The commodities feed: Copper supply risks

Energy

The oil market continues to be driven by external influences, reflecting the lack of fresh fundamental catalysts. Oil prices have resumed their sell-off in early morning trading today. A more aggressive approach from the US Fed, in order to try rein in inflation has not helped, with it likely to prove challenging for the Fed to bring inflation down without a hard landing.

Oil fundamentals remain constructive with the oil market expected to continue to tighten through the year as the EU’s ban on Russian seaborne crude starts to increasingly bite. Although, how tight the market will be really depends on how willing the likes of China and India are to pick up heavily discounted Russian crude. Chinese May trade data suggests there is a strong desire, with China importing a record amount of Russian crude over the month.

Another dynamic in the market which makes it difficult to be overly bearish is the tightness in the refined products market. Whether it is the US or NW Europe, refined product inventories are at or near multi-year lows. This continues to push refinery margins higher. And stronger margins for refiners should equate to stronger crude oil demand from these refiners.

Reduced Russian gas flows via the Nord Stream pipeline is being felt in other markets and regions. Spot Asian LNG has rallied by around 60% over the last week or so on the back of lower pipeline flows to Europe. In addition, the prolonged Freeport LNG outage will only tighten what is already a tight LNG market. Whilst, weak Chinese LNG demand over 1H22 offered some relief to the LNG market, we will need to see if this trend continues in 2H22- much will depend on whether we see the latter part of the year plagued with Chinese lockdowns. Coal has also benefitted from reduced Russian gas flows, with a number of EU countries including increased coal usage as part of measures to counter gas shortages. API2 prices are up around 29% over the week, whilst Newcastle has rallied by around 20% over the period. The issue fore EU buyers is that they will have to look further afield for thermal coal, given the ban on Russian coal.

Metals

LME zinc led gains amongst base metals yesterday, closing more than 2% higher yesterday. This appears to be on the back of a fairly large decline in LME zinc on warrant inventories, with them falling by a little over 18kt yesterday, which is the largest daily decline since April and leaves on warrant stocks at 41.6kt as of yesterday. As a result we have seen a spike in the cash/3M spread, with it hitting a backwardation of US$111/t, up from around US$33/t a week ago.

Shanghai Metals Market (SMM) in its latest survey expects that Chinese refined zinc output will decline by 6% MoM and 4.6% YoY to 484.5kt in June, as flooding has disrupted power supplies to smelters located in the southern province of Guangxi. Smelters in the region hold about 550ktpa capacity, which is roughly 8% of total Chinese capacity.

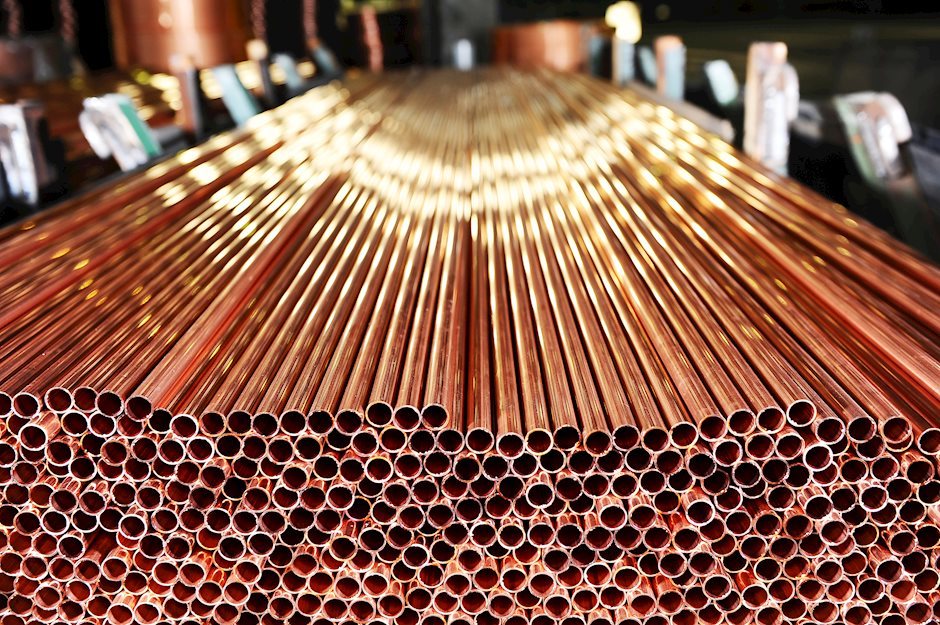

Workers at Codelco are set to go on a nationwide strike in Chile starting today. This is in protest to the management’s decision to close the Ventanas copper smelter. However, copper price action in early morning trading appears to be largely ignoring this development, despite the potential for a large supply impact. Clearly, the market is more focused on macro concerns.

Read the original analysis: The commodities feed: Copper supply risks

Author

Warren Patterson

ING Economic and Financial Analysis

Warren Patterson is a commodities strategist at ING. He joined the bank in April 2016 and covers the entire commodities complex. Previously, he worked at a commodities trade house in London.