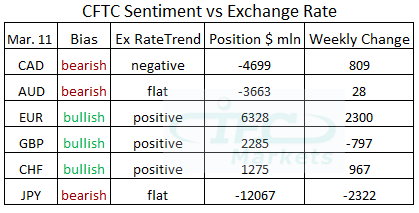

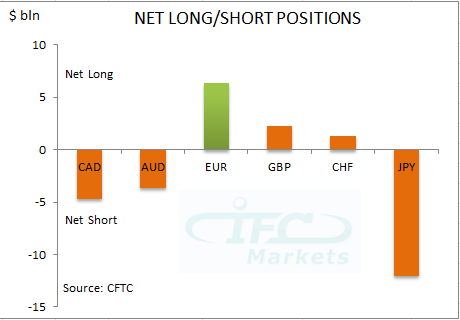

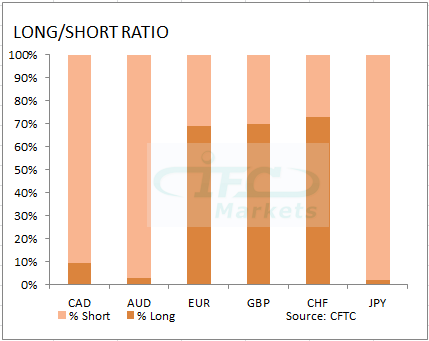

The latest report by Commodity Futures Trading Commission (CFTC) covering data up to 11th of March displayed that bullish sentiment continue to strengthen towards the Euro. In addition the Swiss franc bullish bias is building for another week. At the same time the positive bias moderated with the GBP to $2.3 billion against the US dollar, after finding resistance at 1.6777.

Moreover, Japanese Yen negative bias expanded to $12.07 billion. The Canadian dollar net short position against the US dollar, on the other hand, reduced according to the latest data. Lastly, bearish sentiment remained steady with the Australian dollar, without any significant weekly change taking place.

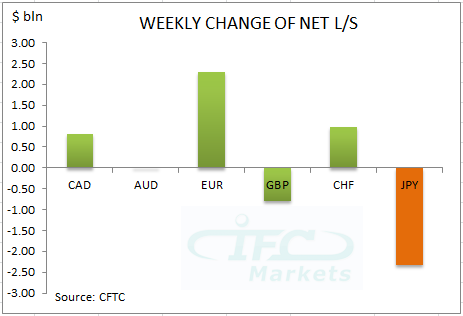

The Euro had the biggest weekly change for one more week. The net long position increased to $6.3 billion, following the European Central Bank decision to hold key rates steady. Also the EURUSD breached key upside hurdle at 1.3832 increasing bullish potential.

The biggest negative weekly change on the Japanese Yen reflects the improvement of traders’ risk appetite sentiment due to shining US jobs report for January. The USDJPY inched to resistance at 103.74 but now has dropped back to 101.20 and for that reason we would expect the net short position to narrow at the next report. Lastly geopolitical risk due to Ukraine crisis is likely to have increased demand for the samurai currency.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.