USDCAD continues to grind higher in line with the weekly bullish trend, and now seems on track to test 2014 highs.

Last week we saw it close to a 6-month high whilst remaining comfortably above the primary bullish trendline (from 2012 lows) with the 50 week MA also pointing upwards to confirm bullish momentum.

We have seen mild losses during Asia today but there are plenty of support levels for bulls to consider bullish setups in liken with this strong bullish trend.

With Canadian GDP is out today and an expectation of 0.2% growth m/m any upside surprise here should see USCAD retreat from the current highs. Friday also has Trade Balance figures but the data set is likely to be overshadowed by US Nonfarm Payroll and ISM Manufacturing Data.

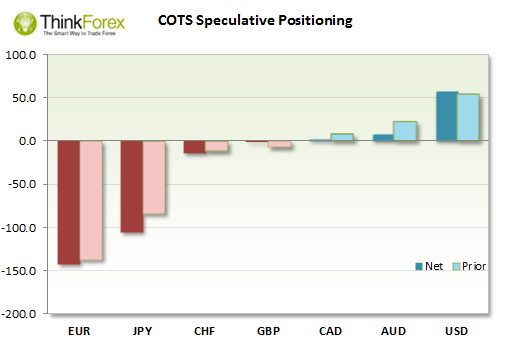

Anyone considering picking any tops against the Greenback should also keep in mind that the USD has just seen 11 straight weeks of gains (a 4-decade record) and Large Speculative Net longs are also at a record highs. Conversely Canadian Dollar Futures are on the brink of hitting Net short after seeing further longs closed last week. Whilst this data is only released weekly and lags by 3-days, this is a lot of deep pockets to be betting against.

Therefor traders may be wise to see any weak US data (or strong CAD) as a gift for bulls to jump back on board the bullish trend at a 'better' price.

Yesterday produced a Spinning Top Doji below 1.118 resistance to suggest a weakness to the D1 move. At this stage a favour a pullback with 1.109 and 1.010 housing several levels of technical support. If we do see the pullback then I will be seeking bullish setups around these levels to trade in the direction of the dominant trend.

A break above this week’s highs should see direct gains towards 1.123 and 1.1275 (2014 highs). I don’t expect this level to break upon first attempt as we're likely to see profit taking, but overall I favour an upside break of this level sooner than later.

Only a break below 1.09 brings into question a much deeper retracement for the weekly chart.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.