EURUSD - tested key area...

...and found buyers. The recent pull back from 1.1375 has put Euro longs under a lot of pressure particularly once trade got below 1.1059 and 200 MA, the last chance for buyers came on a re-test of the tight range (boxed) which coincided with trend line test. So far the area is holding and consolidating above, a move back above 1.1059 will be necessary to confirm the renewed strength. Any break into the range and through both trend lines should see a quick fall to 1.0775 as the area is well traded so no longer needs to hold.

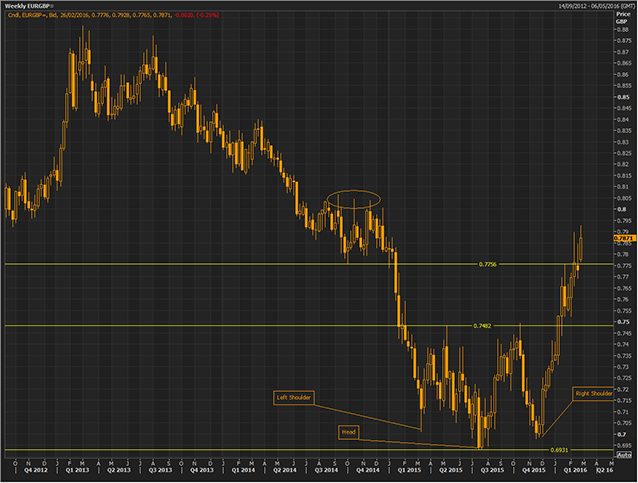

EURGBP - beware being late to the party

With the aforementioned strength in the Euro and the fears around the growing strength of the Brexit campaign, EURGBP looks fundamentally to be heading only one way. The technical picture looks strong too, there is an inside week break which will be confirmed with a close above .7485 today. A close above .7897 looks particularly bullish and the market is above .7756 pivot area. However, it is very easy to see the obvious; the Brexit story is everywhere now and many participants will have been playing it for a while. The inverse Head and Shoulders target is .7993 an overshoot runs into levels .8039-65 (circled) and could see resistance as profit is taken.

USDCAD - last chance for bulls

USDCAD has backed off strongly from mid January as Oil prices have stabilised around the low $30 area. Yesterday saw a break of long term trend line on increased volume and a move to 61.8% retracement of the recent swing higher, the key area is now 1.3457-35. A first time hold here is likely and will see a bounce towards 1.3635. Any close below could see some liquidation of positions with potential for a move to 1.3033.

.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.