Crude Oil HoldFalling Wedge

WTI Crude Oil has beenshowing a lot of signs of bullish price action recently since the confirmationof the Double Bottom at $26. From the break of the important $34.82 level, themarket tested the 38.39 area very quickly and now after a small pullback, themarket has come back to test the major Falling Wedge pattern only to break the39 level. With an inverse Head and Shoulders now formed, a close above thisneckline could be the impetus of a much large move with the only real structureabove at 43.46. If we fail to hold our bid here however the next port of callfor the bulls remains at the 34.82 area.

Gold Holding a Bid

Gold has been one of thebest performing asset classes in 2016 so far which is up some 23%. On a weekly time-frame, the market has held the 1189 to 1193 key support zone and now haseven held a bid above the 1226 level. Given the market has now closed multipleweeks above the bigger time frame Falling Wedge reversal pattern, a test of the1307 area is highly likely in my opinion so long as we can stay above the pinkarea.

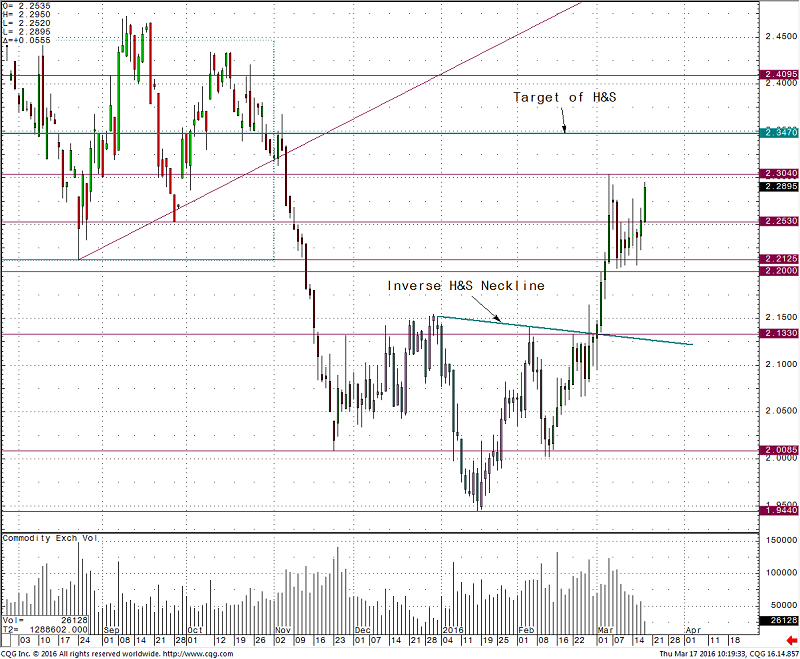

Copper Holds KeySupport Zone

Copper has performed wellin recent weeks after the break of a key Inverse Head and Shoulders pattern.This week, we have managed to hold a bid above the 2.20-2.2125 zone and is nowreaching out for the recent 2.3040 highs. If we manage to take this level out,the market should see the Target of the H&S which comes in at 2.3470. A movebelow the 2.20 area would likely put pressure on short term longs and only amove with a close below the 2.1330 region would negate the setup for me.

.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.