Aussie - keyresistance broken

With Australia being amajor commodity exporter, the recent surge in commodity prices has had theobvious impact of strengthening the AUD and taking it beyond key resistance at.7385 which had capped the top of the range for the last 6 months. Until a closeback below .7386 is seen the next target will be the band .7530-95. The currentcommodity rally has come very suddenly and may be getting a bit overdone if itdoes take a breather and pull back look for support to be found at 200MA andcluster of highs, circled, around .7259-43 as weak longs get squeezed below thekey level.

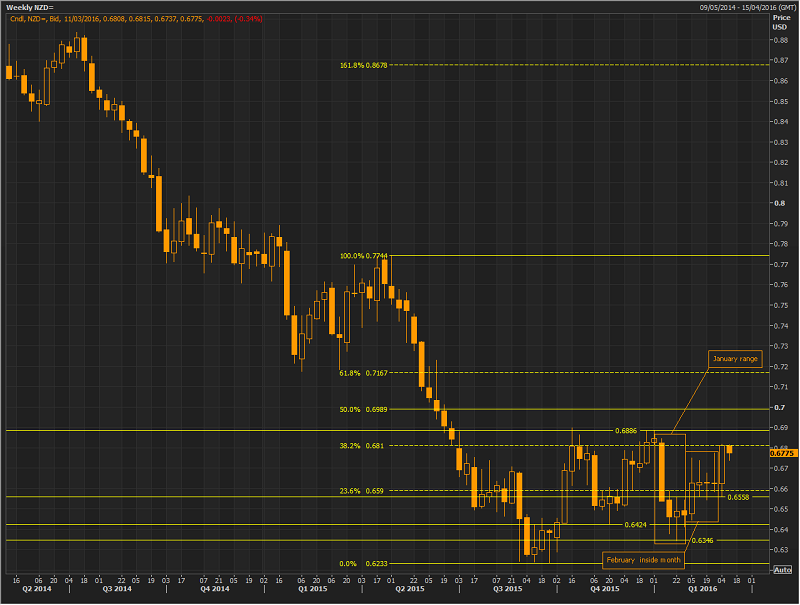

NZD - inside monthbreak ahead of rates

Later today we get thelatest interest rate decision out of the RBNZ, unchanged is expected howeversome analysts are looking for a 0.25% cut to 2.25%. Looking to thetechnicals; last week saw a break and close outside of inside monthabove .6774, so far this week we have tested back down and rejected. The rate decisionmay help NZD higher if it is unchanged and target the top of recent range at.6886-97, however the surprise cut will likely cause a failed inside monthbreak and move back towards .6558 and February lows .6447

Draghi hinted strongly at the last ECB meeting that policy is likely tochange at the meeting on Thursday - all eyes will be on what he does. The Eurois sitting just below decision point giving a decent chance of a move in eitherdirection. The area between 1.10 and 1.1088 has been rejected multiple timeshowever this has not produced a strong move down, any move above 1.1088 shouldsee the highs from the one-time-framing move down taken out quickly up to 1.125gap. A sustained move lower will require a break of 1.0828 to target1.0728 and 1.0670, until then the high volume area 1.0974-1.0843 may provesticky again as those short on the rejection lose conviction on no break.

.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.