent Mar. 16

After Brent Mar. 16 could shrug off higher than expected rising of US crude inventories containing last Wednesday falling to $27.10 by rising to $29.83 last Thursday, it could extend this rebound to reach $32.48 in the beginning session of the new week touching its Hourly 100SMA currently and getting closer to its Daily 20SMA.

The oil prices have been negatively impacted by implying the Iranian nuclear deal but it could now contain most of last week falling which reached $27.10.

Brent Mar. 16 daily RSI is now well into the neutral region reading 44.591 while its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line in into 90.327 leading its signal line which is still in the neutral region reading now 62.406, after continued existence in the oversold area below 20 since Jan. 8.

Brent Mar. 16 daily Parabolic SAR (step 0.02, maximum 0.2) is referring today to $27.20 in its second day of being below the trading rate, after rising extension last Friday to $32.29.

Important levels: Daily SMA20 @ $32.89, Daily SMA50 @ $38.09, Daily SMA100 @ $43.47 and Daily SMA200 @ $51.27

S&R:

S1: $29.28

S2: $27.10

S3: $25.51

R1: $32.66

R2: $35.25

R3: $38.97

Brent Mar. 16 Daily chart:

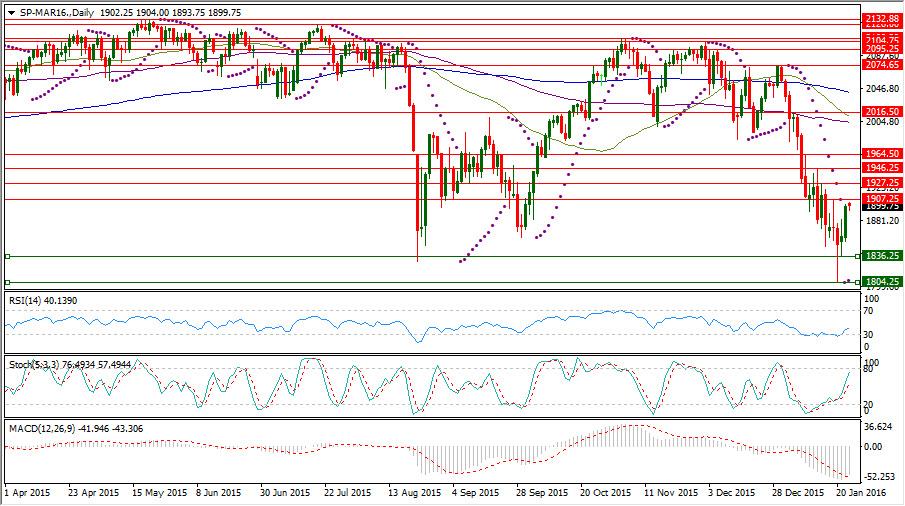

Hot instrument: SP-Mar. 16

SP-MAR16 could prolong its rising from last Wednesday low at 1804.25 to reach 1904 in the beginning of the new week.

SP-Mar16 daily RSI is reading now 40.139 in its neutral region coming from its oversold area below 30 and also its daily Stochastic Oscillator (5, 3, 3) which is more sensitive to the volatility is having now its main line into the neutral region reading 76.493 to have a closer place to the overbought area above 80, after coming from the oversold region below 20 and also its signal line is in the neutral territory but lagging behind the main line reading now 57.494.

SP-Mar. 16 daily Parabolic SAR (step 0.02, maximum 0.2) is referring today to 1806.20 in its second day of being below the trading rate, after rising extension last Friday too reached 1902.

Important levels: Daily SMA50 @ 2011.06, Daily SMA100 @ 2004.47 and Daily SMA200 @ 2041.44

S&R:

S1: 1836.25

S2: 1804.25

S3: 1802.63

R1: 1907.25

R2: 1927.25

R3: 1946.25

SP-Mar. 16 Daily chart:

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.