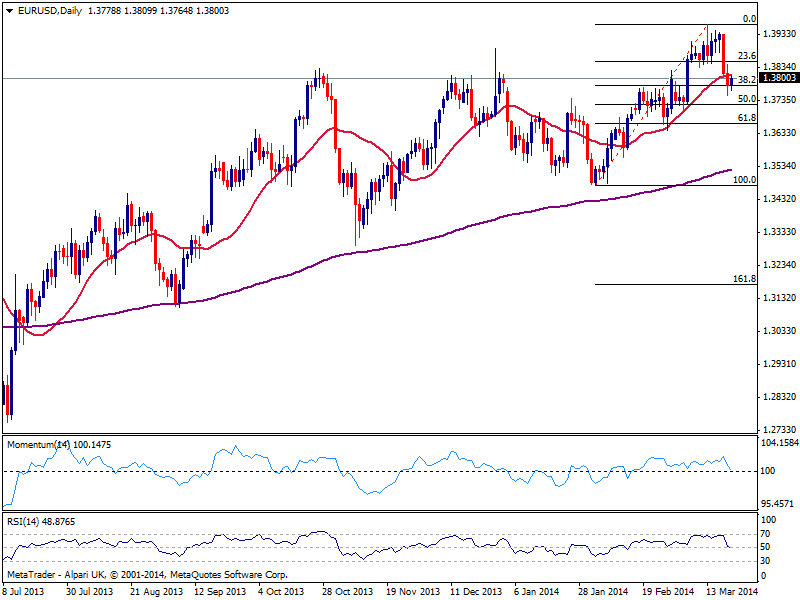

Not really if you ask me: is true the FED has shaken the scheme, but the EUR/USD daily chart is still far from suggesting a top is finally in place: this week slide has held above the 38.2% retracement of its latest bullish run, and price aims to close the week above the 1.3800 figure, which is pretty significant for the health of the bullish trend.

There are indeed some factors of downward risk in the same chart, as indicators had turned lower and rest right above their midlines, while price stands right below its 20 SMA: a new daily opening will probably shed more light on the picture but overall, as commented past week, this last bearish run seems corrective moreover after a 6-week in a row advance. If upcoming week sees price still holding above the 1.3730/50 area and even advancing beyond 1.3860 immediate resistance, then the most likely scenario is an upward continuation back towards the year high of 1.3966, while a break above this last should see price finally testing the 1.4000 elusive figure.

On the other hand, a break below this week low may see price dipping another 100 pips towards 1.3660 price zone, 61.8% retracement of the same rally: a break below this last will indeed signal an increased risk of a midterm bearish run and confirm the interim top posted this March.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.