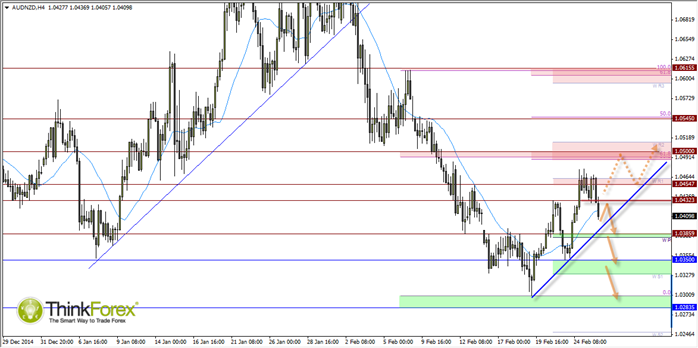

The longer-term trend remains berish and still provides potential for parity this year. Today's price action suggests we may have returned to the bearish path for AUDNZD.

We may have seen the completion of an ABC pattern from the 1.0307 lows but require a downside break of the blue bullish trendline for extra confirmation. Whilst we remain above it we could see a deeper retracement towards the 1.05 or even 1.055 resistance zones.

However judging by today's break below 1.0420 support I suspect the resumption of the downside looms.

One option is to consider sell-limits towards the 1.0420 resistance with stop above 1.0480 swings high to target 1.038 and 1.305.

Alternatively we could consider bullish setups above the blue trendline to assume the deeper correction to target 1.05.

Catalysts this week are Capex data from Australian (30 mines) or Business confidence tomorrow for NZ. Whilst neither data set is likely to be changing any dominant trends they may provide enough juice to move price into suitable buy or sell-zones (depending on your preferred longer-term bias). As my overall bias is bearish I will seek any gains as opportunities to go short.

After tomorrow NZ business confidence Traders will be now be debating the potential for a second consecutive rate cut from RBA next week. Whilst I expect RBA to keep rates on hold next week it is a scenario which remains firmly on the able. A further rate cut will bring downside on the Dollar but rates on hold will likely support it.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.