Crude

The oil price barely moved on Monday. The absence of US investors clearly contributed to the calmest session since early January. Moreover, market paid no attention to lack of agreement between Greece and its creditors nor it was distracted by news about Egypt’s and Libya’s air strikes against the Islamic State (IS) which suggest that risks in the Middle East may be on a rise.

In fact, IEA’s Chief Economist Birol said today that the rise of the IS may undermine necessary investment in oil production needed to keep the market balanced in the next decade. Though the market is well supplied at the moment (or, actually, even better than well supplied) thanks to, among others, US “shale oil” production, Birol’s comments reflect the fact that spending on new projects in Middle East countries is needed to keep the oil market balanced over the long-term.

Birol’s comments support the oil price in early trading today. The front-month contract on Brent is trading above 62 USD/bbl at the time of writing of this note. Nevertheless, as we already pointed out, we think that the recent increase in prices may prove to be short-lived and we still expect oil prices to be under pressure, at least in the short-term.

Metals

Base metals prices are under modest pressure on the eve of the beginning of a week-long Lunar New Year holiday in China; price of the three month contract on copper (LME) is down by about 0.7% and aluminium by about 0.2%. Regarding the latter, news that aluminium stocks at Japan’s ports hit a record in January may add some downward pressure on the price today. As for yesterday’s session, weaker than expected growth of Japan’s economy (which is World’s no.4 consumer of copper and no.5 consumer of aluminium) had only a small impact on prices.

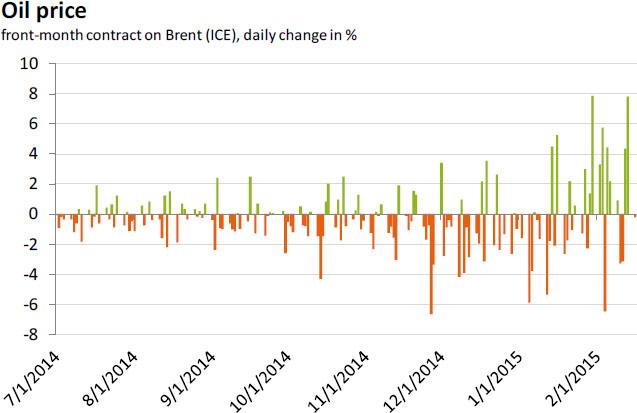

Chart of the day:

Oil experienced an unusually calm session yesterday

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.