Crude

Although yesterday’s Energy Information Agency (EIA) data did not confirm Wednesday’s report from the American Petroleum Institute as far as the volume of increase in crude oil inventories is concerned (the API report had foreseen more than 14 million barrels build in inventories which, if it had been confirmed, would have marked an all-time high), it left the overall message intact. The data showed about twice as large build in stocks than the one that had been anticipated by analysts at the beginning of this week. The oil price therefore fell by about 0.5% yesterday while the US benchmark WTI even lost about 1.9% as inventories in Cushing, the delivery location of NYMEX WTI futures contract, rose by about 3.6 million barrels. Rising stocks in Cushing suggest that traders have recently been taking advantage of relatively wide contango in the front-end of oil forward curve.

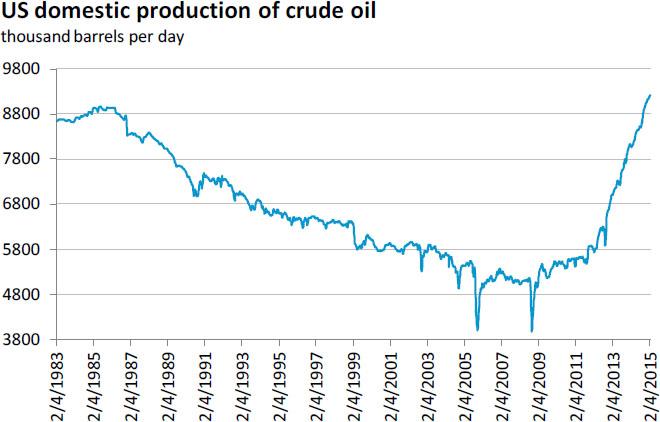

All in all, recent EIA data reminded us that although the supply elasticity of “shale oil” likely is much higher than that of “conventional oil”, it will take some time before the impact of lower oil prices on the US supply is more pronounced. For example, the data showed that US domestic crude oil production increased by more than 800 thousand barrels per day visà- vis June 2014. Let us recall that in the meantime, the oil price fell by about one half…

Metals

Price of gold extended previous declines yesterday and today is therefore seen close to a 1-1/2 month low despite the fact that much is at stake in talks on Greek debt today. If the negotiations fails, for the euro area the immediate contagion might be contained (enough backstops available), but it would be politically disastrous for the internal cohesion of the euro zone and open the way for more defections later on. Geopolitically, it would strengthen the hand of Russian president Putin who could continue to undermine the East flank of the EU.

With respect to what was said above, common sense points to an agreement and that’s probably also the reason why the overall markets remained sanguine...

Chart of the day:

US domestic oil production continues to rise.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.