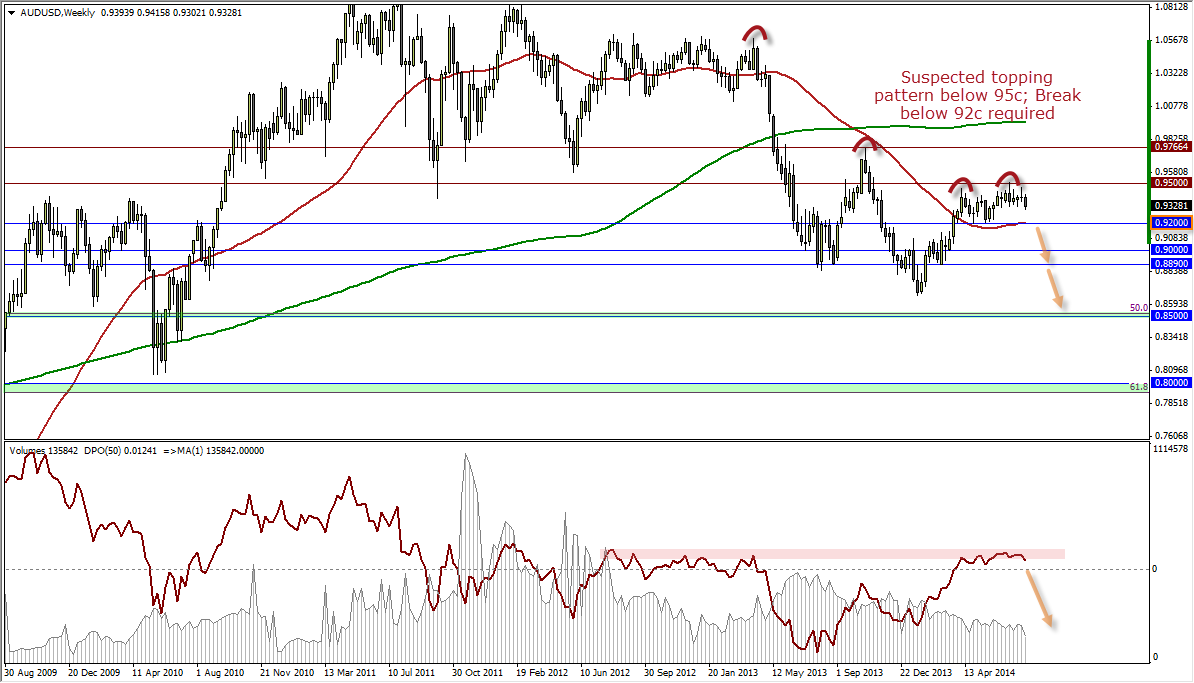

I have suspected the weekly charts are amid a topping pattern but the daily timeframe has provided few clues to back this up. However recent price action suggests this is quickly changing.

Home building approvals disappointed again, for the 4th out of five months, adding further doubt on the housing sector, whilst import and export prices have also declined. With import and export prices also declining this should have a negative impact on pending GDP Q2, whilst painting a slightly more bearish picture for the Australian Dollar.

Prior to the release the A$ was nursing wounds following US GDP rising to 4% which saw it crash through key 0.932 support during the session to test 0.930, a key support for the bulls to defend.

The markets focus will noel be on China PMI and US employment data, with poor numbers required to help it remain above 93c. If however we see China PMI revised down and decent employment data, this could push the fragile A$ down through 93c, which would then target 92c over the coming weeks.

Already we are seeing profit taking around 0.932 which may help support the A$ leading up to the next major event. However we have clear resistance levels at 0.93685 which could entice bearish swing traders to come out of hibernation.

Looking ahead I have decided to resurrect the bearish outlook. WHilst I continue to suepct we are amid a topping pattern on the weekly charts, keep in mind that tops can take time to develop. A break below 0.92 would be my confirmation with targets being 0.90, 0.87 and 0.85. I have highlited the previous 2 cycle tops and timing wise the cycle appears sound. This would also tie in with my bias for the USD having seen a 6.4yr cycle low.

I have also included a 50-week DPO (Detrended price oscillator) which measures the distance between closing price and 50-week MA. We can see that we are also trading in an area which is prone to 'snap back' to its 50-week MA. (Just something to keep in mind...).

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

Fed statement language and QT strategy could drive USD action – LIVE

The US Federal Reserve is set to leave the policy rate unchanged after April 30 - May 1 policy meeting. Possible changes to the statement language and quantitative tightening strategy could impact the USD's valuation.

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.