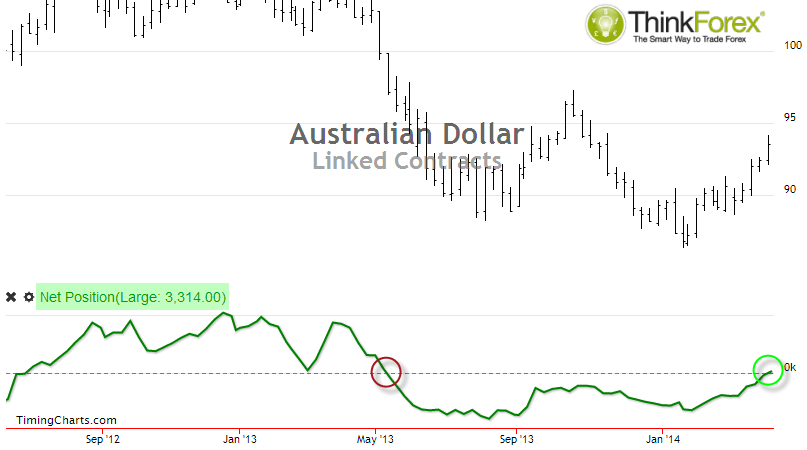

Large speculators were net long on AUD for the first time since May 2013 as the shorts continued to flee the market.

Keeping in mind the report (released each Friday) is 3 days delayed, so there is room for error if significant news impacts the charts between the Tuesday to the Friday. However the information is sufficient enough as a general confirmation tool of price advances/declines.

The chart below shows volume for FXA (Australian Currency Shares Basket) and towards the back of last week price was advancing on lower volume. If you then compare the volume to the AUDUSD chart you will also see the Charts produced a Shooting star reversal and a Hanging Man on the 2 last trading days of last week to watch of near-term weakness below 0.94, which may result in sideways trading or a retracement. However whilst the near-term may exhibit small signs of weakness the trend is clearly up and the medium-term analysis favours new high and to target 0.950 and 0.955.

Tomorrow the RBA release their minutes from their recent interest rate decision which may help reveal which way the RBA are leaning later this year in regards to interest rates. Chine data will also have an input to the likelihood of a bullish trend continuation, along with FED Chair Lady Yellen’s speech on Thursday.

- Near-term suggests sideways trading/retracement below 0.940-42

- Medium-term is bullish and to target 0.945, 50 and 55

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.